Maryland State Retirement & Pension System trimmed its position in Regeneron Pharmaceuticals, Inc. (NASDAQ:REGN - Free Report) by 14.2% in the first quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 4,887 shares of the biopharmaceutical company's stock after selling 806 shares during the period. Maryland State Retirement & Pension System's holdings in Regeneron Pharmaceuticals were worth $3,099,000 as of its most recent SEC filing.

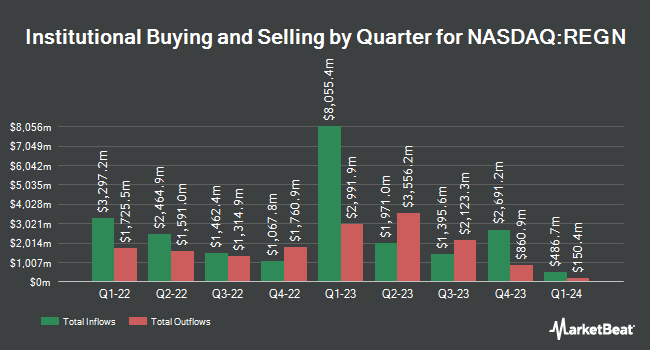

Other institutional investors have also recently added to or reduced their stakes in the company. Adirondack Trust Co. increased its holdings in shares of Regeneron Pharmaceuticals by 4.2% in the first quarter. Adirondack Trust Co. now owns 451 shares of the biopharmaceutical company's stock valued at $286,000 after buying an additional 18 shares in the last quarter. Kingswood Wealth Advisors LLC increased its holdings in shares of Regeneron Pharmaceuticals by 1.8% in the first quarter. Kingswood Wealth Advisors LLC now owns 1,084 shares of the biopharmaceutical company's stock valued at $681,000 after buying an additional 19 shares in the last quarter. Creative Financial Designs Inc. ADV increased its holdings in shares of Regeneron Pharmaceuticals by 9.5% in the first quarter. Creative Financial Designs Inc. ADV now owns 220 shares of the biopharmaceutical company's stock valued at $139,000 after buying an additional 19 shares in the last quarter. Private Trust Co. NA increased its holdings in shares of Regeneron Pharmaceuticals by 13.1% in the first quarter. Private Trust Co. NA now owns 164 shares of the biopharmaceutical company's stock valued at $104,000 after buying an additional 19 shares in the last quarter. Finally, Proficio Capital Partners LLC increased its holdings in shares of Regeneron Pharmaceuticals by 6.2% in the first quarter. Proficio Capital Partners LLC now owns 327 shares of the biopharmaceutical company's stock valued at $207,000 after buying an additional 19 shares in the last quarter. 83.31% of the stock is currently owned by institutional investors and hedge funds.

Regeneron Pharmaceuticals Stock Performance

Regeneron Pharmaceuticals stock traded up $3.20 during trading hours on Friday, reaching $563.00. 1,024,297 shares of the company were exchanged, compared to its average volume of 978,475. The company has a current ratio of 4.60, a quick ratio of 3.72 and a debt-to-equity ratio of 0.09. Regeneron Pharmaceuticals, Inc. has a 12 month low of $476.49 and a 12 month high of $1,211.20. The stock has a 50-day moving average of $536.80 and a 200 day moving average of $598.52. The firm has a market cap of $59.67 billion, a price-to-earnings ratio of 14.19, a PEG ratio of 1.91 and a beta of 0.33.

Regeneron Pharmaceuticals (NASDAQ:REGN - Get Free Report) last released its quarterly earnings results on Friday, August 1st. The biopharmaceutical company reported $12.89 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $8.43 by $4.46. Regeneron Pharmaceuticals had a net margin of 31.37% and a return on equity of 15.06%. The company had revenue of $3,675,600 billion during the quarter, compared to analysts' expectations of $3.30 billion. During the same period in the prior year, the company earned $11.56 earnings per share. The business's quarterly revenue was up 3.6% compared to the same quarter last year. As a group, research analysts anticipate that Regeneron Pharmaceuticals, Inc. will post 35.92 earnings per share for the current year.

Regeneron Pharmaceuticals Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Wednesday, September 3rd. Shareholders of record on Monday, August 18th will be issued a dividend of $0.88 per share. This represents a $3.52 dividend on an annualized basis and a yield of 0.6%. The ex-dividend date is Monday, August 18th. Regeneron Pharmaceuticals's dividend payout ratio is 8.87%.

Analyst Ratings Changes

Several analysts have issued reports on the stock. Cantor Fitzgerald assumed coverage on shares of Regeneron Pharmaceuticals in a research note on Tuesday, April 22nd. They set an "overweight" rating and a $695.00 target price on the stock. Wall Street Zen downgraded shares of Regeneron Pharmaceuticals from a "buy" rating to a "hold" rating in a research note on Thursday, May 1st. JPMorgan Chase & Co. cut their target price on shares of Regeneron Pharmaceuticals from $950.00 to $800.00 and set an "overweight" rating on the stock in a research note on Monday, June 9th. Robert W. Baird cut their target price on shares of Regeneron Pharmaceuticals from $759.00 to $652.00 and set a "neutral" rating on the stock in a research note on Friday, April 25th. Finally, Bank of America cut their target price on shares of Regeneron Pharmaceuticals from $575.00 to $547.00 and set an "underperform" rating on the stock in a research note on Thursday, April 17th. One research analyst has rated the stock with a sell rating, seven have assigned a hold rating, sixteen have given a buy rating and two have issued a strong buy rating to the company. According to MarketBeat.com, Regeneron Pharmaceuticals currently has an average rating of "Moderate Buy" and a consensus target price of $841.30.

View Our Latest Analysis on Regeneron Pharmaceuticals

About Regeneron Pharmaceuticals

(

Free Report)

Regeneron Pharmaceuticals, Inc discovers, invents, develops, manufactures, and commercializes medicines for treating various diseases worldwide. The company's products include EYLEA injection to treat wet age-related macular degeneration and diabetic macular edema; myopic choroidal neovascularization; diabetic retinopathy; neovascular glaucoma; and retinopathy of prematurity.

Featured Articles

Before you consider Regeneron Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Regeneron Pharmaceuticals wasn't on the list.

While Regeneron Pharmaceuticals currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.