Magnetar Financial LLC purchased a new stake in shares of Orchid Island Capital, Inc. (NYSE:ORC - Free Report) in the 1st quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm purchased 91,455 shares of the real estate investment trust's stock, valued at approximately $688,000. Magnetar Financial LLC owned approximately 0.08% of Orchid Island Capital as of its most recent SEC filing.

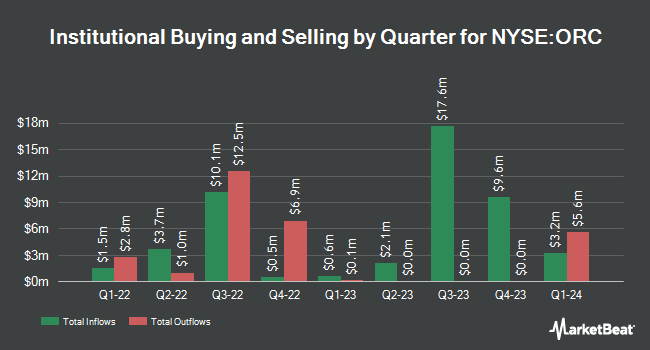

Several other institutional investors and hedge funds also recently made changes to their positions in the company. State of Wyoming increased its position in shares of Orchid Island Capital by 13.2% during the first quarter. State of Wyoming now owns 55,275 shares of the real estate investment trust's stock valued at $416,000 after acquiring an additional 6,460 shares in the last quarter. OMERS ADMINISTRATION Corp bought a new stake in shares of Orchid Island Capital during the first quarter valued at approximately $717,000. Virtus Advisers LLC bought a new stake in shares of Orchid Island Capital during the first quarter valued at approximately $350,000. AlphaQuest LLC bought a new stake in shares of Orchid Island Capital during the first quarter valued at approximately $442,000. Finally, Russell Investments Group Ltd. increased its position in shares of Orchid Island Capital by 52.1% during the first quarter. Russell Investments Group Ltd. now owns 9,379 shares of the real estate investment trust's stock valued at $71,000 after acquiring an additional 3,214 shares in the last quarter. Institutional investors own 32.74% of the company's stock.

Wall Street Analyst Weigh In

Separately, Wall Street Zen cut shares of Orchid Island Capital from a "hold" rating to a "strong sell" rating in a report on Saturday, July 26th. Two analysts have rated the stock with a Hold rating, Based on data from MarketBeat, Orchid Island Capital has an average rating of "Hold".

View Our Latest Report on Orchid Island Capital

Orchid Island Capital Trading Down 0.2%

ORC stock traded down $0.02 on Friday, hitting $7.19. The company had a trading volume of 6,711,374 shares, compared to its average volume of 3,867,138. Orchid Island Capital, Inc. has a 12-month low of $5.68 and a 12-month high of $9.01. The stock's 50-day simple moving average is $7.13 and its 200 day simple moving average is $7.26. The stock has a market cap of $910.56 million, a price-to-earnings ratio of 35.93 and a beta of 1.51.

Orchid Island Capital (NYSE:ORC - Get Free Report) last issued its quarterly earnings results on Thursday, July 24th. The real estate investment trust reported $0.16 earnings per share for the quarter, topping the consensus estimate of $0.15 by $0.01. The business had revenue of $23.15 million for the quarter, compared to analysts' expectations of $23.25 million. Research analysts forecast that Orchid Island Capital, Inc. will post 0.37 earnings per share for the current year.

Orchid Island Capital Dividend Announcement

The firm also recently declared a aug 25 dividend, which will be paid on Monday, September 29th. Stockholders of record on Friday, August 29th will be paid a dividend of $0.12 per share. This represents a dividend yield of 2,038.0%. The ex-dividend date is Friday, August 29th. Orchid Island Capital's dividend payout ratio (DPR) is currently 720.00%.

Orchid Island Capital Company Profile

(

Free Report)

Orchid Island Capital, Inc, a specialty finance company, invests in residential mortgage-backed securities (RMBS) in the United States. The company's RMBS is backed by single-family residential mortgage loans, referred as Agency RMBS. Its portfolio includes traditional pass-through Agency RMBS, such as mortgage pass through certificates and collateralized mortgage obligations; and structured Agency RMBS comprising interest only securities, inverse interest only securities, and principal only securities.

Featured Stories

Before you consider Orchid Island Capital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Orchid Island Capital wasn't on the list.

While Orchid Island Capital currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.