Invesco Ltd. reduced its holdings in Loews Corporation (NYSE:L - Free Report) by 10.2% in the 1st quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 4,009,182 shares of the insurance provider's stock after selling 453,205 shares during the quarter. Invesco Ltd. owned about 1.91% of Loews worth $368,484,000 at the end of the most recent quarter.

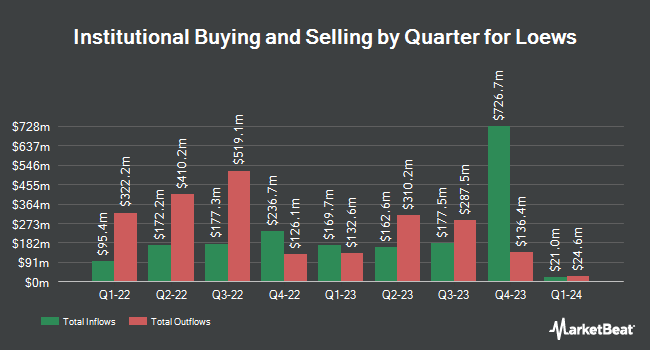

Several other hedge funds have also modified their holdings of L. OneDigital Investment Advisors LLC purchased a new position in Loews in the 1st quarter valued at approximately $224,000. Novem Group purchased a new position in Loews in the 4th quarter valued at approximately $678,000. SG Americas Securities LLC increased its stake in Loews by 589.9% in the 1st quarter. SG Americas Securities LLC now owns 10,162 shares of the insurance provider's stock valued at $934,000 after purchasing an additional 8,689 shares in the last quarter. Moody Lynn & Lieberson LLC purchased a new position in Loews in the 1st quarter valued at approximately $329,000. Finally, Penserra Capital Management LLC increased its stake in Loews by 2,074.6% in the 1st quarter. Penserra Capital Management LLC now owns 10,351 shares of the insurance provider's stock valued at $950,000 after purchasing an additional 9,875 shares in the last quarter. 58.33% of the stock is owned by institutional investors and hedge funds.

Loews Stock Performance

NYSE L opened at $93.70 on Tuesday. The company has a debt-to-equity ratio of 0.43, a current ratio of 0.33 and a quick ratio of 0.33. The business has a 50 day moving average price of $90.70 and a 200 day moving average price of $87.95. The company has a market capitalization of $19.44 billion, a P/E ratio of 14.90 and a beta of 0.69. Loews Corporation has a 1-year low of $75.16 and a 1-year high of $94.62.

Loews (NYSE:L - Get Free Report) last released its quarterly earnings results on Monday, August 4th. The insurance provider reported $1.87 earnings per share for the quarter. The company had revenue of $4.56 billion during the quarter. Loews had a return on equity of 7.43% and a net margin of 7.47%.

Loews Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Tuesday, September 2nd. Shareholders of record on Wednesday, August 20th will be given a dividend of $0.0625 per share. The ex-dividend date of this dividend is Wednesday, August 20th. This represents a $0.25 annualized dividend and a yield of 0.3%. Loews's dividend payout ratio (DPR) is presently 3.97%.

Wall Street Analyst Weigh In

Separately, Wall Street Zen raised Loews from a "hold" rating to a "buy" rating in a research note on Tuesday, May 6th.

Check Out Our Latest Stock Analysis on Loews

About Loews

(

Free Report)

Loews Corporation provides commercial property and casualty insurance in the United States and internationally. The company offers specialty insurance products, such as management and professional liability, and other coverage products; surety and fidelity bonds; property insurance products that include standard and excess property, marine and boiler, and machinery coverages; and casualty insurance products, such as workers' compensation, general and product liability, and commercial auto, surplus, and umbrella coverages.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Loews, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Loews wasn't on the list.

While Loews currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.