Long Pond Capital LP acquired a new stake in shares of Wyndham Hotels & Resorts (NYSE:WH - Free Report) in the first quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund acquired 233,153 shares of the company's stock, valued at approximately $21,103,000. Wyndham Hotels & Resorts comprises 1.4% of Long Pond Capital LP's holdings, making the stock its 21st biggest holding. Long Pond Capital LP owned about 0.30% of Wyndham Hotels & Resorts at the end of the most recent quarter.

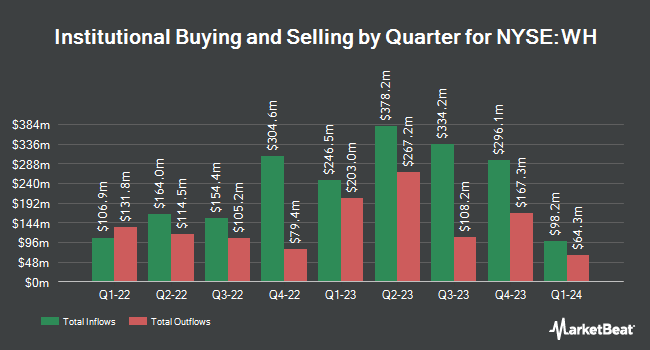

A number of other institutional investors and hedge funds have also modified their holdings of WH. Nuveen LLC bought a new stake in shares of Wyndham Hotels & Resorts in the 1st quarter worth $70,353,000. Freestone Grove Partners LP bought a new stake in shares of Wyndham Hotels & Resorts in the 4th quarter worth $54,738,000. Interval Partners LP bought a new stake in shares of Wyndham Hotels & Resorts in the 4th quarter worth $31,991,000. Balyasny Asset Management L.P. bought a new stake in shares of Wyndham Hotels & Resorts in the fourth quarter worth $29,846,000. Finally, Fiera Capital Corp bought a new stake in shares of Wyndham Hotels & Resorts in the first quarter worth $22,073,000. Institutional investors own 93.46% of the company's stock.

Wyndham Hotels & Resorts Stock Performance

NYSE WH traded down $0.92 during trading hours on Friday, hitting $86.65. The company had a trading volume of 765,725 shares, compared to its average volume of 785,848. The company has a debt-to-equity ratio of 4.44, a quick ratio of 1.03 and a current ratio of 1.03. Wyndham Hotels & Resorts has a 1-year low of $75.91 and a 1-year high of $113.07. The company has a market cap of $6.62 billion, a PE ratio of 20.24, a price-to-earnings-growth ratio of 1.54 and a beta of 0.99. The business has a 50 day moving average of $86.20 and a 200-day moving average of $88.38.

Wyndham Hotels & Resorts (NYSE:WH - Get Free Report) last announced its earnings results on Wednesday, July 23rd. The company reported $1.33 earnings per share for the quarter, topping the consensus estimate of $1.16 by $0.17. The business had revenue of $397.00 million during the quarter, compared to the consensus estimate of $384.69 million. Wyndham Hotels & Resorts had a net margin of 23.10% and a return on equity of 60.79%. The business's quarterly revenue was up 8.2% compared to the same quarter last year. During the same quarter in the prior year, the firm earned $1.13 earnings per share. Wyndham Hotels & Resorts has set its FY 2025 guidance at 4.600-4.780 EPS. As a group, equities research analysts expect that Wyndham Hotels & Resorts will post 4.79 EPS for the current year.

Wyndham Hotels & Resorts Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Tuesday, September 30th. Investors of record on Monday, September 15th will be given a dividend of $0.41 per share. The ex-dividend date is Monday, September 15th. This represents a $1.64 dividend on an annualized basis and a yield of 1.9%. Wyndham Hotels & Resorts's dividend payout ratio (DPR) is 38.32%.

Analyst Ratings Changes

WH has been the subject of several research analyst reports. Morgan Stanley reaffirmed an "overweight" rating and issued a $105.00 price objective on shares of Wyndham Hotels & Resorts in a report on Tuesday, July 15th. JPMorgan Chase & Co. started coverage on Wyndham Hotels & Resorts in a report on Monday, June 23rd. They issued an "overweight" rating and a $101.00 price objective for the company. Truist Financial boosted their price target on Wyndham Hotels & Resorts from $100.00 to $101.00 and gave the company a "buy" rating in a report on Friday, July 25th. Robert W. Baird boosted their price target on Wyndham Hotels & Resorts from $98.00 to $99.00 and gave the company an "outperform" rating in a report on Friday, July 25th. Finally, Barclays upped their target price on shares of Wyndham Hotels & Resorts from $100.00 to $101.00 and gave the stock an "overweight" rating in a research report on Friday, July 25th. Eleven investment analysts have rated the stock with a Buy rating and one has issued a Hold rating to the company's stock. Based on data from MarketBeat.com, Wyndham Hotels & Resorts currently has a consensus rating of "Moderate Buy" and a consensus target price of $106.98.

Check Out Our Latest Analysis on Wyndham Hotels & Resorts

Wyndham Hotels & Resorts Company Profile

(

Free Report)

Wyndham Hotels & Resorts, Inc engages in the franchise and operation of hotels under the Wyndham brand. It operates through the Hotel Franchising and Hotel Management segments. The Hotel Franchising segment focuses on licensing the company's lodging brands and providing related services to third-party hotel owners and others.

Featured Articles

Before you consider Wyndham Hotels & Resorts, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wyndham Hotels & Resorts wasn't on the list.

While Wyndham Hotels & Resorts currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.