Lincluden Management Ltd. decreased its stake in Suncor Energy Inc. (NYSE:SU - Free Report) TSE: SU by 2.0% in the second quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 605,589 shares of the oil and gas producer's stock after selling 12,671 shares during the quarter. Suncor Energy makes up 2.5% of Lincluden Management Ltd.'s portfolio, making the stock its 16th biggest holding. Lincluden Management Ltd.'s holdings in Suncor Energy were worth $22,664,000 as of its most recent filing with the Securities & Exchange Commission.

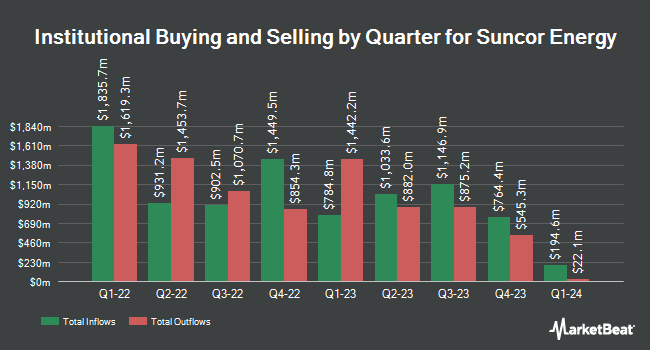

A number of other hedge funds and other institutional investors have also bought and sold shares of the stock. Trust Co. of Toledo NA OH increased its position in Suncor Energy by 3.0% in the second quarter. Trust Co. of Toledo NA OH now owns 24,194 shares of the oil and gas producer's stock worth $906,000 after buying an additional 703 shares in the last quarter. PDS Planning Inc increased its position in Suncor Energy by 19.2% in the second quarter. PDS Planning Inc now owns 6,542 shares of the oil and gas producer's stock worth $245,000 after buying an additional 1,053 shares in the last quarter. IFP Advisors Inc increased its position in Suncor Energy by 27.6% in the second quarter. IFP Advisors Inc now owns 1,428 shares of the oil and gas producer's stock worth $53,000 after buying an additional 309 shares in the last quarter. Mainstay Capital Management LLC ADV bought a new position in shares of Suncor Energy in the second quarter worth about $262,000. Finally, Maryland State Retirement & Pension System boosted its stake in shares of Suncor Energy by 11.5% in the second quarter. Maryland State Retirement & Pension System now owns 319,619 shares of the oil and gas producer's stock worth $11,982,000 after acquiring an additional 32,909 shares during the period. Hedge funds and other institutional investors own 67.37% of the company's stock.

Suncor Energy Price Performance

NYSE:SU opened at $39.53 on Friday. The firm has a market capitalization of $47.79 billion, a price-to-earnings ratio of 12.16, a PEG ratio of 3.20 and a beta of 0.78. Suncor Energy Inc. has a 1 year low of $30.79 and a 1 year high of $43.48. The business has a 50 day simple moving average of $40.70 and a 200-day simple moving average of $38.25. The company has a debt-to-equity ratio of 0.19, a current ratio of 1.26 and a quick ratio of 0.77.

Suncor Energy (NYSE:SU - Get Free Report) TSE: SU last posted its quarterly earnings data on Tuesday, August 5th. The oil and gas producer reported $0.51 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.50 by $0.01. The business had revenue of $8.81 billion during the quarter, compared to analyst estimates of $11.56 billion. Suncor Energy had a return on equity of 13.21% and a net margin of 11.35%.During the same period last year, the company earned $1.27 EPS. Equities analysts forecast that Suncor Energy Inc. will post 3.42 EPS for the current year.

Suncor Energy Increases Dividend

The firm also recently declared a quarterly dividend, which was paid on Thursday, September 25th. Investors of record on Thursday, September 4th were paid a dividend of $0.4135 per share. The ex-dividend date of this dividend was Thursday, September 4th. This represents a $1.65 dividend on an annualized basis and a dividend yield of 4.2%. This is an increase from Suncor Energy's previous quarterly dividend of $0.41. Suncor Energy's dividend payout ratio is 51.08%.

Analyst Ratings Changes

A number of equities analysts have recently weighed in on SU shares. Royal Bank Of Canada reaffirmed an "outperform" rating and issued a $65.00 price objective on shares of Suncor Energy in a research note on Friday, October 3rd. Weiss Ratings reissued a "hold (c+)" rating on shares of Suncor Energy in a research note on Wednesday. Two equities research analysts have rated the stock with a Strong Buy rating, three have issued a Buy rating and four have assigned a Hold rating to the company. Based on data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and a consensus price target of $65.00.

View Our Latest Stock Report on SU

Suncor Energy Company Profile

(

Free Report)

Suncor Energy Inc operates as an integrated energy company in Canada, the United States, and internationally. It operates through Oil Sands; Exploration and Production; and Refining and Marketing segments. The Oil Sands segment explores, develops, and produces bitumen, synthetic crude oil, and related products.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Suncor Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Suncor Energy wasn't on the list.

While Suncor Energy currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.