Mengis Capital Management Inc. bought a new position in Carrier Global Corporation (NYSE:CARR - Free Report) during the 2nd quarter, according to its most recent disclosure with the Securities & Exchange Commission. The fund bought 6,901 shares of the company's stock, valued at approximately $505,000.

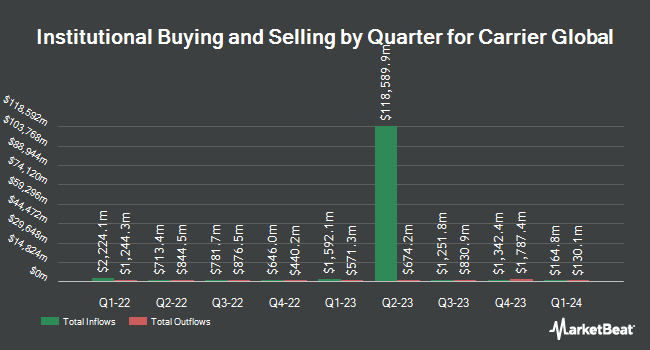

Several other large investors have also recently made changes to their positions in the company. Horizon Bancorp Inc. IN increased its holdings in shares of Carrier Global by 10.4% in the second quarter. Horizon Bancorp Inc. IN now owns 1,852 shares of the company's stock worth $136,000 after purchasing an additional 175 shares during the last quarter. Callan Family Office LLC increased its stake in Carrier Global by 204.2% during the second quarter. Callan Family Office LLC now owns 74,617 shares of the company's stock worth $5,461,000 after acquiring an additional 50,085 shares during the last quarter. Blair William & Co. IL increased its stake in Carrier Global by 6.0% during the second quarter. Blair William & Co. IL now owns 164,862 shares of the company's stock worth $12,066,000 after acquiring an additional 9,341 shares during the last quarter. McElhenny Sheffield Capital Management LLC bought a new stake in Carrier Global during the second quarter worth approximately $12,589,000. Finally, US Bancorp DE increased its stake in Carrier Global by 3.9% during the second quarter. US Bancorp DE now owns 529,191 shares of the company's stock worth $38,732,000 after acquiring an additional 19,976 shares during the last quarter. 91.00% of the stock is owned by institutional investors.

Carrier Global Trading Down 2.9%

CARR opened at $58.08 on Friday. The stock has a market cap of $49.43 billion, a price-to-earnings ratio of 12.65, a P/E/G ratio of 1.86 and a beta of 1.25. The stock's 50 day moving average price is $63.23 and its 200-day moving average price is $67.27. Carrier Global Corporation has a one year low of $54.22 and a one year high of $83.32. The company has a debt-to-equity ratio of 0.76, a quick ratio of 0.80 and a current ratio of 1.17.

Carrier Global (NYSE:CARR - Get Free Report) last announced its quarterly earnings results on Tuesday, July 29th. The company reported $0.92 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.90 by $0.02. The firm had revenue of $6.11 billion during the quarter, compared to analyst estimates of $6.08 billion. Carrier Global had a return on equity of 17.83% and a net margin of 18.33%. Carrier Global has set its FY 2025 guidance at 3.000-3.100 EPS. On average, equities analysts forecast that Carrier Global Corporation will post 2.99 EPS for the current year.

Carrier Global Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Tuesday, November 18th. Investors of record on Wednesday, October 29th will be issued a $0.225 dividend. The ex-dividend date is Wednesday, October 29th. This represents a $0.90 dividend on an annualized basis and a dividend yield of 1.5%. Carrier Global's payout ratio is presently 19.61%.

Wall Street Analysts Forecast Growth

Several equities research analysts have weighed in on CARR shares. Weiss Ratings reissued a "buy (b-)" rating on shares of Carrier Global in a research note on Wednesday. Rothschild & Co Redburn reduced their price objective on Carrier Global from $76.00 to $66.00 and set a "neutral" rating on the stock in a research note on Wednesday, October 1st. JPMorgan Chase & Co. reissued a "neutral" rating and set a $79.00 price objective on shares of Carrier Global in a research note on Tuesday, July 15th. Jefferies Financial Group reaffirmed a "buy" rating on shares of Carrier Global in a research note on Thursday, September 11th. Finally, Melius Research raised Carrier Global to a "hold" rating and set a $90.00 target price on the stock in a research note on Tuesday, July 1st. Twelve investment analysts have rated the stock with a Buy rating and nine have given a Hold rating to the company. According to data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and an average target price of $78.42.

Get Our Latest Stock Analysis on CARR

Carrier Global Company Profile

(

Free Report)

Carrier Global Corporation provides heating, ventilating, and air conditioning (HVAC), refrigeration, fire, security, and building automation technologies in the United States, Europe, the Asia Pacific, and internationally. It operates through three segments: HVAC, Refrigeration, and Fire & Security.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Carrier Global, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Carrier Global wasn't on the list.

While Carrier Global currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.