Matauro LLC acquired a new stake in Sanofi (NASDAQ:SNY - Free Report) in the 2nd quarter, according to its most recent Form 13F filing with the SEC. The institutional investor acquired 38,229 shares of the company's stock, valued at approximately $1,847,000.

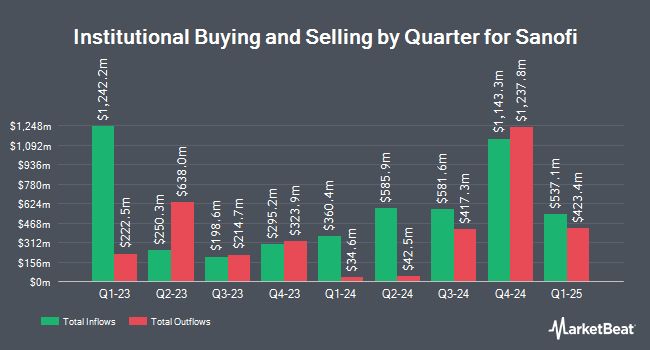

Several other hedge funds have also recently added to or reduced their stakes in SNY. Nuveen LLC acquired a new position in Sanofi in the 1st quarter valued at $177,831,000. Federated Hermes Inc. raised its stake in Sanofi by 58.5% in the 1st quarter. Federated Hermes Inc. now owns 3,947,583 shares of the company's stock valued at $218,933,000 after purchasing an additional 1,456,269 shares during the last quarter. OLD Mission Capital LLC acquired a new position in Sanofi in the 1st quarter valued at $48,938,000. Raymond James Financial Inc. raised its stake in Sanofi by 15.1% in the 1st quarter. Raymond James Financial Inc. now owns 3,244,027 shares of the company's stock valued at $179,914,000 after purchasing an additional 425,597 shares during the last quarter. Finally, GAMMA Investing LLC raised its stake in Sanofi by 8,703.0% in the 1st quarter. GAMMA Investing LLC now owns 335,921 shares of the company's stock valued at $18,630,000 after purchasing an additional 332,105 shares during the last quarter. 14.04% of the stock is owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

SNY has been the subject of several recent research reports. JPMorgan Chase & Co. raised Sanofi from a "neutral" rating to an "overweight" rating in a research note on Friday, August 8th. Wall Street Zen raised Sanofi from a "hold" rating to a "buy" rating in a research note on Saturday, August 2nd. Morgan Stanley raised Sanofi from an "equal weight" rating to an "overweight" rating and raised their target price for the stock from $56.00 to $58.00 in a research note on Monday, September 8th. Barclays reaffirmed an "overweight" rating on shares of Sanofi in a research note on Wednesday, July 2nd. Finally, Deutsche Bank Aktiengesellschaft raised Sanofi from a "hold" rating to a "buy" rating in a research note on Tuesday, September 2nd. Two investment analysts have rated the stock with a Strong Buy rating, six have given a Buy rating and one has issued a Hold rating to the company's stock. Based on data from MarketBeat, the stock currently has an average rating of "Buy" and a consensus price target of $62.67.

Check Out Our Latest Stock Analysis on SNY

Sanofi Stock Performance

NASDAQ SNY opened at $50.14 on Friday. The stock has a market cap of $123.12 billion, a PE ratio of 12.05, a P/E/G ratio of 1.18 and a beta of 0.51. The company has a current ratio of 1.27, a quick ratio of 0.94 and a debt-to-equity ratio of 0.19. Sanofi has a twelve month low of $44.62 and a twelve month high of $60.12. The stock has a fifty day simple moving average of $48.18 and a 200-day simple moving average of $50.15.

Sanofi (NASDAQ:SNY - Get Free Report) last released its quarterly earnings results on Thursday, July 31st. The company reported $0.90 earnings per share for the quarter, missing analysts' consensus estimates of $0.96 by ($0.06). Sanofi had a return on equity of 16.86% and a net margin of 21.47%.The business had revenue of $11.34 billion for the quarter, compared to analysts' expectations of $9.91 billion. During the same quarter in the prior year, the company posted $1.73 earnings per share. The business's revenue for the quarter was down 7.0% compared to the same quarter last year. Equities analysts anticipate that Sanofi will post 4.36 earnings per share for the current year.

Sanofi Company Profile

(

Free Report)

Sanofi, a healthcare company, engages in the research, development, manufacture, and marketing of therapeutic solutions in the United States, Europe, Canada, and internationally. It operates through Pharmaceuticals, Vaccines, and Consumer Healthcare segments. The company provides specialty care, such as DUPIXENT, neurology and immunology, rare diseases, oncology, and rare blood disorders; medicines for diabetes and cardiovascular diseases; and established prescription products.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Sanofi, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sanofi wasn't on the list.

While Sanofi currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.