MetLife Investment Management LLC trimmed its holdings in shares of PayPal Holdings, Inc. (NASDAQ:PYPL - Free Report) by 3.1% during the 1st quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 257,181 shares of the credit services provider's stock after selling 8,177 shares during the quarter. MetLife Investment Management LLC's holdings in PayPal were worth $16,781,000 at the end of the most recent reporting period.

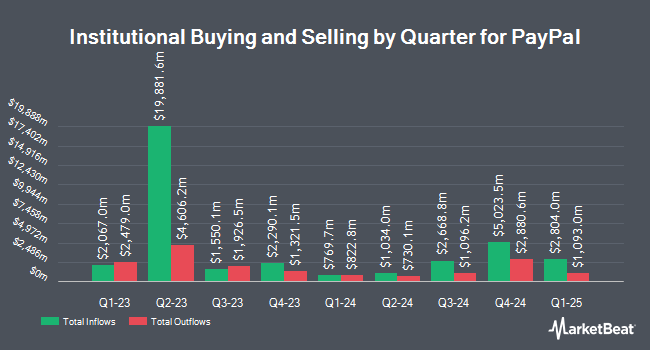

Several other hedge funds have also recently made changes to their positions in the business. Campbell & CO Investment Adviser LLC purchased a new stake in shares of PayPal during the 1st quarter valued at about $3,653,000. Quantitative Investment Management LLC bought a new position in PayPal during the 1st quarter valued at about $1,883,000. Jump Financial LLC grew its holdings in PayPal by 1,860.3% during the 1st quarter. Jump Financial LLC now owns 284,085 shares of the credit services provider's stock valued at $18,537,000 after purchasing an additional 269,593 shares during the last quarter. APG Asset Management N.V. grew its holdings in PayPal by 0.3% during the 1st quarter. APG Asset Management N.V. now owns 629,145 shares of the credit services provider's stock valued at $38,004,000 after purchasing an additional 2,064 shares during the last quarter. Finally, Rahlfs Capital LLC bought a new position in PayPal during the 1st quarter valued at about $596,000. 68.32% of the stock is currently owned by hedge funds and other institutional investors.

PayPal Price Performance

Shares of PYPL opened at $69.90 on Monday. The company has a market cap of $66.78 billion, a price-to-earnings ratio of 14.94, a price-to-earnings-growth ratio of 1.08 and a beta of 1.42. PayPal Holdings, Inc. has a twelve month low of $55.85 and a twelve month high of $93.66. The company has a quick ratio of 1.33, a current ratio of 1.33 and a debt-to-equity ratio of 0.56. The company has a 50 day moving average of $72.07 and a two-hundred day moving average of $70.20.

PayPal (NASDAQ:PYPL - Get Free Report) last announced its earnings results on Tuesday, July 29th. The credit services provider reported $1.40 earnings per share for the quarter, beating the consensus estimate of $1.30 by $0.10. The company had revenue of $8.29 billion during the quarter, compared to the consensus estimate of $8.08 billion. PayPal had a net margin of 14.49% and a return on equity of 25.35%. During the same period last year, the firm earned $1.19 earnings per share. PayPal has set its Q3 2025 guidance at 1.180-1.220 EPS. FY 2025 guidance at 5.150-5.300 EPS. As a group, analysts predict that PayPal Holdings, Inc. will post 5.03 earnings per share for the current fiscal year.

Insider Activity at PayPal

In other PayPal news, CAO Chris Natali sold 7,102 shares of the firm's stock in a transaction on Thursday, July 31st. The shares were sold at an average price of $69.35, for a total value of $492,523.70. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this link. Also, EVP Diego Scotti sold 3,839 shares of the firm's stock in a transaction on Friday, June 6th. The stock was sold at an average price of $73.24, for a total transaction of $281,168.36. Following the completion of the transaction, the executive vice president directly owned 16,989 shares of the company's stock, valued at approximately $1,244,274.36. This represents a 18.43% decrease in their position. The disclosure for this sale can be found here. In the last three months, insiders sold 26,898 shares of company stock worth $1,909,636. Corporate insiders own 0.08% of the company's stock.

Analyst Upgrades and Downgrades

Several brokerages recently commented on PYPL. Piper Sandler set a $74.00 price target on shares of PayPal in a report on Tuesday, July 29th. Truist Financial began coverage on shares of PayPal in a report on Monday, June 2nd. They set a "sell" rating and a $68.00 price target on the stock. Morgan Stanley reiterated a "positive" rating on shares of PayPal in a report on Wednesday, July 30th. Canaccord Genuity Group reiterated a "buy" rating and set a $96.00 price target on shares of PayPal in a report on Wednesday, July 30th. Finally, Wall Street Zen upgraded shares of PayPal from a "hold" rating to a "buy" rating in a research note on Saturday, August 2nd. Seventeen equities research analysts have rated the stock with a Buy rating, fourteen have issued a Hold rating and two have assigned a Sell rating to the stock. According to data from MarketBeat, PayPal presently has a consensus rating of "Hold" and an average target price of $85.00.

View Our Latest Stock Report on PayPal

PayPal Company Profile

(

Free Report)

PayPal Holdings, Inc operates a technology platform that enables digital payments on behalf of merchants and consumers worldwide. It operates a two-sided network at scale that connects merchants and consumers that enables its customers to connect, transact, and send and receive payments through online and in person, as well as transfer and withdraw funds using various funding sources, such as bank accounts, PayPal or Venmo account balance, PayPal and Venmo branded credit products comprising its installment products, credit and debit cards, and cryptocurrencies, as well as other stored value products, including gift cards and eligible rewards.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider PayPal, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PayPal wasn't on the list.

While PayPal currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.