MBB Public Markets I LLC purchased a new stake in shares of 3M Company (NYSE:MMM - Free Report) during the 1st quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund purchased 2,075 shares of the conglomerate's stock, valued at approximately $305,000.

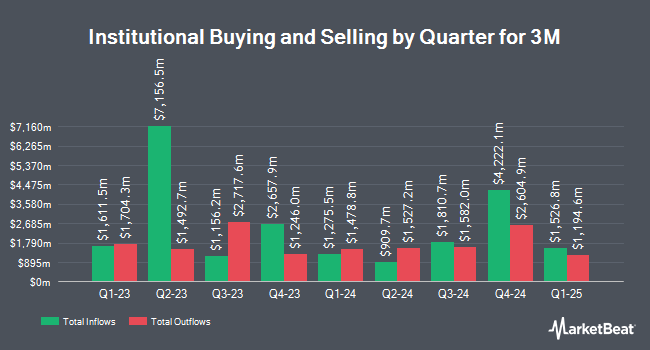

Other institutional investors and hedge funds have also recently added to or reduced their stakes in the company. REAP Financial Group LLC increased its stake in 3M by 88.7% during the fourth quarter. REAP Financial Group LLC now owns 200 shares of the conglomerate's stock valued at $26,000 after acquiring an additional 94 shares during the period. Pinney & Scofield Inc. bought a new stake in shares of 3M in the 4th quarter valued at approximately $28,000. Caitong International Asset Management Co. Ltd bought a new stake in shares of 3M in the 1st quarter valued at approximately $28,000. WPG Advisers LLC bought a new stake in shares of 3M in the 1st quarter valued at approximately $28,000. Finally, Curat Global LLC bought a new stake in shares of 3M in the 1st quarter valued at approximately $29,000. 65.25% of the stock is currently owned by institutional investors.

Insider Buying and Selling at 3M

In other 3M news, insider Christian T. Goralski, Jr. sold 6,165 shares of the company's stock in a transaction on Thursday, August 7th. The stock was sold at an average price of $150.18, for a total transaction of $925,859.70. Following the transaction, the insider owned 2,900 shares of the company's stock, valued at approximately $435,522. This represents a 68.01% decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, CAO Theresa E. Reinseth sold 3,477 shares of the company's stock in a transaction on Tuesday, August 5th. The stock was sold at an average price of $150.63, for a total value of $523,740.51. Following the transaction, the chief accounting officer directly owned 2,561 shares in the company, valued at approximately $385,763.43. This represents a 57.59% decrease in their position. The disclosure for this sale can be found here. 0.48% of the stock is currently owned by corporate insiders.

3M Price Performance

Shares of MMM traded down $2.24 on Tuesday, hitting $154.42. The company's stock had a trading volume of 645,226 shares, compared to its average volume of 3,720,707. The company has a market capitalization of $82.25 billion, a PE ratio of 21.46, a PEG ratio of 2.87 and a beta of 1.04. The company has a debt-to-equity ratio of 2.87, a current ratio of 1.72 and a quick ratio of 1.20. 3M Company has a fifty-two week low of $121.98 and a fifty-two week high of $164.15. The company has a 50 day moving average price of $154.15 and a 200 day moving average price of $147.96.

3M (NYSE:MMM - Get Free Report) last announced its earnings results on Friday, July 18th. The conglomerate reported $2.16 EPS for the quarter, topping the consensus estimate of $2.01 by $0.15. The business had revenue of $6.16 billion for the quarter, compared to the consensus estimate of $6.09 billion. 3M had a return on equity of 96.48% and a net margin of 16.01%.3M's revenue was up 1.4% compared to the same quarter last year. During the same period in the previous year, the business earned $1.93 EPS. On average, research analysts anticipate that 3M Company will post 7.8 earnings per share for the current fiscal year.

3M Announces Dividend

The firm also recently announced a quarterly dividend, which was paid on Friday, September 12th. Stockholders of record on Monday, August 25th were issued a $0.73 dividend. This represents a $2.92 annualized dividend and a dividend yield of 1.9%. The ex-dividend date of this dividend was Monday, August 25th. 3M's payout ratio is presently 40.61%.

Wall Street Analyst Weigh In

Several equities research analysts have recently weighed in on MMM shares. Barclays set a $170.00 price objective on 3M in a research note on Friday, July 18th. Citigroup upped their price objective on 3M from $141.00 to $160.00 and gave the company a "neutral" rating in a research note on Friday, May 30th. Weiss Ratings reiterated a "hold (c+)" rating on shares of 3M in a research note on Saturday. Wells Fargo & Company reiterated an "overweight" rating on shares of 3M in a research note on Friday, July 18th. Finally, JPMorgan Chase & Co. set a $167.00 price objective on 3M in a research note on Friday, July 18th. Seven research analysts have rated the stock with a Buy rating, two have issued a Hold rating and one has issued a Sell rating to the company's stock. Based on data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and a consensus price target of $161.78.

Get Our Latest Report on MMM

3M Profile

(

Free Report)

3M Company provides diversified technology services in the United States and internationally. The company's Safety and Industrial segment offers industrial abrasives and finishing for metalworking applications; autobody repair solutions; closure systems for personal hygiene products, masking, and packaging materials; electrical products and materials for construction and maintenance, power distribution, and electrical original equipment manufacturers; structural adhesives and tapes; respiratory, hearing, eye, and fall protection solutions; and natural and color-coated mineral granules for shingles.

See Also

Before you consider 3M, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and 3M wasn't on the list.

While 3M currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.