Lockheed Martin Investment Management Co. decreased its holdings in shares of Banco Santander, S.A. (NYSE:SAN - Free Report) by 75.7% during the 1st quarter, according to its most recent disclosure with the Securities & Exchange Commission. The fund owned 135,580 shares of the bank's stock after selling 421,810 shares during the quarter. Lockheed Martin Investment Management Co.'s holdings in Banco Santander were worth $908,000 as of its most recent SEC filing.

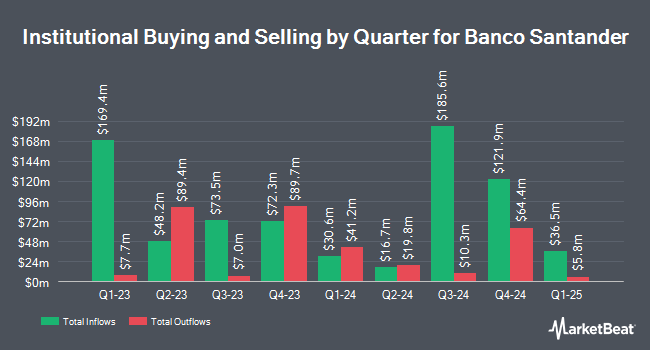

Several other hedge funds have also made changes to their positions in the business. FMR LLC boosted its holdings in shares of Banco Santander by 5.1% during the fourth quarter. FMR LLC now owns 21,953,176 shares of the bank's stock worth $100,106,000 after purchasing an additional 1,059,449 shares during the last quarter. Chevy Chase Trust Holdings LLC raised its position in shares of Banco Santander by 30.5% in the 1st quarter. Chevy Chase Trust Holdings LLC now owns 11,875,594 shares of the bank's stock worth $79,566,000 after buying an additional 2,774,449 shares during the period. Northern Trust Corp raised its position in Banco Santander by 46.4% in the fourth quarter. Northern Trust Corp now owns 10,775,261 shares of the bank's stock valued at $49,135,000 after purchasing an additional 3,413,685 shares during the period. Teachers Retirement System of The State of Kentucky raised its position in Banco Santander by 7.2% in the fourth quarter. Teachers Retirement System of The State of Kentucky now owns 5,429,260 shares of the bank's stock valued at $24,757,000 after purchasing an additional 362,500 shares during the period. Finally, Bank of America Corp DE raised its position in Banco Santander by 19.9% in the fourth quarter. Bank of America Corp DE now owns 2,655,351 shares of the bank's stock valued at $12,108,000 after purchasing an additional 440,676 shares during the period. Institutional investors and hedge funds own 9.19% of the company's stock.

Banco Santander Price Performance

NYSE:SAN traded up $0.08 during mid-day trading on Thursday, reaching $9.61. The stock had a trading volume of 2,514,346 shares, compared to its average volume of 5,719,837. The company has a market capitalization of $142.97 billion, a price-to-earnings ratio of 10.67, a price-to-earnings-growth ratio of 1.05 and a beta of 1.06. Banco Santander, S.A. has a 1-year low of $4.43 and a 1-year high of $9.61. The stock's 50 day simple moving average is $8.49 and its two-hundred day simple moving average is $7.32.

Banco Santander (NYSE:SAN - Get Free Report) last issued its earnings results on Wednesday, July 30th. The bank reported $0.22 EPS for the quarter, missing analysts' consensus estimates of $0.26 by ($0.04). Banco Santander had a net margin of 17.30% and a return on equity of 11.98%. The company had revenue of $17.83 billion during the quarter, compared to analyst estimates of $17.69 billion. Sell-side analysts anticipate that Banco Santander, S.A. will post 0.83 EPS for the current fiscal year.

Analyst Ratings Changes

Several research analysts have commented on the company. Wall Street Zen raised Banco Santander from a "hold" rating to a "buy" rating in a research report on Tuesday, May 13th. Citigroup began coverage on Banco Santander in a research note on Wednesday, June 4th. They set a "buy" rating for the company. Finally, Kepler Capital Markets downgraded Banco Santander from a "strong-buy" rating to a "hold" rating in a research note on Friday, August 1st. Two research analysts have rated the stock with a hold rating, three have given a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat.com, Banco Santander has an average rating of "Moderate Buy".

Check Out Our Latest Stock Analysis on Banco Santander

Banco Santander Company Profile

(

Free Report)

Banco Santander, SA provides various financial services worldwide. The company operates through Retail Banking, Santander Corporate & Investment Banking, Wealth Management & Insurance, and PagoNxt segments. It offers demand and time deposits, mutual funds, and current and savings accounts; mortgages, consumer finance, loans, and various financing solutions; and project finance, debt capital markets, global transaction banking, and corporate finance services.

See Also

Before you consider Banco Santander, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Banco Santander wasn't on the list.

While Banco Santander currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.