Natixis Advisors LLC raised its holdings in Live Nation Entertainment, Inc. (NYSE:LYV - Free Report) by 3.9% during the 1st quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 69,618 shares of the company's stock after acquiring an additional 2,621 shares during the period. Natixis Advisors LLC's holdings in Live Nation Entertainment were worth $9,091,000 at the end of the most recent reporting period.

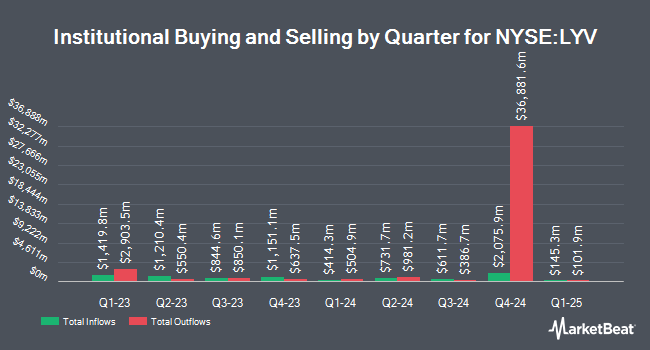

Several other large investors have also recently modified their holdings of the stock. Independent Franchise Partners LLP grew its stake in shares of Live Nation Entertainment by 207.6% in the fourth quarter. Independent Franchise Partners LLP now owns 4,693,986 shares of the company's stock worth $607,871,000 after purchasing an additional 3,168,210 shares during the last quarter. Massachusetts Financial Services Co. MA grew its position in shares of Live Nation Entertainment by 46.1% in the 1st quarter. Massachusetts Financial Services Co. MA now owns 2,804,375 shares of the company's stock worth $366,195,000 after buying an additional 884,745 shares during the last quarter. Jericho Capital Asset Management L.P. increased its stake in shares of Live Nation Entertainment by 32.0% during the fourth quarter. Jericho Capital Asset Management L.P. now owns 3,208,082 shares of the company's stock valued at $415,447,000 after buying an additional 777,105 shares during the period. Voloridge Investment Management LLC bought a new position in shares of Live Nation Entertainment during the fourth quarter valued at approximately $88,394,000. Finally, Capital World Investors lifted its stake in Live Nation Entertainment by 54.2% in the fourth quarter. Capital World Investors now owns 1,707,284 shares of the company's stock worth $221,093,000 after acquiring an additional 599,784 shares during the period. Hedge funds and other institutional investors own 74.52% of the company's stock.

Insiders Place Their Bets

In other Live Nation Entertainment news, EVP John Hopmans sold 34,808 shares of the company's stock in a transaction on Friday, May 16th. The stock was sold at an average price of $147.38, for a total transaction of $5,130,003.04. Following the transaction, the executive vice president directly owned 189,456 shares in the company, valued at $27,922,025.28. This represents a 15.52% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. 3.01% of the stock is currently owned by company insiders.

Analysts Set New Price Targets

LYV has been the topic of a number of research analyst reports. Rosenblatt Securities reduced their price objective on shares of Live Nation Entertainment from $174.00 to $170.00 and set a "buy" rating on the stock in a research report on Friday, May 2nd. Guggenheim reissued a "buy" rating and issued a $170.00 price target on shares of Live Nation Entertainment in a research note on Wednesday, June 18th. Susquehanna set a $165.00 price objective on Live Nation Entertainment and gave the company a "positive" rating in a research report on Tuesday, June 10th. Morgan Stanley set a $180.00 target price on Live Nation Entertainment in a research report on Thursday, July 24th. Finally, Roth Mkm dropped their price target on Live Nation Entertainment from $174.00 to $164.00 and set a "buy" rating on the stock in a research report on Friday, May 2nd. One research analyst has rated the stock with a hold rating and seventeen have assigned a buy rating to the company's stock. According to data from MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and a consensus price target of $165.82.

Check Out Our Latest Stock Analysis on Live Nation Entertainment

Live Nation Entertainment Price Performance

LYV stock traded down $0.88 during mid-day trading on Thursday, reaching $148.41. 3,592,779 shares of the company's stock were exchanged, compared to its average volume of 2,499,155. Live Nation Entertainment, Inc. has a 12-month low of $89.69 and a 12-month high of $157.75. The company has a market cap of $34.40 billion, a price-to-earnings ratio of 50.65, a price-to-earnings-growth ratio of 5.86 and a beta of 1.46. The company has a debt-to-equity ratio of 7.43, a current ratio of 0.96 and a quick ratio of 0.96. The stock's 50 day moving average is $146.83 and its 200 day moving average is $139.82.

Live Nation Entertainment (NYSE:LYV - Get Free Report) last released its earnings results on Thursday, August 7th. The company reported $0.41 earnings per share for the quarter, missing the consensus estimate of $1.08 by ($0.67). Live Nation Entertainment had a net margin of 4.28% and a return on equity of 125.77%. On average, research analysts expect that Live Nation Entertainment, Inc. will post 2.38 EPS for the current year.

About Live Nation Entertainment

(

Free Report)

Live Nation Entertainment, Inc operates as a live entertainment company worldwide. It operates through Concerts, Ticketing, and Sponsorship & Advertising segments. The Concerts segment promotes live music events in its owned or operated venues, and in rented third-party venues. This segment operates and manages music venues; produces music festivals; creates and streams associated content; and offers management and other services to artists.

See Also

Before you consider Live Nation Entertainment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Live Nation Entertainment wasn't on the list.

While Live Nation Entertainment currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.