LGT Fund Management Co Ltd. lessened its stake in Alibaba Group Holding Limited (NYSE:BABA - Free Report) by 53.5% during the 2nd quarter, according to the company in its most recent 13F filing with the SEC. The firm owned 5,700 shares of the specialty retailer's stock after selling 6,568 shares during the quarter. LGT Fund Management Co Ltd.'s holdings in Alibaba Group were worth $646,000 at the end of the most recent reporting period.

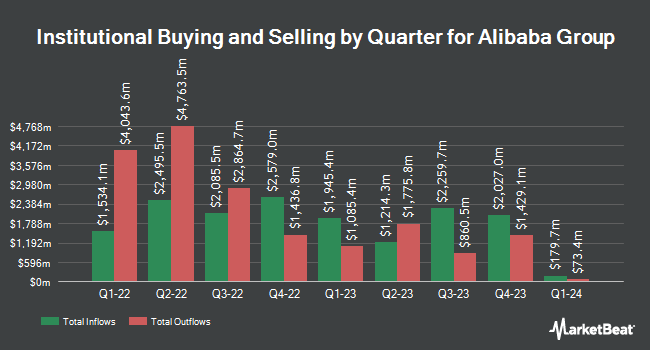

Several other large investors have also recently added to or reduced their stakes in the stock. Brighton Jones LLC grew its position in Alibaba Group by 40.4% in the fourth quarter. Brighton Jones LLC now owns 3,411 shares of the specialty retailer's stock worth $289,000 after acquiring an additional 981 shares in the last quarter. GAMMA Investing LLC boosted its holdings in shares of Alibaba Group by 13,483.0% during the 1st quarter. GAMMA Investing LLC now owns 19,967 shares of the specialty retailer's stock worth $2,640,000 after buying an additional 19,820 shares during the period. Merit Financial Group LLC boosted its holdings in shares of Alibaba Group by 21.7% during the 1st quarter. Merit Financial Group LLC now owns 10,661 shares of the specialty retailer's stock worth $1,410,000 after buying an additional 1,903 shares during the period. RFG Advisory LLC bought a new stake in Alibaba Group in the 1st quarter valued at $643,000. Finally, Thurston Springer Miller Herd & Titak Inc. boosted its holdings in Alibaba Group by 139.5% in the 1st quarter. Thurston Springer Miller Herd & Titak Inc. now owns 1,025 shares of the specialty retailer's stock valued at $136,000 after purchasing an additional 597 shares during the period. Institutional investors and hedge funds own 13.47% of the company's stock.

Alibaba Group Trading Down 0.7%

Shares of Alibaba Group stock opened at $187.94 on Friday. The stock has a market capitalization of $448.06 billion, a P/E ratio of 21.85, a price-to-earnings-growth ratio of 2.22 and a beta of 0.18. The company has a quick ratio of 1.45, a current ratio of 1.45 and a debt-to-equity ratio of 0.19. The company has a 50-day simple moving average of $140.65 and a 200 day simple moving average of $126.04. Alibaba Group Holding Limited has a 12-month low of $80.06 and a 12-month high of $192.67.

Analyst Ratings Changes

BABA has been the subject of a number of research reports. Mizuho increased their price target on shares of Alibaba Group from $149.00 to $159.00 and gave the company an "outperform" rating in a report on Tuesday, September 2nd. Citigroup restated a "buy" rating on shares of Alibaba Group in a research note on Wednesday, September 24th. Sanford C. Bernstein restated an "outperform" rating and issued a $160.00 price objective on shares of Alibaba Group in a research note on Saturday, August 30th. Arete upgraded shares of Alibaba Group from a "neutral" rating to a "buy" rating and set a $152.00 price objective for the company in a research note on Wednesday, September 3rd. Finally, Weiss Ratings restated a "buy (b-)" rating on shares of Alibaba Group in a research note on Saturday, September 27th. One equities research analyst has rated the stock with a Strong Buy rating, seventeen have given a Buy rating and one has assigned a Hold rating to the company's stock. Based on data from MarketBeat.com, the stock currently has an average rating of "Buy" and a consensus price target of $181.88.

View Our Latest Stock Analysis on BABA

About Alibaba Group

(

Free Report)

Alibaba Group Holding Limited, through its subsidiaries, provides technology infrastructure and marketing reach to help merchants, brands, retailers, and other businesses to engage with their users and customers in the People's Republic of China and internationally. The company operates through seven segments: China Commerce, International Commerce, Local Consumer Services, Cainiao, Cloud, Digital Media and Entertainment, and Innovation Initiatives and Others.

Featured Articles

Want to see what other hedge funds are holding BABA? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Alibaba Group Holding Limited (NYSE:BABA - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Alibaba Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alibaba Group wasn't on the list.

While Alibaba Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.