Magnetar Financial LLC bought a new stake in Hyatt Hotels Corporation (NYSE:H - Free Report) during the first quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The firm bought 9,118 shares of the company's stock, valued at approximately $1,117,000.

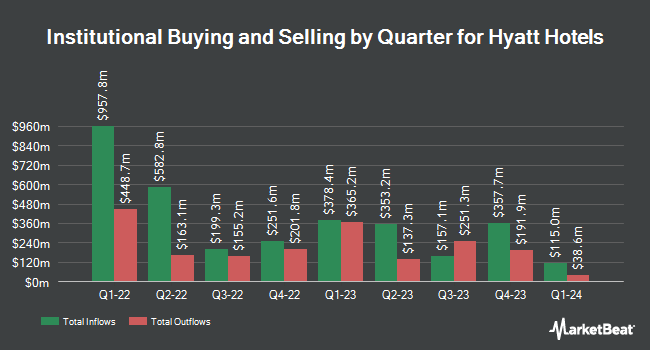

Several other institutional investors and hedge funds also recently added to or reduced their stakes in the company. Bernard Wealth Management Corp. purchased a new stake in shares of Hyatt Hotels during the 4th quarter worth about $26,000. Bank of Jackson Hole Trust purchased a new stake in Hyatt Hotels during the first quarter worth approximately $31,000. UMB Bank n.a. raised its stake in shares of Hyatt Hotels by 138.8% in the 1st quarter. UMB Bank n.a. now owns 499 shares of the company's stock valued at $61,000 after acquiring an additional 290 shares during the period. OMERS ADMINISTRATION Corp lifted its holdings in shares of Hyatt Hotels by 20.6% during the 4th quarter. OMERS ADMINISTRATION Corp now owns 1,849 shares of the company's stock valued at $290,000 after acquiring an additional 316 shares in the last quarter. Finally, Flynn Zito Capital Management LLC boosted its position in Hyatt Hotels by 13.2% during the 1st quarter. Flynn Zito Capital Management LLC now owns 1,914 shares of the company's stock worth $234,000 after purchasing an additional 223 shares during the period. 73.54% of the stock is currently owned by institutional investors and hedge funds.

Hyatt Hotels Stock Performance

NYSE:H traded up $1.87 during trading hours on Thursday, reaching $145.31. 391,042 shares of the stock were exchanged, compared to its average volume of 948,345. The stock has a market capitalization of $13.87 billion, a P/E ratio of 34.52, a P/E/G ratio of 2.26 and a beta of 1.43. The firm has a 50 day simple moving average of $143.62 and a 200-day simple moving average of $132.34. The company has a quick ratio of 0.70, a current ratio of 0.70 and a debt-to-equity ratio of 1.45. Hyatt Hotels Corporation has a 52 week low of $102.43 and a 52 week high of $168.20.

Hyatt Hotels (NYSE:H - Get Free Report) last announced its quarterly earnings data on Thursday, August 7th. The company reported $0.68 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.62 by $0.06. The firm had revenue of $1.81 billion for the quarter, compared to analysts' expectations of $1.74 billion. Hyatt Hotels had a return on equity of 6.54% and a net margin of 6.39%.During the same period last year, the business posted $1.53 earnings per share. As a group, sell-side analysts forecast that Hyatt Hotels Corporation will post 3.05 earnings per share for the current fiscal year.

Hyatt Hotels Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Wednesday, September 10th. Stockholders of record on Wednesday, August 27th will be issued a $0.15 dividend. The ex-dividend date of this dividend is Wednesday, August 27th. This represents a $0.60 annualized dividend and a dividend yield of 0.4%. Hyatt Hotels's payout ratio is 14.25%.

Wall Street Analyst Weigh In

H has been the topic of a number of recent research reports. Robert W. Baird boosted their price objective on Hyatt Hotels from $148.00 to $150.00 and gave the stock a "neutral" rating in a research note on Monday, July 28th. Deutsche Bank Aktiengesellschaft raised Hyatt Hotels from a "hold" rating to a "buy" rating in a research report on Monday, July 14th. Raymond James Financial raised shares of Hyatt Hotels from a "market perform" rating to a "strong-buy" rating and set a $165.00 price objective for the company in a research report on Tuesday, July 1st. Wall Street Zen downgraded shares of Hyatt Hotels from a "hold" rating to a "strong sell" rating in a research note on Sunday, August 17th. Finally, Barclays dropped their price target on shares of Hyatt Hotels from $158.00 to $156.00 and set an "equal weight" rating on the stock in a research note on Friday, August 8th. Two equities research analysts have rated the stock with a Strong Buy rating, eight have issued a Buy rating, eight have issued a Hold rating and one has issued a Sell rating to the company. According to data from MarketBeat, the company presently has an average rating of "Moderate Buy" and a consensus target price of $151.89.

Get Our Latest Analysis on Hyatt Hotels

Insider Buying and Selling at Hyatt Hotels

In other news, insider David Udell sold 3,891 shares of the stock in a transaction that occurred on Tuesday, June 10th. The stock was sold at an average price of $134.03, for a total transaction of $521,510.73. Following the sale, the insider directly owned 16,756 shares in the company, valued at approximately $2,245,806.68. This represents a 18.85% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, Director Cary D. Mcmillan sold 1,000 shares of the business's stock in a transaction that occurred on Friday, June 20th. The shares were sold at an average price of $132.70, for a total value of $132,700.00. Following the transaction, the director owned 498 shares of the company's stock, valued at $66,084.60. This represents a 66.76% decrease in their position. The disclosure for this sale can be found here. Insiders have sold 6,491 shares of company stock worth $870,211 in the last ninety days. Insiders own 23.70% of the company's stock.

Hyatt Hotels Profile

(

Free Report)

Hyatt Hotels Corporation operates as a hospitality company in the United States and internationally. It operates through Owned and Leased Hotels, Americas Management and Franchising, ASPAC Management and Franchising, EAME Management and Franchising, and Apple Leisure Group segments. The company manages, franchises, licenses, owns, and leases portfolio of properties, consisting of full-service hotels and resorts, select service hotels, and other properties, including timeshare, fractional, residential, vacation, and condominium units.

See Also

Before you consider Hyatt Hotels, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hyatt Hotels wasn't on the list.

While Hyatt Hotels currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.