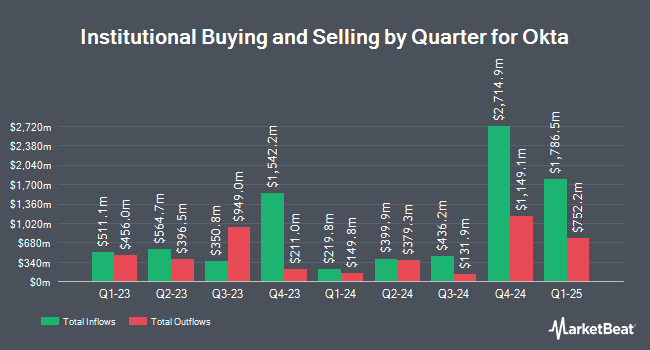

Magnetar Financial LLC raised its holdings in Okta, Inc. (NASDAQ:OKTA - Free Report) by 384.0% during the first quarter, according to the company in its most recent 13F filing with the SEC. The fund owned 103,952 shares of the company's stock after buying an additional 82,475 shares during the quarter. Magnetar Financial LLC owned about 0.06% of Okta worth $10,938,000 at the end of the most recent quarter.

A number of other large investors have also added to or reduced their stakes in the stock. Vanguard Group Inc. grew its holdings in Okta by 3.4% during the first quarter. Vanguard Group Inc. now owns 17,792,886 shares of the company's stock valued at $1,872,167,000 after purchasing an additional 582,956 shares during the period. Wealth Enhancement Advisory Services LLC increased its holdings in Okta by 52.4% during the 4th quarter. Wealth Enhancement Advisory Services LLC now owns 12,126 shares of the company's stock worth $956,000 after purchasing an additional 4,171 shares during the period. Trek Financial LLC acquired a new stake in shares of Okta in the 1st quarter worth $426,000. Merit Financial Group LLC acquired a new stake in Okta during the 1st quarter worth about $823,000. Finally, Stephens Investment Management Group LLC raised its stake in shares of Okta by 10.4% during the 1st quarter. Stephens Investment Management Group LLC now owns 499,125 shares of the company's stock valued at $52,518,000 after buying an additional 46,818 shares during the last quarter. Hedge funds and other institutional investors own 86.64% of the company's stock.

Insiders Place Their Bets

In related news, Director Jacques Frederic Kerrest sold 581 shares of the business's stock in a transaction dated Friday, June 20th. The stock was sold at an average price of $100.29, for a total value of $58,268.49. Following the sale, the director directly owned 2,832 shares in the company, valued at approximately $284,021.28. The trade was a 17.02% decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, CFO Brett Tighe sold 10,000 shares of the company's stock in a transaction that occurred on Friday, July 18th. The shares were sold at an average price of $95.00, for a total value of $950,000.00. Following the sale, the chief financial officer owned 132,288 shares in the company, valued at approximately $12,567,360. This trade represents a 7.03% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last quarter, insiders have sold 88,594 shares of company stock worth $8,382,790. 5.68% of the stock is owned by corporate insiders.

Okta Stock Down 3.5%

Shares of NASDAQ:OKTA traded down $3.27 during trading on Tuesday, hitting $89.50. 4,972,949 shares of the company were exchanged, compared to its average volume of 3,755,142. The business's 50 day moving average is $94.82 and its 200-day moving average is $102.28. The company has a market capitalization of $15.67 billion, a P/E ratio of 105.29, a price-to-earnings-growth ratio of 4.52 and a beta of 0.83. Okta, Inc. has a 1-year low of $70.56 and a 1-year high of $127.57.

Okta (NASDAQ:OKTA - Get Free Report) last issued its quarterly earnings results on Tuesday, August 26th. The company reported $0.91 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.84 by $0.07. Okta had a return on equity of 3.31% and a net margin of 6.08%.The firm had revenue of $728,000 billion for the quarter, compared to analyst estimates of $711.84 million. During the same period in the previous year, the firm earned $0.72 earnings per share. The company's revenue was up 12.7% compared to the same quarter last year. Okta has set its FY 2026 guidance at 3.330-3.380 EPS. Q3 2026 guidance at 0.740-0.750 EPS. As a group, sell-side analysts anticipate that Okta, Inc. will post 0.42 earnings per share for the current year.

Analyst Upgrades and Downgrades

OKTA has been the subject of a number of recent research reports. Truist Financial raised Okta from a "hold" rating to a "buy" rating and raised their target price for the stock from $100.00 to $125.00 in a research note on Monday, August 25th. Stifel Nicolaus upped their price objective on Okta from $120.00 to $130.00 and gave the company a "buy" rating in a research report on Wednesday, May 28th. Roth Capital reissued a "buy" rating and issued a $119.00 price target on shares of Okta in a report on Wednesday, May 28th. Jefferies Financial Group lifted their price target on Okta from $100.00 to $105.00 and gave the company a "hold" rating in a research report on Wednesday, August 27th. Finally, Arete assumed coverage on Okta in a research report on Monday, July 7th. They issued a "sell" rating and a $83.00 price target for the company. Twenty-two investment analysts have rated the stock with a Buy rating, thirteen have issued a Hold rating and three have given a Sell rating to the company. Based on data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and an average price target of $118.25.

Get Our Latest Stock Report on OKTA

Okta Profile

(

Free Report)

Okta, Inc operates as an identity partner in the United States and internationally. The company offers Okta's suite of products and services used to manage and secure identities, such as Single Sign-On that enables users to access applications in the cloud or on-premises from various devices; Adaptive Multi-Factor Authentication provides a layer of security for cloud, mobile, web applications, and data; API Access Management enables organizations to secure APIs; Access Gateway enables organizations to extend Workforce Identity Cloud; and Okta Device Access enables end users to securely log in to devices with Okta credentials.

See Also

Before you consider Okta, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Okta wasn't on the list.

While Okta currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.