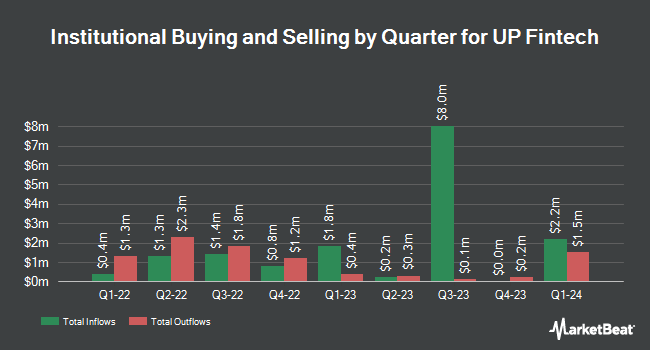

Millennium Management LLC raised its stake in UP Fintech Holding Limited (NASDAQ:TIGR - Free Report) by 48.0% in the 1st quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 2,398,744 shares of the company's stock after buying an additional 777,776 shares during the quarter. Millennium Management LLC owned approximately 1.30% of UP Fintech worth $20,605,000 at the end of the most recent quarter.

Other large investors also recently added to or reduced their stakes in the company. Tower Research Capital LLC TRC grew its holdings in UP Fintech by 527.2% in the 4th quarter. Tower Research Capital LLC TRC now owns 4,641 shares of the company's stock valued at $30,000 after buying an additional 3,901 shares in the last quarter. Deutsche Bank AG acquired a new position in shares of UP Fintech in the 4th quarter valued at $38,000. Tairen Capital Ltd acquired a new position in shares of UP Fintech in the 4th quarter valued at $68,000. Bingham Private Wealth LLC acquired a new position in shares of UP Fintech in the 1st quarter valued at $90,000. Finally, GAMMA Investing LLC lifted its stake in shares of UP Fintech by 17.4% in the 1st quarter. GAMMA Investing LLC now owns 10,728 shares of the company's stock valued at $92,000 after purchasing an additional 1,592 shares during the last quarter. 9.03% of the stock is currently owned by hedge funds and other institutional investors.

UP Fintech Stock Performance

TIGR stock traded down $0.15 during mid-day trading on Thursday, reaching $10.90. The company had a trading volume of 5,936,405 shares, compared to its average volume of 7,190,524. The company has a market capitalization of $2.01 billion, a price-to-earnings ratio of 16.77, a price-to-earnings-growth ratio of 0.72 and a beta of 0.64. The firm has a fifty day simple moving average of $10.94 and a 200 day simple moving average of $9.26. UP Fintech Holding Limited has a fifty-two week low of $3.57 and a fifty-two week high of $14.48.

Wall Street Analysts Forecast Growth

TIGR has been the topic of several recent analyst reports. Citigroup raised UP Fintech from a "neutral" rating to a "buy" rating and upped their price target for the company from $9.50 to $14.00 in a research note on Tuesday, July 22nd. Wall Street Zen raised UP Fintech from a "hold" rating to a "buy" rating in a research note on Saturday, August 30th. Four equities research analysts have rated the stock with a Buy rating, According to MarketBeat, UP Fintech has a consensus rating of "Buy" and a consensus target price of $10.33.

View Our Latest Stock Analysis on UP Fintech

About UP Fintech

(

Free Report)

UP Fintech Holding Limited provides online brokerage services focusing on Chinese investors. The company has developed a brokerage platform, which allows investor to trade stocks, options, warrants, and other financial instruments that can be accessed through its APP and website. It offers brokerage and value-added services, including investor education, community engagement, and IR platform services.

See Also

Before you consider UP Fintech, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and UP Fintech wasn't on the list.

While UP Fintech currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.