Marble Harbor Investment Counsel LLC lessened its stake in Procter & Gamble Company (The) (NYSE:PG - Free Report) by 1.4% in the first quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 160,913 shares of the company's stock after selling 2,314 shares during the quarter. Procter & Gamble comprises 3.1% of Marble Harbor Investment Counsel LLC's investment portfolio, making the stock its 9th biggest position. Marble Harbor Investment Counsel LLC's holdings in Procter & Gamble were worth $27,423,000 as of its most recent filing with the Securities & Exchange Commission.

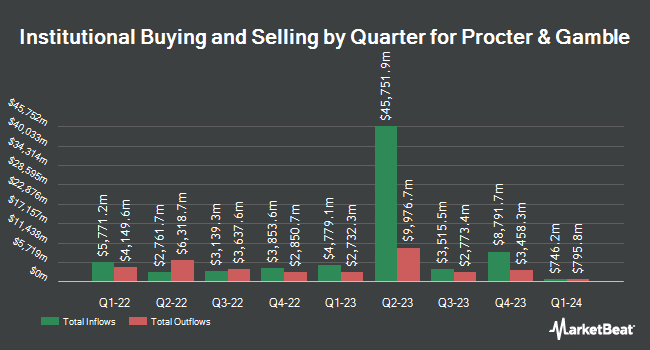

Other hedge funds and other institutional investors have also bought and sold shares of the company. SGL Investment Advisors Inc. grew its position in Procter & Gamble by 13.1% in the first quarter. SGL Investment Advisors Inc. now owns 1,984 shares of the company's stock valued at $315,000 after acquiring an additional 230 shares during the last quarter. Allianz SE boosted its holdings in Procter & Gamble by 3.0% in the first quarter. Allianz SE now owns 109,897 shares of the company's stock valued at $18,729,000 after acquiring an additional 3,206 shares during the last quarter. Commonwealth Equity Services LLC lifted its stake in Procter & Gamble by 4.5% in the first quarter. Commonwealth Equity Services LLC now owns 1,856,447 shares of the company's stock valued at $316,376,000 after buying an additional 79,457 shares during the period. Haven Private LLC acquired a new stake in Procter & Gamble in the 1st quarter valued at $204,000. Finally, Blair William & Co. IL grew its position in Procter & Gamble by 0.3% in the 1st quarter. Blair William & Co. IL now owns 990,180 shares of the company's stock valued at $168,746,000 after purchasing an additional 3,346 shares during the period. Institutional investors and hedge funds own 65.77% of the company's stock.

Procter & Gamble Stock Performance

Procter & Gamble stock traded up $0.18 during trading hours on Tuesday, hitting $150.94. 2,004,585 shares of the stock traded hands, compared to its average volume of 8,221,223. The company has a debt-to-equity ratio of 0.48, a current ratio of 0.70 and a quick ratio of 0.49. The firm's 50 day moving average price is $159.52 and its 200-day moving average price is $163.97. The stock has a market capitalization of $353.88 billion, a price-to-earnings ratio of 23.21, a P/E/G ratio of 3.98 and a beta of 0.37. Procter & Gamble Company has a 1 year low of $149.91 and a 1 year high of $180.43.

Procter & Gamble (NYSE:PG - Get Free Report) last released its quarterly earnings results on Tuesday, July 29th. The company reported $1.48 earnings per share for the quarter, topping analysts' consensus estimates of $1.42 by $0.06. Procter & Gamble had a return on equity of 32.56% and a net margin of 18.95%. The company had revenue of $20.89 billion during the quarter, compared to analysts' expectations of $20.79 billion. During the same quarter in the prior year, the firm posted $1.40 EPS. Procter & Gamble's quarterly revenue was up 1.7% compared to the same quarter last year. As a group, equities analysts expect that Procter & Gamble Company will post 6.91 EPS for the current fiscal year.

Procter & Gamble Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Friday, August 15th. Shareholders of record on Friday, July 18th will be paid a dividend of $1.0568 per share. This represents a $4.23 annualized dividend and a yield of 2.8%. The ex-dividend date is Friday, July 18th. Procter & Gamble's payout ratio is 64.82%.

Analyst Ratings Changes

Several research analysts have recently weighed in on PG shares. Piper Sandler increased their price target on Procter & Gamble from $160.00 to $164.00 and gave the stock a "neutral" rating in a research note on Monday, May 5th. Wells Fargo & Company cut their target price on Procter & Gamble from $175.00 to $173.00 and set an "overweight" rating for the company in a research note on Wednesday, July 30th. Bank of America cut their target price on Procter & Gamble from $190.00 to $180.00 and set a "buy" rating for the company in a research note on Friday, April 25th. Evercore ISI restated an "in-line" rating and issued a $170.00 target price (down previously from $190.00) on shares of Procter & Gamble in a research note on Monday, July 14th. Finally, Barclays set a $164.00 price target on Procter & Gamble and gave the stock an "equal weight" rating in a research note on Thursday, July 31st. Seven investment analysts have rated the stock with a hold rating, ten have issued a buy rating and two have issued a strong buy rating to the stock. Based on data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and a consensus target price of $175.88.

Read Our Latest Analysis on Procter & Gamble

Procter & Gamble Profile

(

Free Report)

Procter & Gamble Co engages in the provision of branded consumer packaged goods. It operates through the following segments: Beauty, Grooming, Health Care, Fabric and Home Care, and Baby, Feminine and Family Care. The Beauty segment offers hair, skin, and personal care. The Grooming segment consists of shave care like female and male blades and razors, pre and post shave products, and appliances.

Further Reading

Before you consider Procter & Gamble, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Procter & Gamble wasn't on the list.

While Procter & Gamble currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.