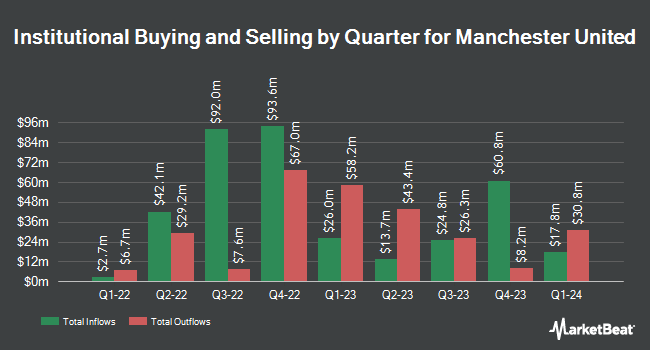

LPL Financial LLC grew its holdings in Manchester United Ltd. (NYSE:MANU - Free Report) by 46.7% during the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 104,830 shares of the company's stock after purchasing an additional 33,361 shares during the quarter. LPL Financial LLC owned about 0.06% of Manchester United worth $1,372,000 as of its most recent SEC filing.

Other institutional investors have also bought and sold shares of the company. Tower Research Capital LLC TRC lifted its stake in Manchester United by 55.2% in the 4th quarter. Tower Research Capital LLC TRC now owns 2,131 shares of the company's stock worth $37,000 after purchasing an additional 758 shares in the last quarter. Point72 Asset Management L.P. purchased a new position in Manchester United in the 4th quarter worth approximately $177,000. Simon Quick Advisors LLC purchased a new position in Manchester United in the 1st quarter worth approximately $137,000. Susquehanna Fundamental Investments LLC purchased a new position in Manchester United in the 4th quarter worth approximately $226,000. Finally, Vident Advisory LLC increased its holdings in shares of Manchester United by 27.1% during the 4th quarter. Vident Advisory LLC now owns 13,535 shares of the company's stock worth $235,000 after buying an additional 2,884 shares during the last quarter. 23.34% of the stock is owned by hedge funds and other institutional investors.

Manchester United Trading Up 1.9%

Shares of NYSE MANU traded up $0.33 during midday trading on Thursday, reaching $17.42. 280,175 shares of the stock were exchanged, compared to its average volume of 163,719. The company has a 50 day simple moving average of $17.69 and a 200 day simple moving average of $15.49. The stock has a market capitalization of $2.95 billion, a P/E ratio of -35.54 and a beta of 0.71. The company has a debt-to-equity ratio of 2.54, a quick ratio of 0.37 and a current ratio of 0.39. Manchester United Ltd. has a twelve month low of $12.05 and a twelve month high of $19.65.

Manchester United (NYSE:MANU - Get Free Report) last posted its earnings results on Friday, June 6th. The company reported ($0.04) earnings per share for the quarter, beating the consensus estimate of ($0.33) by $0.29. Manchester United had a negative net margin of 10.09% and a negative return on equity of 22.40%. The firm had revenue of $203.10 million during the quarter, compared to the consensus estimate of $159.13 million. During the same quarter last year, the firm earned ($0.24) EPS. Manchester United has set its FY 2025 guidance at EPS. As a group, equities analysts expect that Manchester United Ltd. will post -0.74 earnings per share for the current year.

Analysts Set New Price Targets

Separately, Wall Street Zen upgraded shares of Manchester United from a "sell" rating to a "hold" rating in a report on Saturday, May 31st. One research analyst has rated the stock with a Buy rating, According to MarketBeat.com, the company presently has a consensus rating of "Buy" and a consensus price target of $23.00.

Read Our Latest Research Report on MANU

About Manchester United

(

Free Report)

Manchester United plc, together with its subsidiaries, owns and operates a professional sports team in the United Kingdom. It operates Manchester United Football Club, a professional football club. The company develops marketing and sponsorship relationships with international and regional companies to leverage its brand.

Featured Stories

Before you consider Manchester United, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Manchester United wasn't on the list.

While Manchester United currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.