MetLife Investment Management LLC cut its position in shares of Intuit Inc. (NASDAQ:INTU - Free Report) by 1.9% in the first quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 84,473 shares of the software maker's stock after selling 1,631 shares during the period. MetLife Investment Management LLC's holdings in Intuit were worth $51,866,000 as of its most recent filing with the Securities & Exchange Commission.

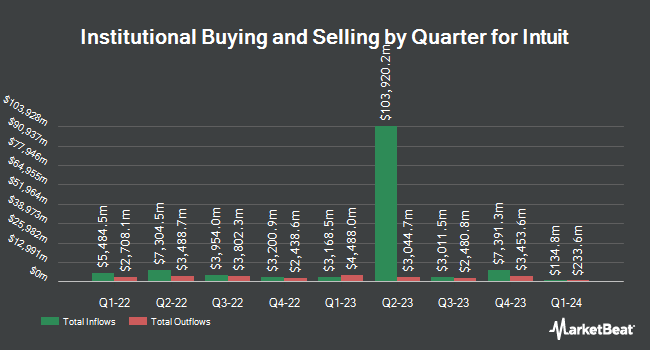

A number of other institutional investors and hedge funds have also bought and sold shares of INTU. GAMMA Investing LLC raised its position in Intuit by 69,701.9% during the 1st quarter. GAMMA Investing LLC now owns 2,825,582 shares of the software maker's stock valued at $17,348,790,000 after purchasing an additional 2,821,534 shares in the last quarter. Nuveen LLC bought a new stake in Intuit during the 1st quarter valued at $882,031,000. Nicholas Hoffman & Company LLC. bought a new stake in Intuit during the 1st quarter valued at $785,564,000. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC raised its position in Intuit by 33.5% during the 4th quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 3,072,021 shares of the software maker's stock valued at $1,930,765,000 after purchasing an additional 771,232 shares in the last quarter. Finally, Price T Rowe Associates Inc. MD raised its position in Intuit by 7.8% during the 1st quarter. Price T Rowe Associates Inc. MD now owns 9,018,770 shares of the software maker's stock valued at $5,537,435,000 after purchasing an additional 649,212 shares in the last quarter. 83.66% of the stock is owned by institutional investors.

Insider Buying and Selling at Intuit

In related news, Director Scott D. Cook sold 529 shares of the firm's stock in a transaction on Monday, August 25th. The shares were sold at an average price of $664.99, for a total transaction of $351,779.71. Following the sale, the director owned 6,162,547 shares in the company, valued at approximately $4,098,032,129.53. This trade represents a 0.01% decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, EVP Alex G. Balazs sold 882 shares of Intuit stock in a transaction on Tuesday, July 8th. The shares were sold at an average price of $781.63, for a total transaction of $689,397.66. The disclosure for this sale can be found here. Over the last ninety days, insiders have sold 149,650 shares of company stock worth $113,959,883. 2.68% of the stock is currently owned by insiders.

Analyst Upgrades and Downgrades

INTU has been the topic of several recent research reports. Piper Sandler reaffirmed an "overweight" rating and set a $825.00 target price (up previously from $785.00) on shares of Intuit in a research report on Friday, May 23rd. Morgan Stanley dropped their target price on Intuit from $900.00 to $880.00 and set an "overweight" rating on the stock in a research report on Friday. Jefferies Financial Group set a $850.00 target price on Intuit and gave the company a "buy" rating in a research report on Friday, May 23rd. Citigroup dropped their target price on Intuit from $815.00 to $803.00 and set a "buy" rating on the stock in a research report on Friday. Finally, BMO Capital Markets increased their target price on Intuit from $820.00 to $870.00 and gave the company an "outperform" rating in a research report on Thursday, July 10th. One research analyst has rated the stock with a Strong Buy rating, twenty have given a Buy rating, three have given a Hold rating and one has assigned a Sell rating to the company's stock. According to data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and a consensus target price of $797.62.

View Our Latest Report on INTU

Intuit Stock Performance

Shares of NASDAQ:INTU traded up $2.58 on Tuesday, hitting $659.54. 3,762,506 shares of the company were exchanged, compared to its average volume of 2,044,962. Intuit Inc. has a 1-year low of $532.65 and a 1-year high of $813.70. The stock's 50 day moving average price is $752.75 and its 200 day moving average price is $675.97. The company has a current ratio of 1.36, a quick ratio of 1.45 and a debt-to-equity ratio of 0.30. The firm has a market capitalization of $183.98 billion, a P/E ratio of 48.00, a price-to-earnings-growth ratio of 2.57 and a beta of 1.28.

Intuit (NASDAQ:INTU - Get Free Report) last posted its quarterly earnings data on Thursday, August 21st. The software maker reported $2.75 EPS for the quarter, topping the consensus estimate of $2.66 by $0.09. Intuit had a net margin of 20.55% and a return on equity of 22.72%. The business had revenue of $3.83 billion during the quarter, compared to the consensus estimate of $3.75 billion. During the same period in the previous year, the firm posted $1.99 earnings per share. The business's revenue for the quarter was up 20.3% compared to the same quarter last year. Intuit has set its Q1 2026 guidance at 3.050-3.120 EPS. FY 2026 guidance at 22.980-23.180 EPS. Sell-side analysts predict that Intuit Inc. will post 14.09 EPS for the current year.

Intuit Increases Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Friday, October 17th. Stockholders of record on Thursday, October 9th will be paid a $1.20 dividend. The ex-dividend date is Thursday, October 9th. This is an increase from Intuit's previous quarterly dividend of $1.04. This represents a $4.80 dividend on an annualized basis and a dividend yield of 0.7%. Intuit's dividend payout ratio (DPR) is currently 30.28%.

About Intuit

(

Free Report)

Intuit Inc provides financial management and compliance products and services for consumers, small businesses, self-employed, and accounting professionals in the United States, Canada, and internationally. The company operates in four segments: Small Business & Self-Employed, Consumer, Credit Karma, and ProTax.

Read More

Before you consider Intuit, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Intuit wasn't on the list.

While Intuit currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report