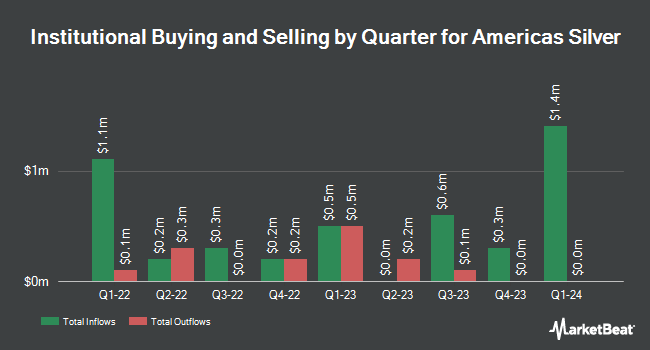

Merk Investments LLC boosted its position in Americas Gold and Silver Corporation (NYSEAMERICAN:USAS - Free Report) by 2,486.3% during the 1st quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 71,151,028 shares of the company's stock after buying an additional 68,400,000 shares during the period. Americas Gold and Silver makes up 20.7% of Merk Investments LLC's holdings, making the stock its 2nd biggest holding. Merk Investments LLC owned about 28.72% of Americas Gold and Silver worth $38,062,000 at the end of the most recent quarter.

Several other hedge funds and other institutional investors have also bought and sold shares of USAS. Cetera Investment Advisers increased its stake in Americas Gold and Silver by 4.8% in the fourth quarter. Cetera Investment Advisers now owns 428,844 shares of the company's stock valued at $167,000 after purchasing an additional 19,696 shares in the last quarter. XTX Topco Ltd increased its stake in Americas Gold and Silver by 494.6% in the first quarter. XTX Topco Ltd now owns 122,207 shares of the company's stock valued at $64,000 after purchasing an additional 101,655 shares in the last quarter. Connor Clark & Lunn Investment Management Ltd. increased its stake in Americas Gold and Silver by 51.9% in the first quarter. Connor Clark & Lunn Investment Management Ltd. now owns 648,500 shares of the company's stock valued at $347,000 after purchasing an additional 221,500 shares in the last quarter. Alps Advisors Inc. increased its stake in Americas Gold and Silver by 1,587.0% in the first quarter. Alps Advisors Inc. now owns 1,609,368 shares of the company's stock valued at $848,000 after purchasing an additional 1,513,968 shares in the last quarter. Finally, Sprott Inc. increased its stake in Americas Gold and Silver by 5.2% in the first quarter. Sprott Inc. now owns 5,757,602 shares of the company's stock valued at $3,081,000 after purchasing an additional 285,500 shares in the last quarter. Institutional investors and hedge funds own 13.38% of the company's stock.

Analyst Ratings Changes

Separately, HC Wainwright reaffirmed a "buy" rating and issued a $3.25 price target (up from $2.50) on shares of Americas Gold and Silver in a research note on Thursday, July 10th. One research analyst has rated the stock with a Buy rating, According to data from MarketBeat.com, Americas Gold and Silver has an average rating of "Buy" and an average price target of $3.25.

Check Out Our Latest Analysis on Americas Gold and Silver

Americas Gold and Silver Stock Performance

NYSEAMERICAN:USAS traded up $0.08 during trading hours on Friday, reaching $2.86. The company's stock had a trading volume of 1,654,042 shares, compared to its average volume of 1,277,027. The company has a market capitalization of $770.06 million, a price-to-earnings ratio of -8.80 and a beta of 0.63. The firm's 50-day moving average price is $2.51. Americas Gold and Silver Corporation has a 1 year low of $0.64 and a 1 year high of $2.97. The company has a debt-to-equity ratio of 0.90, a current ratio of 1.14 and a quick ratio of 1.03.

About Americas Gold and Silver

(

Free Report)

Americas Gold and Silver Corporation engages in the acquisition, evaluation, exploration, development, and operation of mineral properties. The company explores for silver, lead, zinc and copper. It principally owns 100% interests in the Cosalá Operations consisting of 67 mining concessions that cover approximately 19,385 hectares located in the state of Sinaloa, Mexico; and Galena Complex situated near the town of Wallace in the state of Idaho, the United States.

Read More

Before you consider Americas Gold and Silver, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Americas Gold and Silver wasn't on the list.

While Americas Gold and Silver currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.