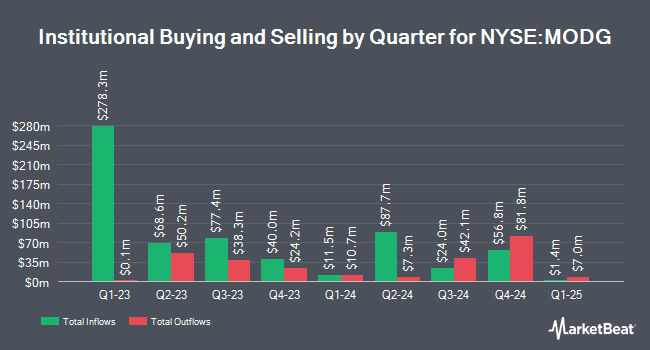

Long Focus Capital Management LLC increased its holdings in shares of Topgolf Callaway Brands Corp. (NYSE:MODG - Free Report) by 44.8% during the first quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 2,950,844 shares of the company's stock after purchasing an additional 912,844 shares during the quarter. Long Focus Capital Management LLC owned 1.61% of Topgolf Callaway Brands worth $19,446,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

Other large investors also recently bought and sold shares of the company. Dynamic Advisor Solutions LLC bought a new stake in Topgolf Callaway Brands in the 1st quarter worth about $66,000. Capstone Financial Advisors Inc. bought a new stake in Topgolf Callaway Brands in the 1st quarter worth about $66,000. Northwestern Mutual Wealth Management Co. increased its holdings in Topgolf Callaway Brands by 52.0% in the 1st quarter. Northwestern Mutual Wealth Management Co. now owns 10,636 shares of the company's stock worth $70,000 after buying an additional 3,640 shares in the last quarter. Schwarz Dygos Wheeler Investment Advisors LLC purchased a new stake in Topgolf Callaway Brands in the first quarter worth approximately $73,000. Finally, Covestor Ltd boosted its holdings in Topgolf Callaway Brands by 26.9% in the first quarter. Covestor Ltd now owns 11,785 shares of the company's stock worth $78,000 after purchasing an additional 2,499 shares during the last quarter. 84.69% of the stock is currently owned by institutional investors.

Wall Street Analyst Weigh In

MODG has been the topic of several research reports. Wall Street Zen upgraded shares of Topgolf Callaway Brands from a "sell" rating to a "hold" rating in a report on Saturday, August 9th. Morgan Stanley assumed coverage on Topgolf Callaway Brands in a report on Friday, July 18th. They issued an "equal weight" rating and a $9.50 price objective for the company. JPMorgan Chase & Co. cut their price objective on Topgolf Callaway Brands from $8.00 to $7.00 and set a "neutral" rating for the company in a report on Tuesday, May 27th. Cfra reaffirmed a "hold" rating and issued a $9.00 price objective on shares of Topgolf Callaway Brands in a report on Friday, July 11th. Finally, B. Riley reaffirmed a "neutral" rating and issued a $9.50 price objective (up previously from $7.00) on shares of Topgolf Callaway Brands in a report on Monday, August 11th. Three research analysts have rated the stock with a Buy rating and seven have assigned a Hold rating to the stock. According to MarketBeat, Topgolf Callaway Brands presently has an average rating of "Hold" and a consensus price target of $10.00.

Get Our Latest Research Report on Topgolf Callaway Brands

Insiders Place Their Bets

In other Topgolf Callaway Brands news, CEO Artie Starrs sold 106,734 shares of Topgolf Callaway Brands stock in a transaction that occurred on Tuesday, August 12th. The stock was sold at an average price of $8.64, for a total value of $922,181.76. Following the sale, the chief executive officer owned 105,823 shares of the company's stock, valued at $914,310.72. The trade was a 50.21% decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available through the SEC website. Also, Director Erik J. Anderson sold 25,704 shares of the firm's stock in a transaction that occurred on Friday, August 8th. The shares were sold at an average price of $9.25, for a total value of $237,762.00. Following the completion of the sale, the director directly owned 20,607 shares of the company's stock, valued at $190,614.75. The trade was a 55.50% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have bought a total of 461,583 shares of company stock valued at $3,054,283 in the last quarter. 2.49% of the stock is currently owned by insiders.

Topgolf Callaway Brands Price Performance

MODG stock traded down $0.01 during midday trading on Thursday, hitting $9.20. The company's stock had a trading volume of 632,778 shares, compared to its average volume of 2,917,492. Topgolf Callaway Brands Corp. has a 12 month low of $5.42 and a 12 month high of $11.41. The company has a quick ratio of 1.25, a current ratio of 1.85 and a debt-to-equity ratio of 0.48. The firm has a market capitalization of $1.69 billion, a price-to-earnings ratio of -1.13 and a beta of 1.25. The company has a 50 day moving average of $9.20 and a two-hundred day moving average of $7.58.

Topgolf Callaway Brands (NYSE:MODG - Get Free Report) last posted its quarterly earnings results on Wednesday, August 6th. The company reported $0.24 earnings per share for the quarter, topping the consensus estimate of $0.03 by $0.21. Topgolf Callaway Brands had a positive return on equity of 0.37% and a negative net margin of 36.08%.The business had revenue of $1.11 billion during the quarter, compared to the consensus estimate of $1.08 billion. During the same period in the prior year, the company posted $0.42 EPS. The firm's revenue for the quarter was down 4.1% compared to the same quarter last year. On average, analysts expect that Topgolf Callaway Brands Corp. will post 0.16 EPS for the current year.

Topgolf Callaway Brands Profile

(

Free Report)

Topgolf Callaway Brands Corp. designs, manufactures, and sells golf equipment, golf and lifestyle apparel, and other accessories in the United States, Europe, Asia, and Internationally. The Topgolf segment operates Topgolf venues equipped with technology-enabled hitting bays, bars, dining areas, and event spaces, as well as Toptracer ball-flight tracking technology; and World Golf Tour digital golf game.

Recommended Stories

Before you consider Topgolf Callaway Brands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Topgolf Callaway Brands wasn't on the list.

While Topgolf Callaway Brands currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.