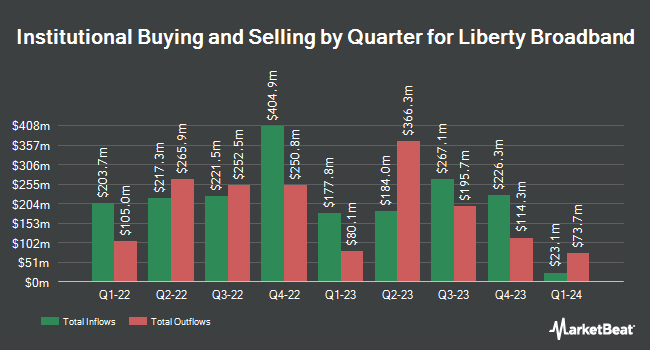

Jane Street Group LLC lifted its position in shares of Liberty Broadband Corporation (NASDAQ:LBRDK - Free Report) by 283.7% during the first quarter, according to the company in its most recent filing with the SEC. The institutional investor owned 396,532 shares of the company's stock after buying an additional 293,176 shares during the quarter. Jane Street Group LLC owned approximately 0.28% of Liberty Broadband worth $33,725,000 at the end of the most recent quarter.

A number of other large investors also recently modified their holdings of the company. Deutsche Bank AG lifted its stake in shares of Liberty Broadband by 125.6% during the 4th quarter. Deutsche Bank AG now owns 3,060,143 shares of the company's stock valued at $228,776,000 after buying an additional 1,703,637 shares in the last quarter. Dimensional Fund Advisors LP lifted its stake in shares of Liberty Broadband by 13.5% during the 1st quarter. Dimensional Fund Advisors LP now owns 2,310,698 shares of the company's stock valued at $196,522,000 after buying an additional 275,354 shares in the last quarter. Madison Asset Management LLC lifted its stake in shares of Liberty Broadband by 8.5% during the 1st quarter. Madison Asset Management LLC now owns 1,781,745 shares of the company's stock valued at $151,537,000 after buying an additional 140,307 shares in the last quarter. Charles Schwab Investment Management Inc. lifted its stake in Liberty Broadband by 4.8% in the 1st quarter. Charles Schwab Investment Management Inc. now owns 1,019,711 shares of the company's stock worth $86,726,000 after purchasing an additional 47,167 shares in the last quarter. Finally, Royal Bank of Canada lifted its stake in Liberty Broadband by 33.2% in the 4th quarter. Royal Bank of Canada now owns 908,860 shares of the company's stock worth $67,946,000 after purchasing an additional 226,360 shares in the last quarter. Hedge funds and other institutional investors own 80.22% of the company's stock.

Analyst Upgrades and Downgrades

Separately, Wall Street Zen upgraded shares of Liberty Broadband to a "hold" rating in a research note on Saturday, July 12th.

Read Our Latest Analysis on LBRDK

Liberty Broadband Price Performance

Shares of Liberty Broadband stock traded up $0.37 during trading hours on Monday, reaching $60.86. The company's stock had a trading volume of 921,185 shares, compared to its average volume of 1,487,758. The firm has a 50 day moving average price of $77.30 and a 200-day moving average price of $83.43. Liberty Broadband Corporation has a one year low of $57.91 and a one year high of $104.00. The company has a debt-to-equity ratio of 0.26, a current ratio of 0.60 and a quick ratio of 0.60. The stock has a market cap of $8.73 billion, a P/E ratio of 8.03 and a beta of 0.97.

Liberty Broadband Profile

(

Free Report)

Liberty Broadband Corporation engages in the communications businesses. The company's GCI Holdings segment provides data, wireless, video, voice, and managed services to residential customers, businesses, governmental entities, educational, and medical institutions in Alaska under the GCI brand.

Featured Articles

Before you consider Liberty Broadband, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Liberty Broadband wasn't on the list.

While Liberty Broadband currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.