LGT Fund Management Co Ltd. grew its holdings in shares of LGI Homes, Inc. (NASDAQ:LGIH - Free Report) by 6.4% during the second quarter, according to its most recent Form 13F filing with the SEC. The firm owned 81,081 shares of the financial services provider's stock after purchasing an additional 4,904 shares during the period. LGT Fund Management Co Ltd. owned 0.35% of LGI Homes worth $4,177,000 as of its most recent SEC filing.

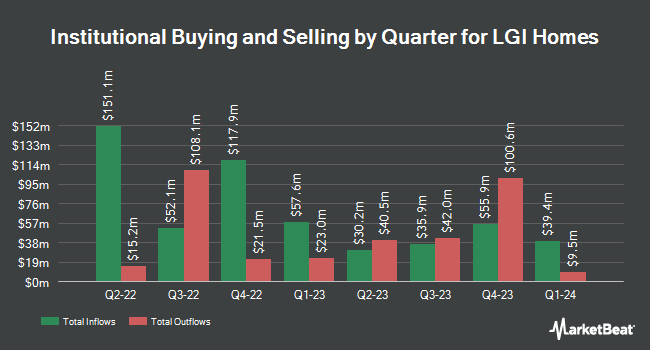

Several other institutional investors have also modified their holdings of LGIH. GAMMA Investing LLC grew its position in shares of LGI Homes by 21,108.3% during the first quarter. GAMMA Investing LLC now owns 58,959 shares of the financial services provider's stock worth $3,919,000 after acquiring an additional 58,681 shares during the last quarter. NBC Securities Inc. grew its position in shares of LGI Homes by 111,600.0% during the first quarter. NBC Securities Inc. now owns 2,234 shares of the financial services provider's stock worth $148,000 after acquiring an additional 2,232 shares during the last quarter. SG Americas Securities LLC grew its position in shares of LGI Homes by 134.0% during the first quarter. SG Americas Securities LLC now owns 4,477 shares of the financial services provider's stock worth $298,000 after acquiring an additional 2,564 shares during the last quarter. Handelsbanken Fonder AB grew its position in shares of LGI Homes by 34.8% during the first quarter. Handelsbanken Fonder AB now owns 10,065 shares of the financial services provider's stock worth $669,000 after acquiring an additional 2,600 shares during the last quarter. Finally, Wealth Enhancement Advisory Services LLC grew its position in shares of LGI Homes by 213.5% during the first quarter. Wealth Enhancement Advisory Services LLC now owns 10,234 shares of the financial services provider's stock worth $680,000 after acquiring an additional 6,970 shares during the last quarter. Institutional investors own 84.89% of the company's stock.

LGI Homes Stock Performance

Shares of LGIH opened at $53.17 on Friday. The firm has a 50-day moving average price of $59.37 and a 200 day moving average price of $57.26. The firm has a market capitalization of $1.23 billion, a PE ratio of 8.02 and a beta of 1.77. The company has a quick ratio of 0.64, a current ratio of 18.18 and a debt-to-equity ratio of 0.85. LGI Homes, Inc. has a 52-week low of $47.17 and a 52-week high of $118.31.

LGI Homes (NASDAQ:LGIH - Get Free Report) last announced its earnings results on Tuesday, August 5th. The financial services provider reported $1.36 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.21 by $0.15. The firm had revenue of $483.49 million during the quarter, compared to analyst estimates of $546.96 million. LGI Homes had a net margin of 7.63% and a return on equity of 8.00%. LGI Homes's revenue was down 19.8% compared to the same quarter last year. During the same quarter in the prior year, the firm posted $2.48 EPS. On average, sell-side analysts anticipate that LGI Homes, Inc. will post 8.46 earnings per share for the current fiscal year.

Analyst Upgrades and Downgrades

Several equities analysts have recently commented on the stock. Citigroup restated a "market outperform" rating on shares of LGI Homes in a research report on Wednesday, August 27th. JPMorgan Chase & Co. lowered their price target on shares of LGI Homes from $52.00 to $47.00 and set an "underweight" rating for the company in a research report on Wednesday, July 9th. Weiss Ratings restated a "sell (d+)" rating on shares of LGI Homes in a research report on Saturday, September 27th. Wedbush restated a "neutral" rating and set a $95.00 price target on shares of LGI Homes in a research report on Friday, September 5th. Finally, JMP Securities increased their target price on shares of LGI Homes from $75.00 to $85.00 and gave the company a "market outperform" rating in a research report on Wednesday, August 27th. Two equities research analysts have rated the stock with a Buy rating, two have assigned a Hold rating and two have issued a Sell rating to the company's stock. According to MarketBeat.com, LGI Homes currently has a consensus rating of "Hold" and an average target price of $75.67.

Check Out Our Latest Report on LGI Homes

About LGI Homes

(

Free Report)

LGI Homes, Inc designs, constructs, and sells homes. It offers entry-level homes, such as attached and detached homes, and active adult homes under the LGI Homes brand name; and luxury series homes under the Terrata Homes brand name. The company also engages in the wholesale business, which include building and selling homes to large institutions looking to acquire single-family rental properties.

See Also

Want to see what other hedge funds are holding LGIH? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for LGI Homes, Inc. (NASDAQ:LGIH - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider LGI Homes, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LGI Homes wasn't on the list.

While LGI Homes currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.