Matauro LLC trimmed its position in Uber Technologies, Inc. (NYSE:UBER - Free Report) by 28.2% in the second quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 14,613 shares of the ride-sharing company's stock after selling 5,748 shares during the quarter. Matauro LLC's holdings in Uber Technologies were worth $1,363,000 as of its most recent filing with the Securities and Exchange Commission.

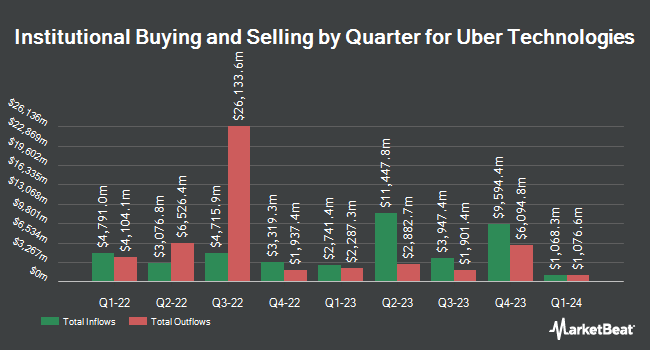

Other institutional investors and hedge funds have also bought and sold shares of the company. Kozak & Associates Inc. increased its position in Uber Technologies by 155.9% during the first quarter. Kozak & Associates Inc. now owns 366 shares of the ride-sharing company's stock worth $27,000 after acquiring an additional 223 shares during the period. Noble Wealth Management PBC bought a new stake in shares of Uber Technologies in the 1st quarter worth about $27,000. Vision Financial Markets LLC bought a new stake in shares of Uber Technologies in the 1st quarter worth about $27,000. West Oak Capital LLC bought a new stake in Uber Technologies during the 2nd quarter worth about $28,000. Finally, GPS Wealth Strategies Group LLC increased its position in Uber Technologies by 305.1% in the 1st quarter. GPS Wealth Strategies Group LLC now owns 397 shares of the ride-sharing company's stock valued at $29,000 after acquiring an additional 299 shares in the last quarter. Institutional investors own 80.24% of the company's stock.

Analysts Set New Price Targets

Several research firms have weighed in on UBER. Royal Bank Of Canada raised their price objective on shares of Uber Technologies from $94.00 to $100.00 and gave the company an "outperform" rating in a research report on Thursday, August 7th. Mizuho initiated coverage on shares of Uber Technologies in a research note on Monday. They set an "outperform" rating and a $130.00 price objective on the stock. BMO Capital Markets lifted their price target on shares of Uber Technologies from $101.00 to $113.00 and gave the company an "outperform" rating in a research note on Thursday, August 7th. Morgan Stanley reaffirmed an "overweight" rating and issued a $115.00 price target (up previously from $95.00) on shares of Uber Technologies in a research note on Monday, July 21st. Finally, Wall Street Zen lowered shares of Uber Technologies from a "buy" rating to a "hold" rating in a research report on Saturday, August 9th. Two equities research analysts have rated the stock with a Strong Buy rating, twenty-eight have given a Buy rating and ten have given a Hold rating to the company. According to MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and a consensus target price of $104.09.

Get Our Latest Report on UBER

Uber Technologies Stock Down 0.1%

UBER stock opened at $96.51 on Friday. The stock has a market capitalization of $201.27 billion, a P/E ratio of 16.44 and a beta of 1.48. The company has a current ratio of 1.11, a quick ratio of 1.11 and a debt-to-equity ratio of 0.41. Uber Technologies, Inc. has a 12 month low of $59.33 and a 12 month high of $101.99. The firm has a 50-day moving average price of $93.83 and a 200-day moving average price of $86.87.

Uber Technologies (NYSE:UBER - Get Free Report) last posted its earnings results on Wednesday, August 6th. The ride-sharing company reported $0.63 EPS for the quarter, topping analysts' consensus estimates of $0.61 by $0.02. Uber Technologies had a net margin of 26.68% and a return on equity of 59.96%. The firm had revenue of $12.65 billion during the quarter, compared to analysts' expectations of $12.45 billion. During the same quarter in the prior year, the business earned $0.47 earnings per share. The business's revenue for the quarter was up 18.2% compared to the same quarter last year. As a group, equities research analysts anticipate that Uber Technologies, Inc. will post 2.54 EPS for the current fiscal year.

Insider Buying and Selling

In other Uber Technologies news, insider Jill Hazelbaker sold 31,250 shares of the stock in a transaction that occurred on Friday, August 22nd. The shares were sold at an average price of $96.42, for a total transaction of $3,013,125.00. Following the completion of the sale, the insider owned 86,531 shares of the company's stock, valued at approximately $8,343,319.02. This represents a 26.53% decrease in their position. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, CFO Prashanth Mahendra-Rajah sold 2,750 shares of the stock in a transaction that occurred on Tuesday, September 16th. The shares were sold at an average price of $99.42, for a total transaction of $273,405.00. Following the sale, the chief financial officer directly owned 22,528 shares of the company's stock, valued at $2,239,733.76. This represents a 10.88% decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 604,571 shares of company stock valued at $58,920,741 over the last three months. Insiders own 3.84% of the company's stock.

Uber Technologies Profile

(

Free Report)

Uber Technologies, Inc develops and operates proprietary technology applications in the United States, Canada, Latin America, Europe, the Middle East, Africa, and Asia excluding China and Southeast Asia. It operates through three segments: Mobility, Delivery, and Freight. The Mobility segment connects consumers with a range of transportation modalities, such as ridesharing, carsharing, micromobility, rentals, public transit, taxis, and other modalities; and offers riders in a variety of vehicle types, as well as financial partnerships products and advertising services.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Uber Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Uber Technologies wasn't on the list.

While Uber Technologies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.