Levin Capital Strategies L.P. lifted its holdings in Eaton Corporation, PLC (NYSE:ETN - Free Report) by 20.0% in the first quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 18,182 shares of the industrial products company's stock after acquiring an additional 3,032 shares during the period. Levin Capital Strategies L.P.'s holdings in Eaton were worth $4,942,000 at the end of the most recent quarter.

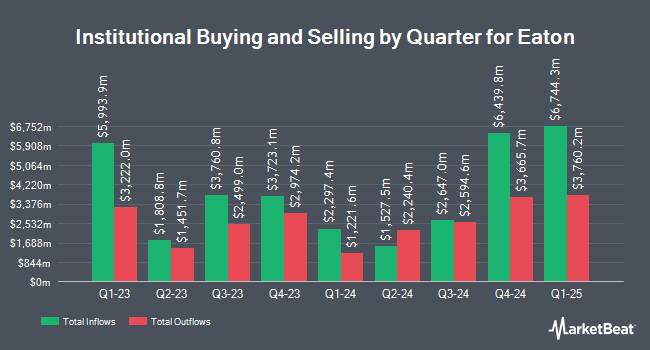

Several other institutional investors and hedge funds also recently added to or reduced their stakes in the stock. IMA Advisory Services Inc. purchased a new stake in Eaton during the 1st quarter valued at $25,000. Capital A Wealth Management LLC purchased a new stake in shares of Eaton in the fourth quarter valued at $26,000. Creative Financial Designs Inc. ADV lifted its holdings in shares of Eaton by 102.0% in the 1st quarter. Creative Financial Designs Inc. ADV now owns 101 shares of the industrial products company's stock worth $27,000 after acquiring an additional 51 shares during the last quarter. Vermillion Wealth Management Inc. purchased a new position in shares of Eaton during the 4th quarter worth about $33,000. Finally, Abound Wealth Management raised its position in Eaton by 73.8% in the 1st quarter. Abound Wealth Management now owns 146 shares of the industrial products company's stock worth $40,000 after purchasing an additional 62 shares during the period. Hedge funds and other institutional investors own 82.97% of the company's stock.

Insiders Place Their Bets

In other Eaton news, insider Craig Arnold sold 103,486 shares of the business's stock in a transaction that occurred on Monday, May 12th. The stock was sold at an average price of $322.75, for a total transaction of $33,400,106.50. Following the completion of the sale, the insider directly owned 490,208 shares in the company, valued at approximately $158,214,632. The trade was a 17.43% decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Corporate insiders own 0.30% of the company's stock.

Eaton Stock Performance

NYSE:ETN traded up $2.91 during trading hours on Friday, hitting $363.07. 2,139,096 shares of the company were exchanged, compared to its average volume of 3,081,167. The company's 50 day moving average price is $354.13 and its 200-day moving average price is $318.34. The stock has a market capitalization of $142.07 billion, a price-to-earnings ratio of 36.53, a PEG ratio of 2.70 and a beta of 1.18. Eaton Corporation, PLC has a 52-week low of $231.85 and a 52-week high of $399.56. The company has a debt-to-equity ratio of 0.47, a current ratio of 1.24 and a quick ratio of 0.84.

Eaton (NYSE:ETN - Get Free Report) last released its quarterly earnings data on Tuesday, August 5th. The industrial products company reported $2.95 earnings per share for the quarter, topping analysts' consensus estimates of $2.92 by $0.03. The firm had revenue of $7.03 billion for the quarter, compared to analyst estimates of $6.93 billion. Eaton had a net margin of 15.11% and a return on equity of 23.91%. The business's quarterly revenue was up 10.7% compared to the same quarter last year. During the same quarter in the prior year, the business earned $2.73 earnings per share. As a group, research analysts forecast that Eaton Corporation, PLC will post 12.02 earnings per share for the current year.

Eaton Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Friday, August 22nd. Shareholders of record on Thursday, August 7th will be given a dividend of $1.04 per share. The ex-dividend date is Thursday, August 7th. This represents a $4.16 dividend on an annualized basis and a yield of 1.1%. Eaton's dividend payout ratio is currently 41.85%.

Analyst Ratings Changes

ETN has been the subject of several recent analyst reports. Morgan Stanley boosted their target price on Eaton from $375.00 to $425.00 and gave the company an "overweight" rating in a research report on Wednesday. Barclays upped their price objective on Eaton from $340.00 to $344.00 and gave the company an "equal weight" rating in a research report on Wednesday. KeyCorp boosted their target price on shares of Eaton from $355.00 to $410.00 and gave the company an "overweight" rating in a research note on Tuesday, July 15th. BNP Paribas initiated coverage on shares of Eaton in a research note on Thursday, May 15th. They set an "outperform" rating and a $380.00 price target for the company. Finally, BNP Paribas Exane began coverage on Eaton in a research note on Thursday, May 15th. They issued an "outperform" rating and a $380.00 price objective on the stock. Seven research analysts have rated the stock with a hold rating and fourteen have assigned a buy rating to the company. Based on data from MarketBeat, Eaton has an average rating of "Moderate Buy" and an average price target of $383.63.

Read Our Latest Analysis on Eaton

Eaton Profile

(

Free Report)

Eaton Corporation plc operates as a power management company worldwide. The company's Electrical Americas and Electrical Global segment provides electrical components, industrial components, power distribution and assemblies, residential products, single and three phase power quality and connectivity products, wiring devices, circuit protection products, utility power distribution products, power reliability equipment, and services, as well as hazardous duty electrical equipment, emergency lighting, fire detection, explosion-proof instrumentation, and structural support systems.

Featured Articles

Before you consider Eaton, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Eaton wasn't on the list.

While Eaton currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.