Texas Yale Capital Corp. lifted its position in Main Street Capital Corporation (NYSE:MAIN - Free Report) by 5.5% during the 1st quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 85,097 shares of the financial services provider's stock after acquiring an additional 4,401 shares during the period. Texas Yale Capital Corp. owned 0.10% of Main Street Capital worth $4,813,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

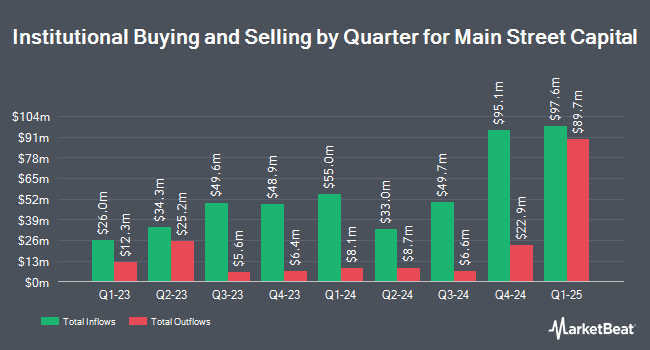

Several other hedge funds have also recently made changes to their positions in the company. Spire Wealth Management acquired a new stake in shares of Main Street Capital during the 1st quarter valued at about $40,000. Kapitalo Investimentos Ltda acquired a new stake in shares of Main Street Capital during the 4th quarter valued at about $45,000. Colonial Trust Advisors acquired a new stake in shares of Main Street Capital during the 4th quarter valued at about $46,000. NBC Securities Inc. acquired a new stake in shares of Main Street Capital during the 1st quarter valued at about $54,000. Finally, GAMMA Investing LLC grew its position in shares of Main Street Capital by 5,557.9% during the 1st quarter. GAMMA Investing LLC now owns 1,075 shares of the financial services provider's stock valued at $61,000 after acquiring an additional 1,056 shares during the period. 20.31% of the stock is owned by institutional investors and hedge funds.

Main Street Capital Price Performance

MAIN traded down $0.73 during trading on Monday, reaching $65.10. The company's stock had a trading volume of 469,544 shares, compared to its average volume of 459,235. The company has a quick ratio of 0.10, a current ratio of 0.10 and a debt-to-equity ratio of 0.12. The firm has a fifty day simple moving average of $59.49 and a two-hundred day simple moving average of $57.95. Main Street Capital Corporation has a 1 year low of $45.00 and a 1 year high of $66.39. The company has a market cap of $5.80 billion, a price-to-earnings ratio of 16.30 and a beta of 0.82.

Main Street Capital (NYSE:MAIN - Get Free Report) last released its quarterly earnings results on Thursday, May 8th. The financial services provider reported $1.01 EPS for the quarter, beating the consensus estimate of $1.00 by $0.01. The firm had revenue of $137.05 million for the quarter, compared to analyst estimates of $137.50 million. Main Street Capital had a net margin of 94.61% and a return on equity of 13.02%. As a group, analysts anticipate that Main Street Capital Corporation will post 4.11 EPS for the current year.

Main Street Capital Cuts Dividend

The company also recently announced a dividend, which was paid on Tuesday, July 15th. Shareholders of record on Wednesday, July 9th were given a $0.255 dividend. This represents a yield of 5.18%. The ex-dividend date of this dividend was Tuesday, July 8th. Main Street Capital's payout ratio is 51.95%.

Insider Transactions at Main Street Capital

In other Main Street Capital news, EVP Jason B. Beauvais sold 13,664 shares of the business's stock in a transaction that occurred on Friday, June 27th. The stock was sold at an average price of $59.37, for a total value of $811,231.68. Following the sale, the executive vice president owned 181,526 shares of the company's stock, valued at $10,777,198.62. The trade was a 7.00% decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. 4.09% of the stock is currently owned by insiders.

Analysts Set New Price Targets

A number of equities research analysts have recently commented on MAIN shares. Wall Street Zen cut Main Street Capital from a "hold" rating to a "sell" rating in a research report on Saturday. B. Riley raised Main Street Capital to a "hold" rating in a report on Monday, June 16th. Truist Financial lowered their price target on Main Street Capital from $62.00 to $54.00 and set a "hold" rating on the stock in a research note on Monday, May 12th. UBS Group reaffirmed a "neutral" rating and issued a $58.00 price target (up from $56.00) on shares of Main Street Capital in a research note on Wednesday, July 16th. Finally, Oppenheimer restated a "market perform" rating on shares of Main Street Capital in a report on Tuesday, May 13th. One investment analyst has rated the stock with a sell rating, four have given a hold rating and one has issued a buy rating to the company. According to MarketBeat.com, Main Street Capital currently has a consensus rating of "Hold" and an average price target of $53.60.

Get Our Latest Stock Report on Main Street Capital

Main Street Capital Profile

(

Free Report)

Main Street Capital Corporation is a business development company specializes in equity capital to lower middle market companies. The firm specializing in recapitalizations, management buyouts, refinancing, family estate planning, management buyouts, refinancing, industry consolidation, mature, later stage emerging growth.

See Also

Before you consider Main Street Capital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Main Street Capital wasn't on the list.

While Main Street Capital currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.