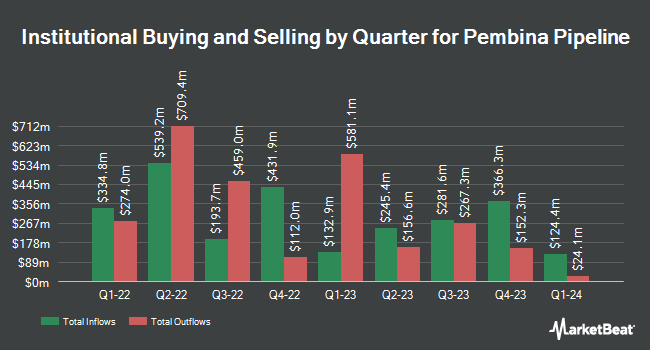

M.E. Allison & CO. Inc. bought a new position in Pembina Pipeline Corp. (NYSE:PBA - Free Report) TSE: PPL in the second quarter, according to the company in its most recent Form 13F filing with the SEC. The firm bought 7,450 shares of the pipeline company's stock, valued at approximately $279,000.

Other institutional investors and hedge funds have also modified their holdings of the company. First Horizon Advisors Inc. increased its holdings in shares of Pembina Pipeline by 69.9% in the 1st quarter. First Horizon Advisors Inc. now owns 673 shares of the pipeline company's stock worth $27,000 after purchasing an additional 277 shares in the last quarter. N.E.W. Advisory Services LLC bought a new stake in shares of Pembina Pipeline in the 1st quarter worth $27,000. Larson Financial Group LLC increased its holdings in shares of Pembina Pipeline by 53.4% in the 1st quarter. Larson Financial Group LLC now owns 1,341 shares of the pipeline company's stock worth $54,000 after purchasing an additional 467 shares in the last quarter. Ameritas Advisory Services LLC bought a new stake in Pembina Pipeline in the 2nd quarter worth approximately $66,000. Finally, Dunhill Financial LLC raised its stake in Pembina Pipeline by 42.6% during the 1st quarter. Dunhill Financial LLC now owns 1,925 shares of the pipeline company's stock valued at $77,000 after buying an additional 575 shares during the last quarter. Institutional investors own 55.37% of the company's stock.

Pembina Pipeline Trading Down 1.6%

Shares of PBA stock opened at $39.00 on Monday. Pembina Pipeline Corp. has a 1 year low of $34.13 and a 1 year high of $43.44. The firm has a fifty day moving average price of $38.49 and a 200-day moving average price of $37.88. The company has a debt-to-equity ratio of 0.81, a current ratio of 0.77 and a quick ratio of 0.62. The company has a market cap of $22.66 billion, a price-to-earnings ratio of 18.31 and a beta of 0.76.

Pembina Pipeline Increases Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Monday, September 29th. Stockholders of record on Monday, September 15th were given a dividend of $0.71 per share. This represents a $2.84 dividend on an annualized basis and a dividend yield of 7.3%. The ex-dividend date of this dividend was Monday, September 15th. This is a positive change from Pembina Pipeline's previous quarterly dividend of $0.51. Pembina Pipeline's payout ratio is presently 97.18%.

Analysts Set New Price Targets

PBA has been the subject of a number of research reports. Weiss Ratings reiterated a "hold (c+)" rating on shares of Pembina Pipeline in a research note on Wednesday, October 8th. National Bankshares upgraded shares of Pembina Pipeline from a "sector perform" rating to an "outperform" rating in a research note on Thursday, June 26th. Raymond James Financial reiterated an "outperform" rating on shares of Pembina Pipeline in a research note on Monday, August 11th. BMO Capital Markets reiterated an "outperform" rating on shares of Pembina Pipeline in a research note on Monday, August 11th. Finally, National Bank Financial upgraded shares of Pembina Pipeline from a "hold" rating to a "strong-buy" rating in a research note on Wednesday, June 25th. One research analyst has rated the stock with a Strong Buy rating, six have issued a Buy rating, two have given a Hold rating and one has assigned a Sell rating to the company's stock. Based on data from MarketBeat, Pembina Pipeline presently has an average rating of "Moderate Buy".

View Our Latest Stock Analysis on PBA

Pembina Pipeline Company Profile

(

Free Report)

Pembina Pipeline Corporation provides energy transportation and midstream services. It operates through three segments: Pipelines, Facilities, and Marketing & New Ventures. The Pipelines segment operates conventional, oil sands and heavy oil, and transmission assets with a transportation capacity of 2.9 millions of barrels of oil equivalent per day, the ground storage capacity of 10 millions of barrels, and rail terminalling capacity of approximately 105 thousands of barrels of oil equivalent per day serving markets and basins across North America.

See Also

Want to see what other hedge funds are holding PBA? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Pembina Pipeline Corp. (NYSE:PBA - Free Report) TSE: PPL.

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Pembina Pipeline, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pembina Pipeline wasn't on the list.

While Pembina Pipeline currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.