CDAM UK Ltd lifted its position in shares of LGI Homes, Inc. (NASDAQ:LGIH - Free Report) by 4.4% during the 1st quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 766,210 shares of the financial services provider's stock after purchasing an additional 32,267 shares during the quarter. LGI Homes makes up about 8.2% of CDAM UK Ltd's investment portfolio, making the stock its 8th largest position. CDAM UK Ltd owned 3.27% of LGI Homes worth $50,930,000 at the end of the most recent reporting period.

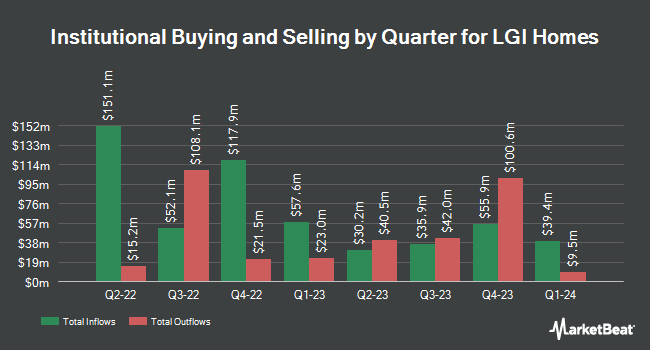

Other institutional investors also recently modified their holdings of the company. Sterling Capital Management LLC grew its holdings in shares of LGI Homes by 801.5% during the 4th quarter. Sterling Capital Management LLC now owns 613 shares of the financial services provider's stock worth $55,000 after purchasing an additional 545 shares in the last quarter. Caitong International Asset Management Co. Ltd grew its holdings in shares of LGI Homes by 12,620.0% during the 1st quarter. Caitong International Asset Management Co. Ltd now owns 636 shares of the financial services provider's stock worth $42,000 after purchasing an additional 631 shares in the last quarter. GAMMA Investing LLC grew its holdings in shares of LGI Homes by 219.1% during the 1st quarter. GAMMA Investing LLC now owns 887 shares of the financial services provider's stock worth $59,000 after purchasing an additional 609 shares in the last quarter. CWM LLC grew its holdings in shares of LGI Homes by 50.3% during the 1st quarter. CWM LLC now owns 1,178 shares of the financial services provider's stock worth $78,000 after purchasing an additional 394 shares in the last quarter. Finally, Summit Investment Advisors Inc. grew its holdings in shares of LGI Homes by 6.9% during the 4th quarter. Summit Investment Advisors Inc. now owns 2,185 shares of the financial services provider's stock worth $195,000 after purchasing an additional 141 shares in the last quarter. Institutional investors and hedge funds own 84.89% of the company's stock.

LGI Homes Price Performance

Shares of LGI Homes stock traded up $5.45 during midday trading on Friday, hitting $67.47. 813,285 shares of the company were exchanged, compared to its average volume of 409,977. The company has a debt-to-equity ratio of 0.85, a current ratio of 18.18 and a quick ratio of 0.64. The firm has a market cap of $1.56 billion, a P/E ratio of 10.18 and a beta of 1.69. LGI Homes, Inc. has a 52 week low of $47.17 and a 52 week high of $125.83. The firm has a 50 day simple moving average of $55.71 and a 200-day simple moving average of $61.21.

LGI Homes (NASDAQ:LGIH - Get Free Report) last posted its earnings results on Tuesday, August 5th. The financial services provider reported $1.36 EPS for the quarter, topping the consensus estimate of $1.21 by $0.15. The business had revenue of $483.49 million during the quarter, compared to the consensus estimate of $546.96 million. LGI Homes had a return on equity of 8.00% and a net margin of 7.63%.LGI Homes's revenue was down 19.8% on a year-over-year basis. During the same quarter last year, the company earned $2.48 EPS. Research analysts forecast that LGI Homes, Inc. will post 8.46 earnings per share for the current year.

Analysts Set New Price Targets

Several brokerages have recently weighed in on LGIH. Citigroup reissued an "outperform" rating on shares of LGI Homes in a report on Thursday, August 7th. Wedbush reissued a "neutral" rating and set a $93.00 price objective on shares of LGI Homes in a report on Monday, July 7th. JMP Securities cut their target price on LGI Homes from $140.00 to $75.00 and set a "market outperform" rating for the company in a research report on Thursday, August 7th. Finally, JPMorgan Chase & Co. cut their target price on LGI Homes from $52.00 to $47.00 and set an "underweight" rating for the company in a research report on Wednesday, July 9th. Two investment analysts have rated the stock with a Buy rating, two have given a Hold rating and one has given a Sell rating to the company's stock. According to data from MarketBeat.com, the company has a consensus rating of "Hold" and a consensus price target of $71.67.

Check Out Our Latest Research Report on LGIH

LGI Homes Profile

(

Free Report)

LGI Homes, Inc designs, constructs, and sells homes. It offers entry-level homes, such as attached and detached homes, and active adult homes under the LGI Homes brand name; and luxury series homes under the Terrata Homes brand name. The company also engages in the wholesale business, which include building and selling homes to large institutions looking to acquire single-family rental properties.

Read More

Before you consider LGI Homes, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LGI Homes wasn't on the list.

While LGI Homes currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.