Meyer Handelman Co. lessened its holdings in shares of Bristol Myers Squibb Company (NYSE:BMY - Free Report) by 3.2% during the second quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 527,956 shares of the biopharmaceutical company's stock after selling 17,307 shares during the period. Meyer Handelman Co.'s holdings in Bristol Myers Squibb were worth $24,439,000 as of its most recent filing with the SEC.

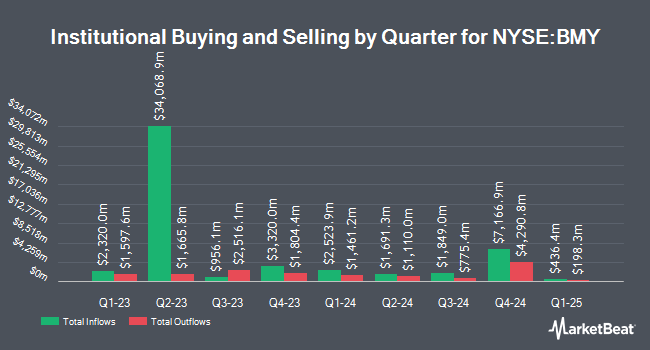

Other institutional investors also recently modified their holdings of the company. Vanguard Group Inc. increased its stake in shares of Bristol Myers Squibb by 0.8% in the first quarter. Vanguard Group Inc. now owns 191,403,004 shares of the biopharmaceutical company's stock valued at $11,673,669,000 after buying an additional 1,458,488 shares during the period. Charles Schwab Investment Management Inc. increased its position in Bristol Myers Squibb by 0.5% during the 1st quarter. Charles Schwab Investment Management Inc. now owns 60,606,905 shares of the biopharmaceutical company's stock valued at $3,696,415,000 after purchasing an additional 306,430 shares during the period. Bank of New York Mellon Corp raised its holdings in Bristol Myers Squibb by 8.6% during the 1st quarter. Bank of New York Mellon Corp now owns 26,865,073 shares of the biopharmaceutical company's stock worth $1,638,501,000 after purchasing an additional 2,131,205 shares during the last quarter. Northern Trust Corp lifted its position in shares of Bristol Myers Squibb by 5.3% in the 1st quarter. Northern Trust Corp now owns 25,974,504 shares of the biopharmaceutical company's stock worth $1,584,185,000 after purchasing an additional 1,316,144 shares during the period. Finally, Wellington Management Group LLP boosted its stake in shares of Bristol Myers Squibb by 297.0% in the 1st quarter. Wellington Management Group LLP now owns 23,728,443 shares of the biopharmaceutical company's stock valued at $1,447,198,000 after purchasing an additional 17,750,938 shares during the last quarter. Institutional investors own 76.41% of the company's stock.

Bristol Myers Squibb Stock Performance

Shares of BMY stock opened at $43.45 on Friday. The company has a current ratio of 1.21, a quick ratio of 1.11 and a debt-to-equity ratio of 2.54. The firm has a fifty day simple moving average of $46.70 and a two-hundred day simple moving average of $49.27. Bristol Myers Squibb Company has a 12 month low of $42.96 and a 12 month high of $63.33. The firm has a market capitalization of $88.44 billion, a PE ratio of 17.52, a price-to-earnings-growth ratio of 2.26 and a beta of 0.35.

Bristol Myers Squibb (NYSE:BMY - Get Free Report) last issued its quarterly earnings data on Thursday, July 31st. The biopharmaceutical company reported $1.46 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.07 by $0.39. The firm had revenue of $12.27 billion during the quarter, compared to analysts' expectations of $11.32 billion. Bristol Myers Squibb had a net margin of 10.58% and a return on equity of 80.04%. The business's revenue was up .6% on a year-over-year basis. During the same period last year, the company earned $2.07 earnings per share. Bristol Myers Squibb has set its FY 2025 guidance at 6.350-6.650 EPS. Analysts forecast that Bristol Myers Squibb Company will post 6.74 EPS for the current fiscal year.

Bristol Myers Squibb Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Monday, November 3rd. Stockholders of record on Friday, October 3rd will be paid a $0.62 dividend. The ex-dividend date of this dividend is Friday, October 3rd. This represents a $2.48 annualized dividend and a dividend yield of 5.7%. Bristol Myers Squibb's dividend payout ratio is 100.00%.

Insider Buying and Selling at Bristol Myers Squibb

In related news, EVP David V. Elkins sold 56,000 shares of Bristol Myers Squibb stock in a transaction that occurred on Tuesday, September 2nd. The stock was sold at an average price of $47.33, for a total transaction of $2,650,480.00. Following the transaction, the executive vice president owned 167,379 shares of the company's stock, valued at $7,922,048.07. The trade was a 25.07% decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. 0.09% of the stock is owned by corporate insiders.

Analyst Ratings Changes

A number of brokerages recently weighed in on BMY. Daiwa America downgraded shares of Bristol Myers Squibb from a "strong-buy" rating to a "hold" rating in a research note on Tuesday, August 5th. Daiwa Capital Markets downgraded Bristol Myers Squibb from an "outperform" rating to a "neutral" rating and set a $42.00 price objective on the stock. in a research note on Tuesday, August 5th. Wall Street Zen lowered Bristol Myers Squibb from a "strong-buy" rating to a "buy" rating in a research report on Friday, June 6th. Citigroup lowered their target price on Bristol Myers Squibb from $51.00 to $47.00 and set a "neutral" rating for the company in a report on Friday, August 1st. Finally, Morgan Stanley restated a "hold" rating on shares of Bristol Myers Squibb in a report on Thursday, July 31st. One research analyst has rated the stock with a Strong Buy rating, four have issued a Buy rating, fifteen have assigned a Hold rating and one has given a Sell rating to the company. According to data from MarketBeat, Bristol Myers Squibb has a consensus rating of "Hold" and a consensus price target of $56.38.

Read Our Latest Research Report on Bristol Myers Squibb

Bristol Myers Squibb Profile

(

Free Report)

Bristol-Myers Squibb Company discovers, develops, licenses, manufactures, markets, distributes, and sells biopharmaceutical products worldwide. It offers products for hematology, oncology, cardiovascular, immunology, fibrotic, and neuroscience diseases. The company's products include Eliquis for reduction in risk of stroke/systemic embolism in non-valvular atrial fibrillation, and for the treatment of DVT/PE; Opdivo for various anti-cancer indications, including bladder, blood, CRC, head and neck, RCC, HCC, lung, melanoma, MPM, stomach and esophageal cancer; Pomalyst/Imnovid for multiple myeloma; Orencia for active rheumatoid arthritis and psoriatic arthritis; and Sprycel for the treatment of Philadelphia chromosome-positive chronic myeloid leukemia.

See Also

Want to see what other hedge funds are holding BMY? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Bristol Myers Squibb Company (NYSE:BMY - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Bristol Myers Squibb, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bristol Myers Squibb wasn't on the list.

While Bristol Myers Squibb currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report