Sei Investments Co. lessened its holdings in MDU Resources Group, Inc. (NYSE:MDU - Free Report) by 13.9% in the 1st quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 102,779 shares of the utilities provider's stock after selling 16,619 shares during the period. Sei Investments Co. owned about 0.05% of MDU Resources Group worth $1,839,000 as of its most recent filing with the Securities & Exchange Commission.

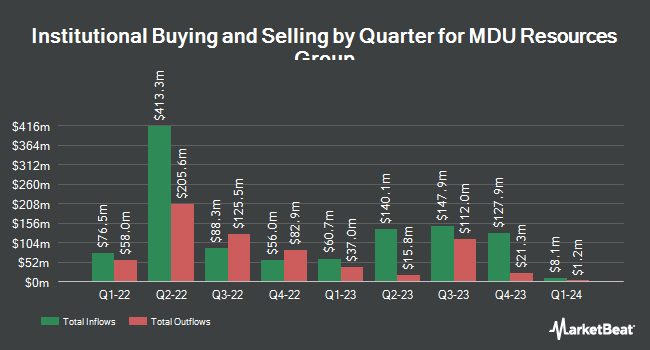

Several other institutional investors and hedge funds have also recently modified their holdings of MDU. Raymond James Financial Inc. purchased a new position in shares of MDU Resources Group in the 4th quarter valued at about $861,000. Mariner LLC increased its stake in shares of MDU Resources Group by 64.5% in the 4th quarter. Mariner LLC now owns 21,670 shares of the utilities provider's stock valued at $390,000 after purchasing an additional 8,496 shares in the last quarter. Walleye Capital LLC increased its stake in shares of MDU Resources Group by 51.6% in the 4th quarter. Walleye Capital LLC now owns 42,232 shares of the utilities provider's stock valued at $761,000 after purchasing an additional 14,366 shares in the last quarter. Jump Financial LLC increased its stake in shares of MDU Resources Group by 121.6% in the 4th quarter. Jump Financial LLC now owns 54,693 shares of the utilities provider's stock valued at $986,000 after purchasing an additional 30,014 shares in the last quarter. Finally, NewEdge Advisors LLC increased its stake in shares of MDU Resources Group by 13.1% in the 4th quarter. NewEdge Advisors LLC now owns 62,072 shares of the utilities provider's stock valued at $1,119,000 after purchasing an additional 7,207 shares in the last quarter. Hedge funds and other institutional investors own 71.44% of the company's stock.

Insider Buying and Selling at MDU Resources Group

In other MDU Resources Group news, CFO Jason L. Vollmer bought 5,000 shares of the firm's stock in a transaction dated Tuesday, August 19th. The stock was acquired at an average price of $16.27 per share, for a total transaction of $81,350.00. Following the completion of the purchase, the chief financial officer owned 339,548 shares of the company's stock, valued at approximately $5,524,445.96. This represents a 1.49% increase in their ownership of the stock. The acquisition was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this link. Company insiders own 0.94% of the company's stock.

Wall Street Analysts Forecast Growth

Separately, Wall Street Zen lowered shares of MDU Resources Group from a "hold" rating to a "sell" rating in a research note on Saturday, August 9th. Two analysts have rated the stock with a Buy rating and one has assigned a Hold rating to the stock. According to data from MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and an average price target of $18.00.

Check Out Our Latest Stock Report on MDU

MDU Resources Group Stock Down 0.0%

Shares of NYSE:MDU traded down $0.0050 during trading on Thursday, hitting $16.3750. The company's stock had a trading volume of 216,562 shares, compared to its average volume of 1,685,174. The company has a debt-to-equity ratio of 0.75, a quick ratio of 0.71 and a current ratio of 0.74. The business has a 50 day moving average price of $16.69 and a two-hundred day moving average price of $16.82. The company has a market capitalization of $3.35 billion, a PE ratio of 15.45, a P/E/G ratio of 2.60 and a beta of 0.73. MDU Resources Group, Inc. has a fifty-two week low of $14.91 and a fifty-two week high of $30.52.

MDU Resources Group (NYSE:MDU - Get Free Report) last issued its earnings results on Thursday, August 7th. The utilities provider reported $0.07 EPS for the quarter, missing analysts' consensus estimates of $0.13 by ($0.06). The firm had revenue of $351.20 million for the quarter, compared to analyst estimates of $315.67 million. MDU Resources Group had a return on equity of 8.29% and a net margin of 8.25%.The business's revenue for the quarter was up 1.9% on a year-over-year basis. During the same quarter in the previous year, the firm posted $0.32 EPS. MDU Resources Group has set its FY 2025 guidance at 0.880-0.950 EPS. As a group, research analysts expect that MDU Resources Group, Inc. will post 0.94 EPS for the current fiscal year.

MDU Resources Group Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Wednesday, October 1st. Shareholders of record on Thursday, September 11th will be paid a $0.14 dividend. This represents a $0.56 annualized dividend and a yield of 3.4%. This is an increase from MDU Resources Group's previous quarterly dividend of $0.13. MDU Resources Group's dividend payout ratio is currently 49.06%.

MDU Resources Group Company Profile

(

Free Report)

MDU Resources Group, Inc engages in the regulated energy delivery, and construction materials and services businesses in the United States. It operates through four segments: Electric, Natural Gas Distribution, Pipeline, and Construction Services. The Electric segment generates, transmits, and distributes electricity for residential, commercial, industrial, and municipal customers in Montana, North Dakota, South Dakota, and Wyoming; and operates 3,400 miles of transmission lines, 4,800 miles of distribution lines, and 82 transmission and 298 distribution substations.

See Also

Before you consider MDU Resources Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MDU Resources Group wasn't on the list.

While MDU Resources Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.