Millennium Management LLC raised its holdings in shares of Intercontinental Hotels Group (NYSE:IHG - Free Report) by 170.5% in the 1st quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 305,177 shares of the company's stock after acquiring an additional 192,342 shares during the quarter. Millennium Management LLC owned approximately 0.20% of Intercontinental Hotels Group worth $33,444,000 as of its most recent filing with the Securities and Exchange Commission.

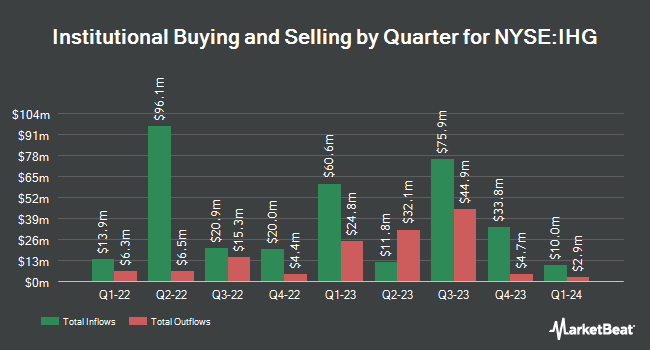

Several other hedge funds have also recently added to or reduced their stakes in the business. Allspring Global Investments Holdings LLC lifted its stake in shares of Intercontinental Hotels Group by 4.8% during the first quarter. Allspring Global Investments Holdings LLC now owns 2,092 shares of the company's stock valued at $232,000 after buying an additional 96 shares during the period. Aaron Wealth Advisors LLC lifted its stake in shares of Intercontinental Hotels Group by 4.5% during the first quarter. Aaron Wealth Advisors LLC now owns 2,245 shares of the company's stock valued at $246,000 after buying an additional 96 shares during the period. Golden State Wealth Management LLC lifted its stake in shares of Intercontinental Hotels Group by 100.0% during the first quarter. Golden State Wealth Management LLC now owns 228 shares of the company's stock valued at $25,000 after buying an additional 114 shares during the period. TD Private Client Wealth LLC lifted its stake in shares of Intercontinental Hotels Group by 48.7% during the first quarter. TD Private Client Wealth LLC now owns 348 shares of the company's stock valued at $38,000 after buying an additional 114 shares during the period. Finally, Freedom Investment Management Inc. lifted its stake in shares of Intercontinental Hotels Group by 4.4% during the first quarter. Freedom Investment Management Inc. now owns 3,929 shares of the company's stock valued at $431,000 after buying an additional 166 shares during the period. 15.09% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

Separately, Wall Street Zen upgraded shares of Intercontinental Hotels Group from a "hold" rating to a "buy" rating in a report on Saturday, August 30th. Two analysts have rated the stock with a Buy rating, two have assigned a Hold rating and two have assigned a Sell rating to the company. According to MarketBeat, the company currently has a consensus rating of "Hold".

View Our Latest Stock Report on Intercontinental Hotels Group

Intercontinental Hotels Group Stock Performance

Intercontinental Hotels Group stock traded up $0.99 during trading on Tuesday, reaching $120.49. The company had a trading volume of 147,679 shares, compared to its average volume of 146,187. Intercontinental Hotels Group has a 12-month low of $94.78 and a 12-month high of $137.25. The stock's 50 day moving average price is $119.98 and its two-hundred day moving average price is $115.38. The firm has a market capitalization of $18.52 billion, a price-to-earnings ratio of 21.36, a PEG ratio of 1.70 and a beta of 1.27.

Intercontinental Hotels Group Cuts Dividend

The firm also recently disclosed a semi-annual dividend, which will be paid on Thursday, October 2nd. Shareholders of record on Friday, August 22nd will be paid a dividend of $0.566 per share. This represents a yield of 140.0%. The ex-dividend date is Friday, August 22nd. Intercontinental Hotels Group's payout ratio is currently 20.04%.

Intercontinental Hotels Group Profile

(

Free Report)

InterContinental Hotels Group PLC owns, manages, franchises, and leases hotels in the Americas, Europe, Asia, the Middle East, Africa, and Greater China. The company operates hotels under the Six Senses, Regent, InterContinental Hotels & Resorts, Vignette Collection, Kimpton Hotels & Restaurants, Hotel Indigo, voco, HUALUXE, Crowne Plaza, Iberostar Beachfront Resorts, EVEN, Holiday Inn Express, Holiday Inn, Garner, avid hotels, Atwell Suites, Staybridge Suites, Iberostar Beachfront Resorts, Holiday Inn Club Vacations, and Candlewood Suites brand names.

Read More

Before you consider Intercontinental Hotels Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Intercontinental Hotels Group wasn't on the list.

While Intercontinental Hotels Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for October 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.