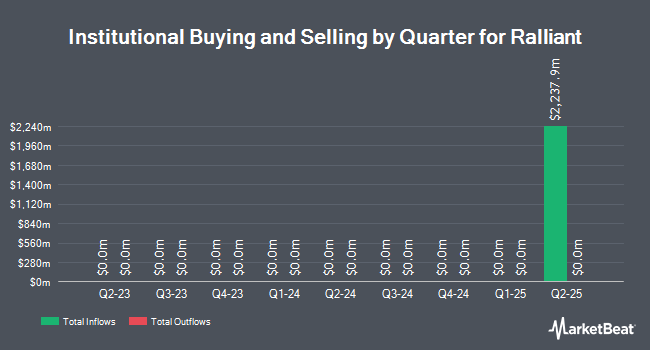

Louisiana State Employees Retirement System acquired a new stake in shares of Ralliant Corporation (NYSE:RAL - Free Report) during the 2nd quarter, according to its most recent 13F filing with the SEC. The firm acquired 52,666 shares of the company's stock, valued at approximately $2,554,000.

Several other large investors have also bought and sold shares of RAL. ST Germain D J Co. Inc. bought a new position in Ralliant during the 2nd quarter valued at $27,000. CX Institutional bought a new position in Ralliant during the 2nd quarter valued at $47,000. GAMMA Investing LLC bought a new position in Ralliant during the 2nd quarter valued at $56,000. ORG Partners LLC bought a new position in Ralliant during the 2nd quarter valued at $70,000. Finally, Bartlett & CO. Wealth Management LLC bought a new position in Ralliant during the 2nd quarter valued at $74,000.

Wall Street Analyst Weigh In

Several brokerages have weighed in on RAL. Melius initiated coverage on Ralliant in a research note on Tuesday, July 22nd. They set a "hold" rating and a $56.00 price objective on the stock. Oppenheimer initiated coverage on Ralliant in a research report on Wednesday, September 10th. They set an "outperform" rating and a $55.00 target price for the company. Royal Bank Of Canada raised Ralliant to a "hold" rating in a research report on Tuesday, August 19th. Barclays decreased their target price on Ralliant from $60.00 to $59.00 and set an "overweight" rating for the company in a research report on Wednesday, August 13th. Finally, Weiss Ratings reaffirmed a "sell (d+)" rating on shares of Ralliant in a research report on Wednesday. Four analysts have rated the stock with a Buy rating, six have issued a Hold rating and one has given a Sell rating to the company. According to MarketBeat.com, the company presently has a consensus rating of "Hold" and a consensus target price of $55.13.

View Our Latest Analysis on Ralliant

Ralliant Price Performance

Shares of RAL opened at $41.49 on Friday. The business has a 50-day moving average price of $43.09. Ralliant Corporation has a fifty-two week low of $40.70 and a fifty-two week high of $55.08. The company has a quick ratio of 1.03, a current ratio of 1.59 and a debt-to-equity ratio of 0.38.

Ralliant (NYSE:RAL - Get Free Report) last announced its quarterly earnings data on Monday, August 11th. The company reported $0.67 earnings per share for the quarter, topping the consensus estimate of $0.60 by $0.07. The firm had revenue of $503.30 million during the quarter, compared to analysts' expectations of $509.90 million. Ralliant has set its Q3 2025 guidance at 0.540-0.600 EPS.

Ralliant Announces Dividend

The company also recently disclosed a -- dividend, which was paid on Tuesday, September 23rd. Investors of record on Monday, September 8th were issued a $0.05 dividend. The ex-dividend date of this dividend was Monday, September 8th.

Ralliant Profile

(

Free Report)

Ralliant Corporation is a provider of precision technologies which specializes in designing, developing, manufacturing and servicing precision instruments and engineered products. Ralliant Corporation is based in RALEIGH, N.C.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Ralliant, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ralliant wasn't on the list.

While Ralliant currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.