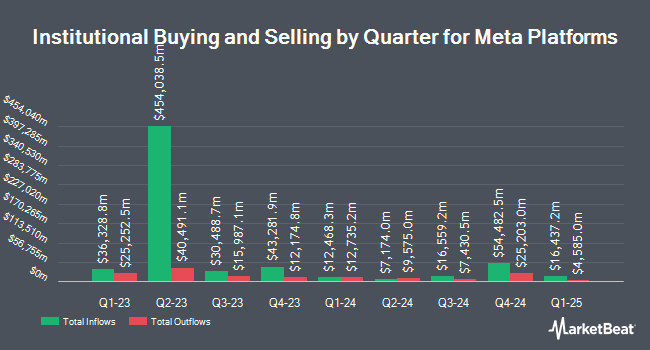

Blue Investment Partners LLC boosted its stake in Meta Platforms, Inc. (NASDAQ:META - Free Report) by 11.0% during the first quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 17,320 shares of the social networking company's stock after purchasing an additional 1,722 shares during the period. Meta Platforms comprises 3.8% of Blue Investment Partners LLC's investment portfolio, making the stock its 10th largest position. Blue Investment Partners LLC's holdings in Meta Platforms were worth $9,983,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

A number of other institutional investors have also recently made changes to their positions in the stock. Csenge Advisory Group grew its stake in shares of Meta Platforms by 12.0% in the first quarter. Csenge Advisory Group now owns 9,539 shares of the social networking company's stock worth $5,498,000 after purchasing an additional 1,019 shares during the last quarter. Suvretta Capital Management LLC increased its stake in shares of Meta Platforms by 1.1% in the 4th quarter. Suvretta Capital Management LLC now owns 170,338 shares of the social networking company's stock worth $99,735,000 after acquiring an additional 1,850 shares in the last quarter. Skye Global Management LP increased its stake in shares of Meta Platforms by 130.9% during the fourth quarter. Skye Global Management LP now owns 76,200 shares of the social networking company's stock valued at $44,616,000 after purchasing an additional 43,200 shares in the last quarter. ARQ Wealth Advisors LLC increased its position in Meta Platforms by 4.5% during the 1st quarter. ARQ Wealth Advisors LLC now owns 785 shares of the social networking company's stock valued at $452,000 after buying an additional 34 shares in the last quarter. Finally, JMG Financial Group Ltd. purchased a new position in shares of Meta Platforms in the 1st quarter worth about $284,000. Hedge funds and other institutional investors own 79.91% of the company's stock.

Meta Platforms Stock Up 2.1%

NASDAQ META traded up $15.69 on Friday, reaching $754.79. 10,590,214 shares of the stock traded hands, compared to its average volume of 13,538,896. The company has a market cap of $1.90 trillion, a price-to-earnings ratio of 27.33, a PEG ratio of 1.57 and a beta of 1.27. The company has a debt-to-equity ratio of 0.15, a quick ratio of 1.97 and a current ratio of 1.97. Meta Platforms, Inc. has a 12 month low of $479.80 and a 12 month high of $796.25. The company has a fifty day moving average price of $730.31 and a 200-day moving average price of $657.36.

Meta Platforms (NASDAQ:META - Get Free Report) last posted its quarterly earnings results on Wednesday, July 30th. The social networking company reported $7.14 EPS for the quarter, beating the consensus estimate of $5.75 by $1.39. Meta Platforms had a net margin of 39.99% and a return on equity of 39.33%. The business had revenue of $47.52 billion during the quarter, compared to analyst estimates of $44.55 billion. During the same quarter in the previous year, the business posted $5.16 EPS. The company's quarterly revenue was up 21.6% compared to the same quarter last year. Meta Platforms has set its Q3 2025 guidance at EPS. As a group, research analysts forecast that Meta Platforms, Inc. will post 26.7 EPS for the current fiscal year.

Meta Platforms Announces Dividend

The firm also recently announced a quarterly dividend, which was paid on Thursday, June 26th. Investors of record on Monday, June 16th were paid a dividend of $0.525 per share. This represents a $2.10 annualized dividend and a yield of 0.3%. The ex-dividend date was Monday, June 16th. Meta Platforms's payout ratio is 7.60%.

Insider Activity at Meta Platforms

In other Meta Platforms news, CEO Mark Zuckerberg sold 15,847 shares of the firm's stock in a transaction dated Friday, August 1st. The stock was sold at an average price of $753.43, for a total value of $11,939,605.21. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this link. Also, insider Christopher K. Cox sold 60,000 shares of the business's stock in a transaction dated Tuesday, August 5th. The shares were sold at an average price of $775.95, for a total value of $46,557,000.00. Following the sale, the insider owned 237,205 shares in the company, valued at approximately $184,059,219.75. The trade was a 20.19% decrease in their position. The disclosure for this sale can be found here. Insiders have sold 313,803 shares of company stock valued at $235,276,424 in the last ninety days. Corporate insiders own 13.61% of the company's stock.

Wall Street Analysts Forecast Growth

Several research analysts have recently weighed in on META shares. Oppenheimer boosted their price target on Meta Platforms from $775.00 to $870.00 and gave the stock an "outperform" rating in a research note on Thursday, July 31st. BMO Capital Markets boosted their price target on Meta Platforms from $610.00 to $710.00 and gave the company a "market perform" rating in a report on Thursday, July 31st. Evercore ISI boosted their price objective on Meta Platforms from $725.00 to $750.00 and gave the company an "outperform" rating in a research note on Thursday, May 1st. Moffett Nathanson increased their price target on Meta Platforms from $525.00 to $605.00 and gave the stock a "buy" rating in a research note on Thursday, May 1st. Finally, Needham & Company LLC raised shares of Meta Platforms from an "underperform" rating to a "hold" rating in a research note on Thursday, July 3rd. Three analysts have rated the stock with a Strong Buy rating, thirty-nine have issued a Buy rating and five have issued a Hold rating to the company. According to MarketBeat, the stock has a consensus rating of "Moderate Buy" and a consensus price target of $822.41.

View Our Latest Report on Meta Platforms

Meta Platforms Company Profile

(

Free Report)

Meta Platforms, Inc engages in the development of products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality headsets, and wearables worldwide. It operates in two segments, Family of Apps and Reality Labs. The Family of Apps segment offers Facebook, which enables people to share, discuss, discover, and connect with interests; Instagram, a community for sharing photos, videos, and private messages, as well as feed, stories, reels, video, live, and shops; Messenger, a messaging application for people to connect with friends, family, communities, and businesses across platforms and devices through text, audio, and video calls; and WhatsApp, a messaging application that is used by people and businesses to communicate and transact privately.

Read More

Before you consider Meta Platforms, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Meta Platforms wasn't on the list.

While Meta Platforms currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report