Lyrical Asset Management LP lessened its stake in F5, Inc. (NASDAQ:FFIV - Free Report) by 1.5% in the 1st quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm owned 1,066,101 shares of the network technology company's stock after selling 15,982 shares during the quarter. F5 accounts for about 4.4% of Lyrical Asset Management LP's investment portfolio, making the stock its 9th biggest holding. Lyrical Asset Management LP owned about 1.86% of F5 worth $283,871,000 as of its most recent filing with the Securities & Exchange Commission.

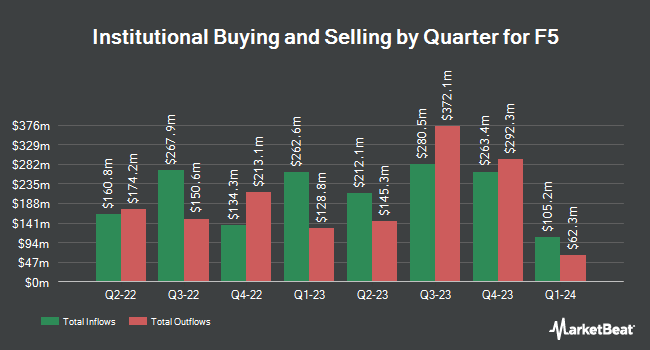

Several other institutional investors and hedge funds also recently made changes to their positions in FFIV. Annis Gardner Whiting Capital Advisors LLC boosted its holdings in shares of F5 by 134.1% in the first quarter. Annis Gardner Whiting Capital Advisors LLC now owns 103 shares of the network technology company's stock valued at $27,000 after buying an additional 59 shares during the period. Golden State Wealth Management LLC boosted its holdings in shares of F5 by 275.0% in the first quarter. Golden State Wealth Management LLC now owns 105 shares of the network technology company's stock valued at $28,000 after buying an additional 77 shares during the period. Park Square Financial Group LLC acquired a new position in shares of F5 in the fourth quarter valued at approximately $31,000. Kayne Anderson Rudnick Investment Management LLC acquired a new position in shares of F5 in the fourth quarter valued at approximately $60,000. Finally, MassMutual Private Wealth & Trust FSB boosted its holdings in shares of F5 by 31.4% in the first quarter. MassMutual Private Wealth & Trust FSB now owns 293 shares of the network technology company's stock valued at $78,000 after buying an additional 70 shares during the period. Institutional investors and hedge funds own 90.66% of the company's stock.

Insider Buying and Selling at F5

In related news, EVP Chad Michael Whalen sold 5,297 shares of the firm's stock in a transaction dated Monday, August 11th. The shares were sold at an average price of $322.24, for a total transaction of $1,706,905.28. Following the transaction, the executive vice president directly owned 23,591 shares of the company's stock, valued at approximately $7,601,963.84. This trade represents a 18.34% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. Also, Director Elizabeth Buse sold 1,500 shares of the firm's stock in a transaction dated Wednesday, June 11th. The shares were sold at an average price of $293.53, for a total transaction of $440,295.00. Following the completion of the transaction, the director directly owned 5,013 shares in the company, valued at approximately $1,471,465.89. This represents a 23.03% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 13,816 shares of company stock valued at $4,227,002 in the last quarter. Company insiders own 0.52% of the company's stock.

F5 Price Performance

FFIV stock traded down $0.2050 during trading hours on Tuesday, reaching $316.0550. The stock had a trading volume of 78,349 shares, compared to its average volume of 544,715. The stock has a market capitalization of $18.16 billion, a PE ratio of 27.84, a price-to-earnings-growth ratio of 3.64 and a beta of 1.03. The stock has a 50-day simple moving average of $301.56 and a 200 day simple moving average of $285.99. F5, Inc. has a fifty-two week low of $195.06 and a fifty-two week high of $334.00.

F5 (NASDAQ:FFIV - Get Free Report) last issued its quarterly earnings data on Wednesday, July 30th. The network technology company reported $4.16 earnings per share for the quarter, beating the consensus estimate of $3.49 by $0.67. The company had revenue of $780.37 million for the quarter, compared to analyst estimates of $750.64 million. F5 had a net margin of 22.06% and a return on equity of 21.77%. The company's revenue was up 12.2% on a year-over-year basis. During the same period in the prior year, the firm earned $3.36 earnings per share. F5 has set its FY 2025 guidance at 15.240-15.380 EPS. Q4 2025 guidance at 3.870-3.990 EPS. On average, sell-side analysts forecast that F5, Inc. will post 11.2 EPS for the current fiscal year.

Analyst Ratings Changes

Several research firms have recently weighed in on FFIV. Needham & Company LLC upped their price target on shares of F5 from $320.00 to $345.00 and gave the company a "buy" rating in a report on Thursday, July 31st. Royal Bank Of Canada increased their target price on shares of F5 from $314.00 to $326.00 and gave the stock a "sector perform" rating in a report on Thursday, July 31st. William Blair restated an "outperform" rating on shares of F5 in a report on Tuesday, April 29th. Morgan Stanley increased their target price on shares of F5 from $305.00 to $312.00 and gave the stock an "equal weight" rating in a report on Thursday, July 31st. Finally, Wall Street Zen cut shares of F5 from a "strong-buy" rating to a "buy" rating in a report on Thursday, May 22nd. Three analysts have rated the stock with a Buy rating, seven have assigned a Hold rating and one has given a Sell rating to the stock. According to data from MarketBeat.com, the stock has a consensus rating of "Hold" and an average target price of $309.89.

Read Our Latest Analysis on F5

F5 Company Profile

(

Free Report)

F5, Inc provides multi-cloud application security and delivery solutions in the United States, Europe, the Middle East, Africa, and the Asia Pacific region. The company's distributed cloud services enable its customers to deploy, secure, and operate applications in any architecture, from on-premises to the public cloud.

Featured Stories

Before you consider F5, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and F5 wasn't on the list.

While F5 currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.