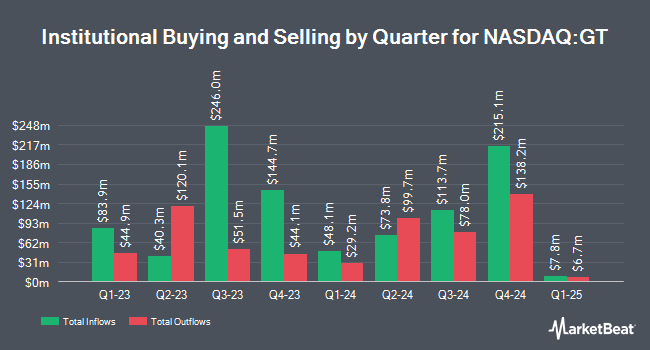

LSV Asset Management lowered its stake in shares of The Goodyear Tire & Rubber Company (NASDAQ:GT - Free Report) by 4.6% during the 1st quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor owned 5,176,627 shares of the company's stock after selling 248,503 shares during the quarter. LSV Asset Management owned 1.82% of Goodyear Tire & Rubber worth $47,832,000 at the end of the most recent quarter.

Other institutional investors have also added to or reduced their stakes in the company. Nisa Investment Advisors LLC boosted its position in Goodyear Tire & Rubber by 3.3% during the first quarter. Nisa Investment Advisors LLC now owns 28,766 shares of the company's stock valued at $266,000 after buying an additional 932 shares during the period. John G Ullman & Associates Inc. boosted its position in Goodyear Tire & Rubber by 9.1% during the first quarter. John G Ullman & Associates Inc. now owns 18,000 shares of the company's stock valued at $166,000 after buying an additional 1,500 shares during the period. Baird Financial Group Inc. boosted its holdings in shares of Goodyear Tire & Rubber by 15.1% during the fourth quarter. Baird Financial Group Inc. now owns 12,296 shares of the company's stock worth $111,000 after purchasing an additional 1,617 shares during the period. SummerHaven Investment Management LLC boosted its holdings in shares of Goodyear Tire & Rubber by 2.3% during the first quarter. SummerHaven Investment Management LLC now owns 73,318 shares of the company's stock worth $677,000 after purchasing an additional 1,621 shares during the period. Finally, GAMMA Investing LLC raised its stake in Goodyear Tire & Rubber by 147.5% in the first quarter. GAMMA Investing LLC now owns 2,809 shares of the company's stock worth $26,000 after buying an additional 1,674 shares in the last quarter. Institutional investors own 84.19% of the company's stock.

Goodyear Tire & Rubber Stock Performance

Shares of Goodyear Tire & Rubber stock traded up $0.10 on Thursday, hitting $10.04. 1,430,163 shares of the company's stock were exchanged, compared to its average volume of 6,098,561. The company has a 50-day simple moving average of $10.86 and a 200-day simple moving average of $10.12. The stock has a market capitalization of $2.87 billion, a PE ratio of 11.96, a PEG ratio of 0.32 and a beta of 1.37. The Goodyear Tire & Rubber Company has a 1 year low of $7.27 and a 1 year high of $12.03. The company has a debt-to-equity ratio of 1.44, a quick ratio of 0.64 and a current ratio of 1.22.

Goodyear Tire & Rubber (NASDAQ:GT - Get Free Report) last issued its quarterly earnings results on Wednesday, May 7th. The company reported ($0.04) earnings per share for the quarter, topping the consensus estimate of ($0.06) by $0.02. Goodyear Tire & Rubber had a net margin of 1.30% and a return on equity of 5.31%. The business had revenue of $4.25 billion for the quarter, compared to analysts' expectations of $4.41 billion. During the same quarter last year, the company posted $0.10 EPS. The company's revenue was down 6.3% compared to the same quarter last year. As a group, equities analysts anticipate that The Goodyear Tire & Rubber Company will post 1.5 EPS for the current year.

Wall Street Analysts Forecast Growth

A number of brokerages have weighed in on GT. JPMorgan Chase & Co. reaffirmed an "overweight" rating and set a $17.00 target price (down previously from $18.00) on shares of Goodyear Tire & Rubber in a research note on Thursday, May 22nd. BNP Paribas Exane raised shares of Goodyear Tire & Rubber from a "neutral" rating to an "outperform" rating and set a $15.00 price target for the company in a research report on Monday, June 9th. Wall Street Zen downgraded shares of Goodyear Tire & Rubber from a "buy" rating to a "hold" rating in a research report on Saturday, May 10th. Finally, BNP Paribas raised shares of Goodyear Tire & Rubber from a "hold" rating to a "strong-buy" rating in a research report on Monday, June 9th. Two equities research analysts have rated the stock with a hold rating, four have given a buy rating and two have assigned a strong buy rating to the company's stock. According to data from MarketBeat.com, the company currently has a consensus rating of "Buy" and an average target price of $14.20.

Get Our Latest Report on GT

About Goodyear Tire & Rubber

(

Free Report)

Goodyear Tire & Rubber Co engages in the development, manufacture, distribution, and sale of tires. It operates through the following geographical segments: Americas, Europe, Middle East, and Africa, and Asia Pacific. The Americas segment is involved in the development, manufacture, distribution, and sale of tires and related products and services in North, Central, and South America.

Recommended Stories

Before you consider Goodyear Tire & Rubber, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Goodyear Tire & Rubber wasn't on the list.

While Goodyear Tire & Rubber currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.