Mackenzie Financial Corp bought a new position in shares of V2X, Inc. (NYSE:VVX - Free Report) during the 1st quarter, according to the company in its most recent filing with the SEC. The fund bought 12,457 shares of the company's stock, valued at approximately $611,000.

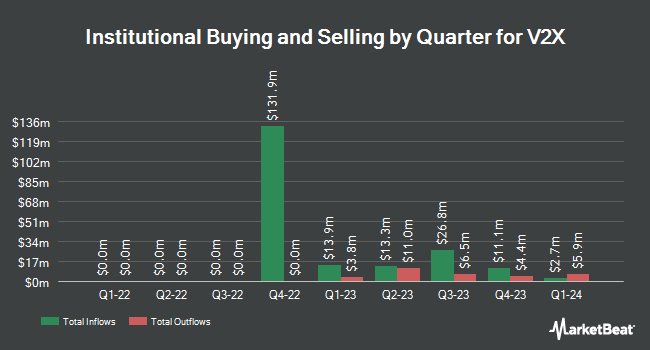

Other institutional investors and hedge funds also recently added to or reduced their stakes in the company. State of Wyoming acquired a new position in V2X during the 4th quarter worth approximately $45,000. CWM LLC increased its position in V2X by 239.0% during the 1st quarter. CWM LLC now owns 990 shares of the company's stock worth $49,000 after purchasing an additional 698 shares during the period. Whipplewood Advisors LLC boosted its stake in shares of V2X by 4,066.7% during the 1st quarter. Whipplewood Advisors LLC now owns 1,000 shares of the company's stock worth $49,000 after acquiring an additional 976 shares in the last quarter. Summit Investment Advisors Inc. boosted its stake in shares of V2X by 24.1% during the 4th quarter. Summit Investment Advisors Inc. now owns 1,482 shares of the company's stock worth $71,000 after acquiring an additional 288 shares in the last quarter. Finally, Wealthquest Corp purchased a new stake in shares of V2X during the 1st quarter worth approximately $97,000. Institutional investors and hedge funds own 95.18% of the company's stock.

Insider Transactions at V2X

In related news, SVP Richard L. Jr. Caputo sold 4,000 shares of the company's stock in a transaction that occurred on Thursday, June 5th. The stock was sold at an average price of $44.43, for a total value of $177,720.00. Following the sale, the senior vice president owned 15,869 shares of the company's stock, valued at approximately $705,059.67. This represents a 20.13% decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Insiders own 1.10% of the company's stock.

V2X Price Performance

VVX stock traded down $2.50 on Friday, reaching $50.81. The company had a trading volume of 1,060,695 shares, compared to its average volume of 263,019. V2X, Inc. has a 1 year low of $41.08 and a 1 year high of $69.75. The company has a debt-to-equity ratio of 1.02, a quick ratio of 1.16 and a current ratio of 1.20. The company's fifty day moving average is $47.60 and its 200 day moving average is $48.26. The company has a market cap of $1.61 billion, a P/E ratio of 23.10, a PEG ratio of 0.55 and a beta of 0.27.

V2X (NYSE:VVX - Get Free Report) last posted its earnings results on Monday, August 4th. The company reported $1.33 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.00 by $0.33. V2X had a return on equity of 15.28% and a net margin of 1.63%. The firm had revenue of $1.08 billion for the quarter, compared to analyst estimates of $1.06 billion. During the same quarter in the prior year, the company earned $0.83 EPS. V2X's revenue was up .6% on a year-over-year basis. On average, research analysts forecast that V2X, Inc. will post 4.16 earnings per share for the current year.

Analyst Upgrades and Downgrades

Several equities research analysts have recently commented on VVX shares. Truist Financial decreased their price target on V2X from $68.00 to $55.00 and set a "buy" rating on the stock in a research note on Monday, April 14th. Stifel Nicolaus set a $63.00 price target on V2X and gave the stock a "buy" rating in a research note on Tuesday, August 5th. Morgan Stanley started coverage on V2X in a research note on Wednesday, April 16th. They set an "underweight" rating and a $51.00 price target on the stock. Finally, Wall Street Zen raised V2X from a "hold" rating to a "buy" rating in a research note on Saturday. Two equities research analysts have rated the stock with a sell rating, one has given a hold rating, eight have assigned a buy rating and one has assigned a strong buy rating to the stock. According to MarketBeat, the stock has a consensus rating of "Moderate Buy" and a consensus price target of $63.60.

View Our Latest Report on V2X

About V2X

(

Free Report)

V2X, Inc provides critical mission solutions and support services to defense clients worldwide. It offers a suite of integrated solutions across the operations and logistics, aerospace, training, and technology markets to national security, defense, civilian, and international clients. The company was incorporated in 2014 and is headquartered in Mclean, Virginia.

Featured Stories

Before you consider V2X, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and V2X wasn't on the list.

While V2X currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.