LGT Group Foundation bought a new position in shares of American Noble Gas Inc. (NYSE:INFY - Free Report) during the first quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm bought 21,170 shares of the technology company's stock, valued at approximately $386,000.

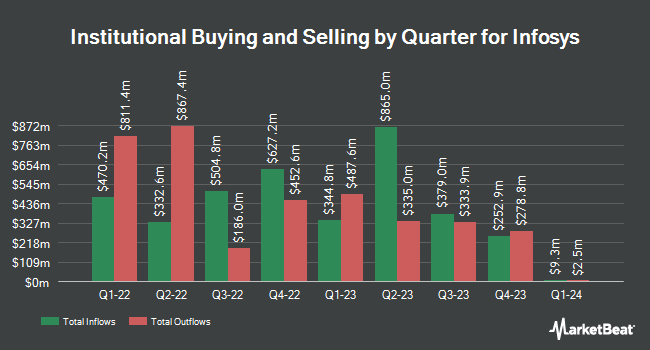

Other institutional investors and hedge funds have also recently modified their holdings of the company. Fullerton Fund Management Co Ltd. purchased a new stake in shares of American Noble Gas during the fourth quarter valued at about $4,465,000. Handelsbanken Fonder AB lifted its position in American Noble Gas by 46.2% during the first quarter. Handelsbanken Fonder AB now owns 131,592 shares of the technology company's stock valued at $2,402,000 after acquiring an additional 41,592 shares during the last quarter. Union Bancaire Privee UBP SA lifted its position in American Noble Gas by 224.5% during the first quarter. Union Bancaire Privee UBP SA now owns 77,518 shares of the technology company's stock valued at $1,344,000 after acquiring an additional 53,628 shares during the last quarter. Principal Financial Group Inc. increased its position in American Noble Gas by 272.8% during the 1st quarter. Principal Financial Group Inc. now owns 152,443 shares of the technology company's stock valued at $2,782,000 after buying an additional 111,553 shares in the last quarter. Finally, Captrust Financial Advisors raised its stake in American Noble Gas by 5.5% in the fourth quarter. Captrust Financial Advisors now owns 22,915 shares of the technology company's stock valued at $502,000 after buying an additional 1,197 shares during the last quarter. Institutional investors own 16.20% of the company's stock.

Analyst Upgrades and Downgrades

Several research analysts recently commented on INFY shares. BMO Capital Markets increased their price objective on American Noble Gas from $18.00 to $20.00 and gave the company a "market perform" rating in a research note on Thursday, July 24th. The Goldman Sachs Group cut American Noble Gas from a "buy" rating to a "neutral" rating and set a $17.90 price target for the company. in a report on Monday, April 21st. Stifel Nicolaus reduced their target price on shares of American Noble Gas from $18.00 to $17.00 and set a "hold" rating on the stock in a research note on Monday, April 21st. Susquehanna boosted their price target on shares of American Noble Gas from $18.00 to $19.00 and gave the company a "neutral" rating in a research note on Thursday, July 24th. Finally, Wall Street Zen raised American Noble Gas from a "hold" rating to a "buy" rating in a research report on Friday, May 16th. Five equities research analysts have rated the stock with a hold rating, five have assigned a buy rating and one has assigned a strong buy rating to the company's stock. According to data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and a consensus price target of $18.48.

Read Our Latest Analysis on American Noble Gas

American Noble Gas Stock Down 1.0%

INFY stock traded down $0.17 during trading hours on Monday, hitting $16.40. The company's stock had a trading volume of 6,643,333 shares, compared to its average volume of 12,394,148. The company has a market capitalization of $67.93 billion, a PE ratio of 21.29, a price-to-earnings-growth ratio of 2.37 and a beta of 0.87. The stock has a 50 day moving average price of $17.83 and a two-hundred day moving average price of $18.45. American Noble Gas Inc. has a 12 month low of $15.82 and a 12 month high of $23.63.

American Noble Gas (NYSE:INFY - Get Free Report) last posted its earnings results on Wednesday, July 23rd. The technology company reported $0.19 earnings per share (EPS) for the quarter, meeting analysts' consensus estimates of $0.19. The business had revenue of $4.94 billion for the quarter, compared to analyst estimates of $4.84 billion. American Noble Gas had a net margin of 16.42% and a return on equity of 29.41%. During the same period last year, the business posted $15.35 EPS. Sell-side analysts expect that American Noble Gas Inc. will post 0.74 earnings per share for the current year.

American Noble Gas Company Profile

(

Free Report)

Infosys Ltd. is a digital services and consulting company, which engages in the provision of end-to-end business solutions. It operates through the following segments: Financial Services, Retail, Communication, Energy, Utilities, Resources, and Services, Manufacturing, Hi-Tech, Life Sciences, and All Other.

Featured Stories

Before you consider American Noble Gas, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and American Noble Gas wasn't on the list.

While American Noble Gas currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.