Northern Trust Corp lessened its holdings in Microchip Technology Incorporated (NASDAQ:MCHP - Free Report) by 7.8% in the 1st quarter, according to its most recent filing with the SEC. The firm owned 6,415,333 shares of the semiconductor company's stock after selling 543,169 shares during the period. Northern Trust Corp owned about 1.19% of Microchip Technology worth $310,566,000 at the end of the most recent quarter.

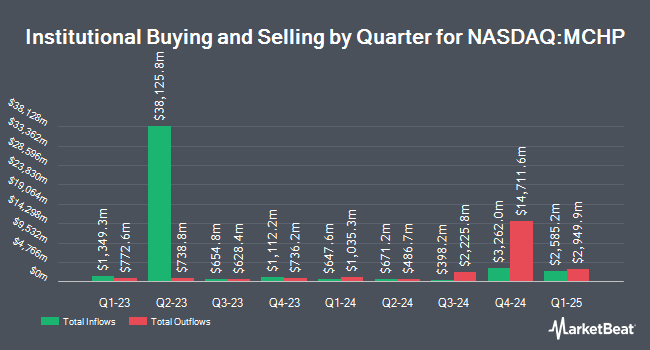

Several other hedge funds have also recently modified their holdings of MCHP. Garde Capital Inc. purchased a new stake in shares of Microchip Technology in the 1st quarter worth approximately $30,000. Orion Capital Management LLC purchased a new stake in shares of Microchip Technology in the 4th quarter worth approximately $41,000. Byrne Asset Management LLC purchased a new stake in shares of Microchip Technology in the 1st quarter worth approximately $41,000. GW&K Investment Management LLC lifted its position in shares of Microchip Technology by 161.0% in the 1st quarter. GW&K Investment Management LLC now owns 937 shares of the semiconductor company's stock worth $45,000 after purchasing an additional 578 shares during the period. Finally, American National Bank & Trust purchased a new stake in shares of Microchip Technology in the 1st quarter worth approximately $48,000. Hedge funds and other institutional investors own 91.51% of the company's stock.

Analyst Ratings Changes

A number of research firms recently commented on MCHP. TD Cowen decreased their target price on shares of Microchip Technology from $75.00 to $60.00 and set a "hold" rating for the company in a research report on Friday, August 8th. Wall Street Zen raised shares of Microchip Technology from a "sell" rating to a "hold" rating in a research report on Friday, June 27th. Bank of America raised shares of Microchip Technology from an "underperform" rating to a "neutral" rating and set a $56.00 target price for the company in a research report on Friday, May 9th. Citigroup increased their target price on shares of Microchip Technology from $68.00 to $90.00 and gave the company a "buy" rating in a research report on Monday, July 7th. Finally, Stifel Nicolaus increased their target price on shares of Microchip Technology from $70.00 to $82.00 and gave the company a "buy" rating in a research report on Friday, July 18th. One analyst has rated the stock with a Strong Buy rating, thirteen have issued a Buy rating and six have assigned a Hold rating to the company. According to data from MarketBeat.com, Microchip Technology has an average rating of "Moderate Buy" and an average price target of $76.58.

Get Our Latest Stock Analysis on Microchip Technology

Microchip Technology Stock Performance

Microchip Technology stock traded up $3.04 during mid-day trading on Friday, reaching $69.14. 12,427,539 shares of the company traded hands, compared to its average volume of 9,231,423. The company has a debt-to-equity ratio of 0.80, a current ratio of 2.31 and a quick ratio of 1.33. Microchip Technology Incorporated has a fifty-two week low of $34.13 and a fifty-two week high of $82.65. The company has a market capitalization of $37.31 billion, a price-to-earnings ratio of -203.35, a price-to-earnings-growth ratio of 2.00 and a beta of 1.55. The firm's fifty day moving average is $69.57 and its two-hundred day moving average is $58.80.

Microchip Technology (NASDAQ:MCHP - Get Free Report) last issued its quarterly earnings results on Thursday, August 7th. The semiconductor company reported $0.27 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.24 by $0.03. Microchip Technology had a negative net margin of 3.50% and a positive return on equity of 6.24%. The business had revenue of $1.08 billion for the quarter, compared to analyst estimates of $1.05 billion. During the same quarter in the prior year, the business posted $0.53 EPS. Microchip Technology's revenue for the quarter was down 13.3% compared to the same quarter last year. Microchip Technology has set its Q2 2026 guidance at 0.340-0.370 EPS. On average, equities research analysts expect that Microchip Technology Incorporated will post 1.03 earnings per share for the current fiscal year.

Microchip Technology Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Friday, September 5th. Stockholders of record on Friday, August 22nd will be paid a $0.455 dividend. The ex-dividend date is Friday, August 22nd. This represents a $1.82 dividend on an annualized basis and a dividend yield of 2.6%. Microchip Technology's dividend payout ratio is presently -535.29%.

About Microchip Technology

(

Free Report)

Microchip Technology Incorporated engages in the development, manufacture, and sale of smart, connected, and secure embedded control solutions in the Americas, Europe, and Asia. The company offers general purpose 8-bit, 16-bit, and 32-bit mixed-signal microcontrollers; 32-bit embedded mixed-signal microprocessors; and specialized microcontrollers for automotive, industrial, computing, communications, lighting, power supplies, motor control, human machine interface, security, wired connectivity, and wireless connectivity applications.

Featured Articles

Before you consider Microchip Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Microchip Technology wasn't on the list.

While Microchip Technology currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.