Maridea Wealth Management LLC bought a new position in DTE Energy Company (NYSE:DTE - Free Report) during the second quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm bought 3,600 shares of the utilities provider's stock, valued at approximately $477,000.

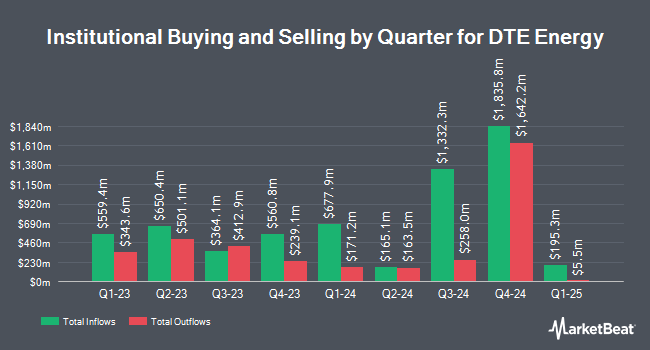

A number of other hedge funds and other institutional investors also recently bought and sold shares of the stock. Tidal Investments LLC raised its position in shares of DTE Energy by 14.1% during the 4th quarter. Tidal Investments LLC now owns 2,841 shares of the utilities provider's stock worth $343,000 after purchasing an additional 351 shares during the period. Squarepoint Ops LLC increased its position in DTE Energy by 3.7% in the fourth quarter. Squarepoint Ops LLC now owns 5,779 shares of the utilities provider's stock worth $698,000 after buying an additional 205 shares during the period. Vident Advisory LLC boosted its holdings in shares of DTE Energy by 11.5% during the fourth quarter. Vident Advisory LLC now owns 2,790 shares of the utilities provider's stock valued at $337,000 after acquiring an additional 287 shares during the period. Vise Technologies Inc. bought a new position in shares of DTE Energy during the fourth quarter worth about $213,000. Finally, Toronto Dominion Bank increased its holdings in shares of DTE Energy by 24.0% in the 4th quarter. Toronto Dominion Bank now owns 114,936 shares of the utilities provider's stock worth $13,879,000 after acquiring an additional 22,265 shares during the period. 76.06% of the stock is currently owned by institutional investors and hedge funds.

DTE Energy Price Performance

Shares of DTE Energy stock opened at $137.64 on Friday. DTE Energy Company has a 52 week low of $115.59 and a 52 week high of $142.05. The company has a current ratio of 0.94, a quick ratio of 0.57 and a debt-to-equity ratio of 1.96. The stock has a market cap of $28.57 billion, a PE ratio of 19.80, a price-to-earnings-growth ratio of 2.76 and a beta of 0.42. The company's 50-day moving average price is $137.83 and its two-hundred day moving average price is $135.43.

DTE Energy (NYSE:DTE - Get Free Report) last announced its quarterly earnings data on Tuesday, July 29th. The utilities provider reported $1.36 earnings per share (EPS) for the quarter, missing the consensus estimate of $1.37 by ($0.01). DTE Energy had a return on equity of 12.72% and a net margin of 10.16%.The business had revenue of $2.91 billion during the quarter, compared to analyst estimates of $2.67 billion. As a group, sell-side analysts anticipate that DTE Energy Company will post 7.18 EPS for the current fiscal year.

Wall Street Analyst Weigh In

A number of research analysts have issued reports on DTE shares. Morgan Stanley reduced their target price on shares of DTE Energy from $140.00 to $137.00 and set an "overweight" rating for the company in a research note on Thursday. Wall Street Zen downgraded DTE Energy from a "hold" rating to a "sell" rating in a research report on Sunday, September 14th. BMO Capital Markets lifted their target price on DTE Energy from $140.00 to $144.00 and gave the company a "market perform" rating in a research note on Monday, August 25th. Barclays boosted their price target on DTE Energy from $136.00 to $138.00 and gave the stock an "equal weight" rating in a research report on Tuesday, July 15th. Finally, JPMorgan Chase & Co. raised their price target on DTE Energy from $145.00 to $147.00 and gave the company a "neutral" rating in a report on Tuesday, July 15th. Seven analysts have rated the stock with a Buy rating and five have issued a Hold rating to the company. According to MarketBeat.com, DTE Energy has a consensus rating of "Moderate Buy" and an average target price of $144.00.

View Our Latest Research Report on DTE Energy

Insider Transactions at DTE Energy

In other DTE Energy news, VP Lisa A. Muschong sold 1,600 shares of the company's stock in a transaction on Thursday, August 14th. The stock was sold at an average price of $140.53, for a total value of $224,848.00. Following the transaction, the vice president owned 4,153 shares of the company's stock, valued at approximately $583,621.09. This represents a 27.81% decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Company insiders own 0.33% of the company's stock.

DTE Energy Profile

(

Free Report)

DTE Energy Company engages in the utility operations. The company's Electric segment generates, purchases, distributes, and sells electricity to various residential, commercial, and industrial customers in southeastern Michigan. It generates electricity through coal-fired plants, hydroelectric pumped storage, and nuclear plants, as well as wind and solar assets.

Further Reading

Want to see what other hedge funds are holding DTE? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for DTE Energy Company (NYSE:DTE - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider DTE Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DTE Energy wasn't on the list.

While DTE Energy currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.