LPL Financial LLC increased its position in shares of Virtu Financial, Inc. (NASDAQ:VIRT - Free Report) by 43.7% in the first quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 105,403 shares of the financial services provider's stock after purchasing an additional 32,061 shares during the quarter. LPL Financial LLC owned 0.07% of Virtu Financial worth $4,018,000 as of its most recent SEC filing.

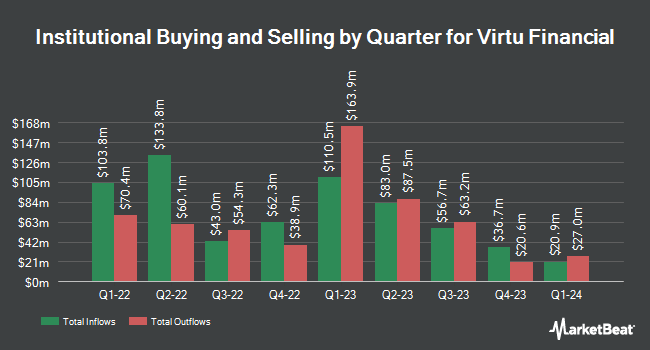

Other hedge funds and other institutional investors also recently bought and sold shares of the company. Penserra Capital Management LLC acquired a new stake in shares of Virtu Financial during the 1st quarter worth approximately $54,000. Vontobel Holding Ltd. acquired a new stake in Virtu Financial during the first quarter valued at $231,000. Mirae Asset Global Investments Co. Ltd. increased its holdings in Virtu Financial by 3,319.6% in the first quarter. Mirae Asset Global Investments Co. Ltd. now owns 10,635 shares of the financial services provider's stock valued at $405,000 after buying an additional 10,324 shares in the last quarter. Principal Financial Group Inc. raised its position in shares of Virtu Financial by 2.4% in the first quarter. Principal Financial Group Inc. now owns 401,117 shares of the financial services provider's stock worth $15,291,000 after acquiring an additional 9,569 shares during the period. Finally, Victory Capital Management Inc. boosted its stake in shares of Virtu Financial by 92.3% during the 1st quarter. Victory Capital Management Inc. now owns 107,761 shares of the financial services provider's stock worth $4,108,000 after acquiring an additional 51,713 shares in the last quarter. Institutional investors and hedge funds own 45.78% of the company's stock.

Insider Activity

In related news, COO Brett Fairclough sold 90,701 shares of Virtu Financial stock in a transaction that occurred on Thursday, August 7th. The stock was sold at an average price of $42.40, for a total transaction of $3,845,722.40. The sale was disclosed in a filing with the SEC, which is accessible through this hyperlink. 47.20% of the stock is owned by company insiders.

Virtu Financial Price Performance

VIRT traded down $0.25 on Tuesday, reaching $41.22. 85,591 shares of the company's stock were exchanged, compared to its average volume of 942,777. Virtu Financial, Inc. has a twelve month low of $29.23 and a twelve month high of $45.77. The stock has a market cap of $6.30 billion, a PE ratio of 11.92, a P/E/G ratio of 1.14 and a beta of 0.69. The company has a debt-to-equity ratio of 1.11, a current ratio of 0.49 and a quick ratio of 0.49. The stock's fifty day moving average price is $43.12 and its 200-day moving average price is $40.09.

Virtu Financial Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Monday, September 15th. Stockholders of record on Monday, September 1st will be given a $0.24 dividend. The ex-dividend date is Friday, August 29th. This represents a $0.96 dividend on an annualized basis and a dividend yield of 2.3%. Virtu Financial's dividend payout ratio is 21.82%.

Wall Street Analysts Forecast Growth

A number of brokerages have issued reports on VIRT. Evercore ISI increased their price target on Virtu Financial from $41.00 to $42.00 and gave the stock an "in-line" rating in a research report on Thursday, April 24th. Bank of America cut shares of Virtu Financial from a "buy" rating to a "neutral" rating and set a $43.00 price target on the stock. in a research note on Thursday, May 15th. Piper Sandler boosted their price target on shares of Virtu Financial from $44.00 to $48.00 and gave the stock an "overweight" rating in a report on Tuesday, July 15th. UBS Group reaffirmed a "neutral" rating and set a $45.00 price objective (up from $40.00) on shares of Virtu Financial in a report on Monday, August 4th. Finally, Wall Street Zen cut shares of Virtu Financial from a "buy" rating to a "hold" rating in a research note on Saturday, May 24th. One investment analyst has rated the stock with a sell rating, six have issued a hold rating and two have issued a buy rating to the company's stock. According to MarketBeat.com, the stock presently has a consensus rating of "Hold" and a consensus price target of $39.75.

Check Out Our Latest Report on Virtu Financial

Virtu Financial Company Profile

(

Free Report)

Virtu Financial, Inc operates as a financial services company in the United States, Asia Pacific, Canada, EMEA, Ireland, and internationally. The company operates through two segments, Market Making and Execution Services. Its product includes offerings in execution, liquidity sourcing, analytics and broker-neutral, capital markets, and multi-dealer platforms in workflow technology.

Featured Stories

Before you consider Virtu Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Virtu Financial wasn't on the list.

While Virtu Financial currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.