LPL Financial LLC increased its position in shares of AppFolio, Inc. (NASDAQ:APPF - Free Report) by 131.1% during the first quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The firm owned 10,279 shares of the software maker's stock after purchasing an additional 5,832 shares during the period. LPL Financial LLC's holdings in AppFolio were worth $2,231,000 at the end of the most recent reporting period.

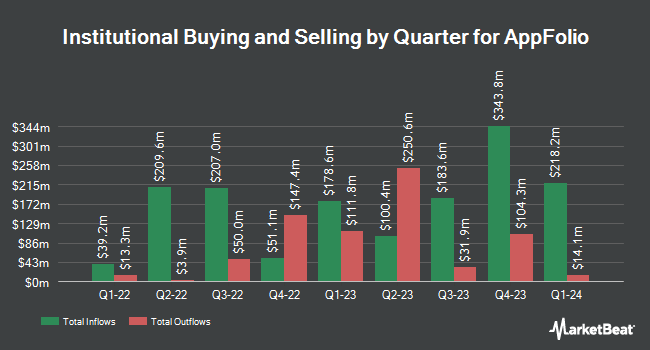

Several other hedge funds and other institutional investors have also recently bought and sold shares of APPF. Barclays PLC increased its holdings in AppFolio by 82.9% in the 4th quarter. Barclays PLC now owns 18,084 shares of the software maker's stock valued at $4,463,000 after buying an additional 8,196 shares during the period. Mariner LLC boosted its position in shares of AppFolio by 9.0% during the 4th quarter. Mariner LLC now owns 2,107 shares of the software maker's stock valued at $520,000 after acquiring an additional 174 shares in the last quarter. Dimensional Fund Advisors LP increased its stake in AppFolio by 45.6% in the fourth quarter. Dimensional Fund Advisors LP now owns 189,405 shares of the software maker's stock valued at $46,731,000 after acquiring an additional 59,279 shares during the period. Natixis bought a new stake in AppFolio in the fourth quarter valued at about $572,000. Finally, MetLife Investment Management LLC raised its position in AppFolio by 8.4% in the fourth quarter. MetLife Investment Management LLC now owns 14,001 shares of the software maker's stock worth $3,454,000 after purchasing an additional 1,084 shares in the last quarter. 85.19% of the stock is owned by institutional investors.

Insider Buying and Selling at AppFolio

In other AppFolio news, CEO William Shane Trigg sold 3,012 shares of the stock in a transaction dated Friday, August 15th. The shares were sold at an average price of $264.98, for a total transaction of $798,119.76. Following the sale, the chief executive officer owned 63,556 shares of the company's stock, valued at $16,841,068.88. This represents a 4.52% decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, major shareholder Maurice J. Duca sold 2,324 shares of the firm's stock in a transaction dated Tuesday, August 12th. The shares were sold at an average price of $276.80, for a total transaction of $643,283.20. Following the completion of the sale, the insider owned 35,376 shares of the company's stock, valued at $9,792,076.80. The trade was a 6.16% decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders have bought 18,500 shares of company stock worth $4,024,220 and have sold 41,018 shares worth $11,774,602. 4.68% of the stock is currently owned by corporate insiders.

AppFolio Stock Performance

Shares of NASDAQ APPF traded up $5.35 during mid-day trading on Friday, hitting $275.32. 328,243 shares of the stock were exchanged, compared to its average volume of 433,669. AppFolio, Inc. has a twelve month low of $189.01 and a twelve month high of $326.04. The stock's fifty day simple moving average is $255.51 and its two-hundred day simple moving average is $230.14. The company has a market cap of $9.87 billion, a P/E ratio of 49.70 and a beta of 0.95.

AppFolio (NASDAQ:APPF - Get Free Report) last released its quarterly earnings results on Thursday, July 31st. The software maker reported $1.38 EPS for the quarter, topping analysts' consensus estimates of $1.27 by $0.11. AppFolio had a return on equity of 26.32% and a net margin of 23.54%.The business had revenue of $235.58 million for the quarter, compared to analyst estimates of $230.10 million. During the same period in the prior year, the company earned $1.12 EPS. AppFolio's revenue for the quarter was up 19.4% on a year-over-year basis. AppFolio has set its FY 2025 guidance at EPS. As a group, equities research analysts predict that AppFolio, Inc. will post 3.96 earnings per share for the current fiscal year.

Analyst Upgrades and Downgrades

A number of equities research analysts have weighed in on APPF shares. Keefe, Bruyette & Woods raised AppFolio from an "underperform" rating to a "market perform" rating and lifted their price objective for the company from $205.00 to $267.00 in a report on Thursday, July 31st. DA Davidson reissued a "buy" rating and issued a $350.00 target price on shares of AppFolio in a report on Friday, August 1st. Finally, Piper Sandler raised AppFolio from a "neutral" rating to an "overweight" rating and boosted their price target for the company from $240.00 to $350.00 in a research note on Friday, August 1st. Four analysts have rated the stock with a Buy rating and two have assigned a Hold rating to the stock. According to MarketBeat, the stock has a consensus rating of "Moderate Buy" and a consensus price target of $303.00.

Read Our Latest Stock Analysis on APPF

About AppFolio

(

Free Report)

AppFolio, Inc, together with its subsidiaries, provides cloud business management solutions for the real estate industry in the United States. The company provides a cloud-based platform that enables users to automate and optimize common workflows; tools that assist with leasing, maintenance, and accounting; and other technology and services offered by third parties.

Recommended Stories

Before you consider AppFolio, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AppFolio wasn't on the list.

While AppFolio currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.