LexAurum Advisors LLC raised its position in shares of Coinbase Global, Inc. (NASDAQ:COIN) by 10.0% in the second quarter, according to its most recent filing with the SEC. The firm owned 13,171 shares of the cryptocurrency exchange's stock after purchasing an additional 1,200 shares during the quarter. LexAurum Advisors LLC's holdings in Coinbase Global were worth $4,616,000 at the end of the most recent quarter.

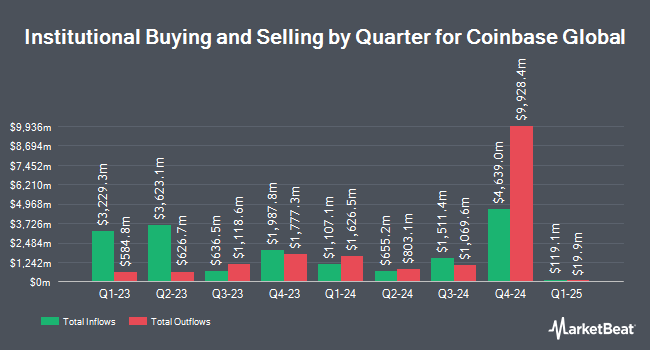

A number of other institutional investors and hedge funds have also recently modified their holdings of the business. Cadent Capital Advisors LLC boosted its holdings in shares of Coinbase Global by 1.0% during the 2nd quarter. Cadent Capital Advisors LLC now owns 3,162 shares of the cryptocurrency exchange's stock worth $1,108,000 after buying an additional 30 shares in the last quarter. Thurston Springer Miller Herd & Titak Inc. boosted its holdings in shares of Coinbase Global by 4.2% during the 2nd quarter. Thurston Springer Miller Herd & Titak Inc. now owns 1,015 shares of the cryptocurrency exchange's stock worth $356,000 after buying an additional 41 shares in the last quarter. Pallas Capital Advisors LLC boosted its holdings in shares of Coinbase Global by 1.6% during the 2nd quarter. Pallas Capital Advisors LLC now owns 2,662 shares of the cryptocurrency exchange's stock worth $933,000 after buying an additional 41 shares in the last quarter. Clare Market Investments LLC boosted its holdings in shares of Coinbase Global by 1.8% during the 2nd quarter. Clare Market Investments LLC now owns 2,552 shares of the cryptocurrency exchange's stock worth $894,000 after buying an additional 45 shares in the last quarter. Finally, Brooklyn Investment Group boosted its holdings in shares of Coinbase Global by 7.1% during the 1st quarter. Brooklyn Investment Group now owns 720 shares of the cryptocurrency exchange's stock worth $124,000 after buying an additional 48 shares in the last quarter. 68.84% of the stock is currently owned by institutional investors.

Insider Activity

In other news, CFO Alesia J. Haas sold 4,675 shares of the firm's stock in a transaction on Monday, September 15th. The stock was sold at an average price of $322.24, for a total transaction of $1,506,472.00. Following the completion of the sale, the chief financial officer directly owned 89,220 shares of the company's stock, valued at $28,750,252.80. This trade represents a 4.98% decrease in their position. The sale was disclosed in a document filed with the SEC, which is available through the SEC website. Also, CAO Jennifer N. Jones sold 1,756 shares of the firm's stock in a transaction on Friday, August 22nd. The shares were sold at an average price of $300.52, for a total value of $527,713.12. The disclosure for this sale can be found here. Over the last quarter, insiders sold 724,515 shares of company stock worth $275,533,175. 23.43% of the stock is owned by insiders.

Wall Street Analysts Forecast Growth

A number of equities analysts recently issued reports on the company. Piper Sandler reiterated a "neutral" rating and issued a $350.00 target price on shares of Coinbase Global in a report on Thursday, July 31st. Canaccord Genuity Group reiterated a "buy" rating and issued a $400.00 target price on shares of Coinbase Global in a report on Friday, August 1st. Compass Point reiterated a "sell" rating and issued a $248.00 target price (down from $330.00) on shares of Coinbase Global in a report on Monday, August 4th. Argus assumed coverage on Coinbase Global in a report on Monday, July 14th. They issued a "buy" rating and a $400.00 target price on the stock. Finally, William Blair assumed coverage on Coinbase Global in a report on Wednesday, June 11th. They issued an "outperform" rating on the stock. Thirteen equities research analysts have rated the stock with a Buy rating, ten have assigned a Hold rating and two have issued a Sell rating to the company's stock. According to MarketBeat, Coinbase Global presently has a consensus rating of "Hold" and an average price target of $356.18.

Check Out Our Latest Analysis on Coinbase Global

Coinbase Global Price Performance

Shares of NASDAQ:COIN opened at $333.99 on Tuesday. Coinbase Global, Inc. has a 1-year low of $142.58 and a 1-year high of $444.64. The stock has a market cap of $85.82 billion, a PE ratio of 32.30 and a beta of 3.68. The stock's fifty day simple moving average is $326.71 and its two-hundred day simple moving average is $277.31. The company has a current ratio of 2.12, a quick ratio of 2.13 and a debt-to-equity ratio of 0.25.

Coinbase Global (NASDAQ:COIN - Get Free Report) last announced its earnings results on Thursday, July 31st. The cryptocurrency exchange reported $0.12 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.91 by ($0.79). Coinbase Global had a net margin of 40.87% and a return on equity of 16.02%. The business had revenue of $1.50 billion for the quarter, compared to analysts' expectations of $1.68 billion. During the same period in the prior year, the business earned $0.14 earnings per share. The company's revenue for the quarter was up 3.3% compared to the same quarter last year. As a group, analysts forecast that Coinbase Global, Inc. will post 7.22 EPS for the current fiscal year.

Coinbase Global Company Profile

(

Free Report)

Coinbase Global, Inc provides financial infrastructure and technology for the crypto economy in the United States and internationally. The company offers the primary financial account in the crypto economy for consumers; and a marketplace with a pool of liquidity for transacting in crypto assets for institutions.

Read More

Want to see what other hedge funds are holding COIN? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Coinbase Global, Inc. (NASDAQ:COIN - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Coinbase Global, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Coinbase Global wasn't on the list.

While Coinbase Global currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.