Mackenzie Financial Corp purchased a new position in shares of CompoSecure, Inc. (NASDAQ:CMPO - Free Report) during the 1st quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The firm purchased 52,257 shares of the company's stock, valued at approximately $568,000. Mackenzie Financial Corp owned about 0.05% of CompoSecure as of its most recent filing with the Securities and Exchange Commission (SEC).

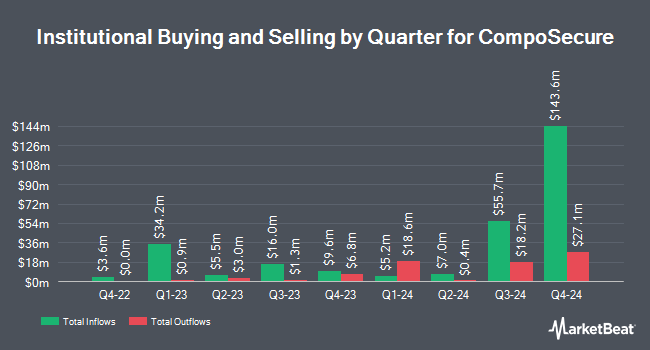

Other large investors have also modified their holdings of the company. GAMMA Investing LLC lifted its position in shares of CompoSecure by 1,524.4% during the first quarter. GAMMA Investing LLC now owns 2,794 shares of the company's stock worth $30,000 after purchasing an additional 2,622 shares during the last quarter. MorganRosel Wealth Management LLC bought a new position in CompoSecure in the first quarter worth about $43,000. KLP Kapitalforvaltning AS bought a new position in CompoSecure in the fourth quarter worth about $75,000. Price T Rowe Associates Inc. MD bought a new position in CompoSecure in the fourth quarter worth about $156,000. Finally, Zurcher Kantonalbank Zurich Cantonalbank lifted its holdings in CompoSecure by 71.1% in the first quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 10,547 shares of the company's stock worth $115,000 after acquiring an additional 4,384 shares during the last quarter. Institutional investors own 37.56% of the company's stock.

Analyst Ratings Changes

CMPO has been the topic of a number of recent research reports. Needham & Company LLC reissued a "buy" rating and issued a $15.00 target price on shares of CompoSecure in a report on Tuesday, May 13th. Wall Street Zen cut shares of CompoSecure from a "buy" rating to a "hold" rating in a report on Thursday, May 22nd. Finally, Benchmark raised their target price on shares of CompoSecure from $14.00 to $17.00 and gave the stock a "buy" rating in a report on Friday. Two research analysts have rated the stock with a hold rating and six have assigned a buy rating to the company. Based on data from MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and an average target price of $17.07.

View Our Latest Report on CMPO

CompoSecure Price Performance

Shares of CMPO stock traded up $3.13 on Friday, hitting $17.53. The company's stock had a trading volume of 4,118,329 shares, compared to its average volume of 664,680. CompoSecure, Inc. has a fifty-two week low of $9.24 and a fifty-two week high of $17.71. The firm's fifty day moving average price is $14.29 and its 200-day moving average price is $13.19. The stock has a market capitalization of $1.79 billion, a price-to-earnings ratio of -10.43 and a beta of 0.94.

CompoSecure (NASDAQ:CMPO - Get Free Report) last announced its earnings results on Monday, May 12th. The company reported $0.25 EPS for the quarter, topping the consensus estimate of $0.19 by $0.06. The firm had revenue of $103.90 million for the quarter, compared to the consensus estimate of $103.22 million. CompoSecure had a negative net margin of 24.53% and a negative return on equity of 59.26%. Analysts predict that CompoSecure, Inc. will post 1.02 EPS for the current fiscal year.

CompoSecure Company Profile

(

Free Report)

CompoSecure, Inc manufactures and designs metal, composite, and proprietary financial transaction cards in the United States and internationally. Its primary metal form factors include embedded, metal veneer lite, metal veneer, and full metal products. The company also offers Arculus Cold Storage Wallet, a three-factor authentication solution, which supports specific digital assets, including Bitcoin, Ethereum, non-fungible tokens and others.

See Also

Before you consider CompoSecure, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CompoSecure wasn't on the list.

While CompoSecure currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.