Mediolanum International Funds Ltd trimmed its position in Uber Technologies, Inc. (NYSE:UBER - Free Report) by 2.5% in the 1st quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 306,485 shares of the ride-sharing company's stock after selling 7,948 shares during the period. Mediolanum International Funds Ltd's holdings in Uber Technologies were worth $22,297,000 at the end of the most recent reporting period.

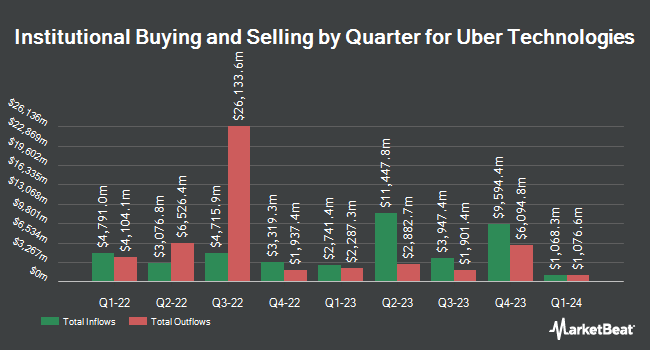

Several other large investors have also recently bought and sold shares of UBER. Capital Research Global Investors boosted its stake in Uber Technologies by 79.0% during the fourth quarter. Capital Research Global Investors now owns 118,131,681 shares of the ride-sharing company's stock valued at $7,125,728,000 after buying an additional 52,125,476 shares during the period. Pacer Advisors Inc. raised its holdings in shares of Uber Technologies by 2,571.2% in the 1st quarter. Pacer Advisors Inc. now owns 6,498,167 shares of the ride-sharing company's stock valued at $473,456,000 after acquiring an additional 6,254,898 shares in the last quarter. Toyota Motor Corp bought a new stake in shares of Uber Technologies during the 4th quarter valued at about $309,192,000. Jericho Capital Asset Management L.P. purchased a new position in shares of Uber Technologies during the fourth quarter worth about $298,644,000. Finally, Capital World Investors increased its position in shares of Uber Technologies by 10.1% in the fourth quarter. Capital World Investors now owns 30,355,075 shares of the ride-sharing company's stock worth $1,831,021,000 after purchasing an additional 2,792,039 shares during the last quarter. 80.24% of the stock is owned by institutional investors.

Insider Buying and Selling at Uber Technologies

In related news, CFO Prashanth Mahendra-Rajah sold 2,750 shares of the stock in a transaction dated Monday, July 7th. The shares were sold at an average price of $95.00, for a total transaction of $261,250.00. Following the sale, the chief financial officer directly owned 21,975 shares of the company's stock, valued at approximately $2,087,625. This represents a 11.12% decrease in their position. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, insider Jill Hazelbaker sold 34,884 shares of the firm's stock in a transaction dated Monday, May 12th. The shares were sold at an average price of $86.03, for a total transaction of $3,001,070.52. Following the sale, the insider owned 102,135 shares of the company's stock, valued at approximately $8,786,674.05. This represents a 25.46% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 40,384 shares of company stock worth $3,496,071 over the last three months. Corporate insiders own 3.84% of the company's stock.

Uber Technologies Trading Up 0.5%

Shares of NYSE UBER opened at $91.31 on Friday. Uber Technologies, Inc. has a 1 year low of $54.84 and a 1 year high of $97.71. The company has a debt-to-equity ratio of 0.37, a current ratio of 1.02 and a quick ratio of 1.02. The firm has a 50-day moving average of $89.29 and a 200 day moving average of $79.51. The stock has a market cap of $190.94 billion, a P/E ratio of 15.99, a price-to-earnings-growth ratio of 1.05 and a beta of 1.40.

Uber Technologies (NYSE:UBER - Get Free Report) last released its earnings results on Wednesday, May 7th. The ride-sharing company reported $0.83 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.50 by $0.33. The firm had revenue of $11.53 billion during the quarter, compared to analyst estimates of $11.61 billion. Uber Technologies had a net margin of 27.07% and a return on equity of 66.46%. The business's revenue was up 13.8% on a year-over-year basis. During the same period last year, the business earned ($0.32) earnings per share. As a group, sell-side analysts expect that Uber Technologies, Inc. will post 2.54 EPS for the current fiscal year.

Analyst Upgrades and Downgrades

UBER has been the subject of several research analyst reports. Raymond James Financial lowered shares of Uber Technologies from a "strong-buy" rating to a "moderate buy" rating in a research report on Wednesday, June 18th. Stifel Nicolaus assumed coverage on shares of Uber Technologies in a research report on Wednesday, June 11th. They issued a "buy" rating and a $110.00 target price for the company. Canaccord Genuity Group reissued a "hold" rating and issued a $84.00 target price (down previously from $90.00) on shares of Uber Technologies in a research note on Friday, June 27th. Royal Bank Of Canada reaffirmed an "outperform" rating and set a $82.00 price target on shares of Uber Technologies in a research note on Monday, May 5th. Finally, KeyCorp increased their price objective on Uber Technologies from $90.00 to $110.00 and gave the company an "overweight" rating in a research report on Monday, July 14th. Ten investment analysts have rated the stock with a hold rating and twenty-nine have issued a buy rating to the stock. Based on data from MarketBeat.com, Uber Technologies presently has a consensus rating of "Moderate Buy" and a consensus target price of $100.26.

Get Our Latest Analysis on Uber Technologies

About Uber Technologies

(

Free Report)

Uber Technologies, Inc develops and operates proprietary technology applications in the United States, Canada, Latin America, Europe, the Middle East, Africa, and Asia excluding China and Southeast Asia. It operates through three segments: Mobility, Delivery, and Freight. The Mobility segment connects consumers with a range of transportation modalities, such as ridesharing, carsharing, micromobility, rentals, public transit, taxis, and other modalities; and offers riders in a variety of vehicle types, as well as financial partnerships products and advertising services.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Uber Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Uber Technologies wasn't on the list.

While Uber Technologies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report