Middleton & Co. Inc. MA decreased its holdings in Fiserv, Inc. (NYSE:FI - Free Report) by 12.6% during the 1st quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm owned 46,534 shares of the business services provider's stock after selling 6,693 shares during the period. Fiserv comprises approximately 1.2% of Middleton & Co. Inc. MA's investment portfolio, making the stock its 28th biggest holding. Middleton & Co. Inc. MA's holdings in Fiserv were worth $10,276,000 at the end of the most recent quarter.

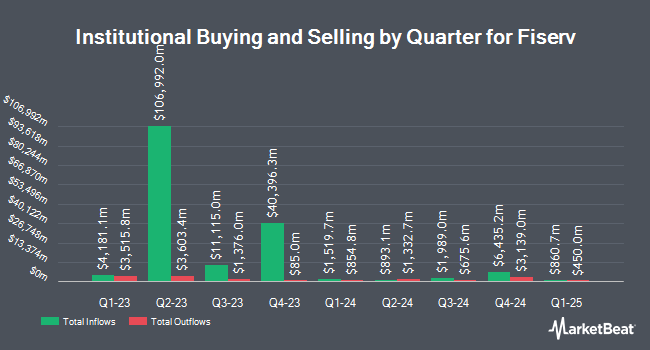

Other institutional investors and hedge funds have also recently bought and sold shares of the company. Vega Investment Solutions bought a new position in shares of Fiserv during the fourth quarter worth approximately $25,000. Park Square Financial Group LLC acquired a new stake in Fiserv during the fourth quarter worth approximately $28,000. Abound Financial LLC acquired a new stake in Fiserv during the first quarter worth approximately $38,000. Quarry LP grew its position in Fiserv by 51.9% during the fourth quarter. Quarry LP now owns 205 shares of the business services provider's stock worth $42,000 after buying an additional 70 shares in the last quarter. Finally, Mpwm Advisory Solutions LLC acquired a new stake in Fiserv during the fourth quarter worth approximately $54,000. Institutional investors own 90.98% of the company's stock.

Fiserv Trading Down 1.1%

Shares of FI stock traded down $1.50 during mid-day trading on Thursday, hitting $132.54. The company's stock had a trading volume of 6,306,037 shares, compared to its average volume of 6,911,371. The company's fifty day simple moving average is $160.58 and its 200-day simple moving average is $190.74. Fiserv, Inc. has a 52 week low of $128.22 and a 52 week high of $238.59. The company has a debt-to-equity ratio of 1.09, a quick ratio of 1.09 and a current ratio of 1.09. The company has a market cap of $72.05 billion, a PE ratio of 22.13, a P/E/G ratio of 0.87 and a beta of 0.91.

Fiserv (NYSE:FI - Get Free Report) last issued its earnings results on Wednesday, July 23rd. The business services provider reported $2.47 EPS for the quarter, beating the consensus estimate of $2.43 by $0.04. The company had revenue of $5.20 billion during the quarter, compared to the consensus estimate of $5.20 billion. Fiserv had a return on equity of 19.69% and a net margin of 16.00%. The firm's revenue for the quarter was up 8.0% compared to the same quarter last year. During the same period last year, the business posted $2.13 EPS. As a group, equities research analysts expect that Fiserv, Inc. will post 10.23 earnings per share for the current fiscal year.

Analyst Upgrades and Downgrades

FI has been the topic of a number of analyst reports. Deutsche Bank Aktiengesellschaft initiated coverage on Fiserv in a research report on Thursday, July 17th. They set a "buy" rating and a $200.00 price target on the stock. UBS Group reduced their target price on Fiserv from $225.00 to $170.00 and set a "buy" rating on the stock in a report on Friday, July 25th. Morgan Stanley reduced their target price on Fiserv from $268.00 to $266.00 and set an "overweight" rating on the stock in a report on Monday, July 21st. Royal Bank Of Canada set a $237.00 target price on Fiserv in a report on Friday, April 25th. Finally, Tigress Financial raised their target price on Fiserv from $244.00 to $250.00 and gave the company a "buy" rating in a report on Thursday, May 29th. One research analyst has rated the stock with a sell rating, two have issued a hold rating, twenty-three have assigned a buy rating and one has given a strong buy rating to the company. According to data from MarketBeat, the stock presently has an average rating of "Moderate Buy" and a consensus price target of $207.08.

Get Our Latest Stock Analysis on FI

Insider Transactions at Fiserv

In other news, EVP Andrew Gelb sold 5,652 shares of the business's stock in a transaction that occurred on Wednesday, May 28th. The stock was sold at an average price of $160.00, for a total value of $904,320.00. Following the transaction, the executive vice president owned 25,385 shares in the company, valued at $4,061,600. The trade was a 18.21% decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, insider Adam L. Rosman sold 2,512 shares of the business's stock in a transaction that occurred on Tuesday, May 27th. The stock was sold at an average price of $160.68, for a total value of $403,628.16. Following the completion of the transaction, the insider owned 53,385 shares in the company, valued at $8,577,901.80. The trade was a 4.49% decrease in their position. The disclosure for this sale can be found here. 0.74% of the stock is currently owned by insiders.

About Fiserv

(

Free Report)

Fiserv, Inc, together with its subsidiaries, provides payments and financial services technology services in the United States, Europe, the Middle East and Africa, Latin America, the Asia-Pacific, and internationally. It operates through Merchant Acceptance, Financial Technology, and Payments and Network segments.

Featured Articles

Before you consider Fiserv, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fiserv wasn't on the list.

While Fiserv currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.