MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. raised its holdings in shares of Verint Systems Inc. (NASDAQ:VRNT - Free Report) by 73.3% in the first quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 422,128 shares of the technology company's stock after buying an additional 178,499 shares during the quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. owned about 0.68% of Verint Systems worth $7,535,000 as of its most recent SEC filing.

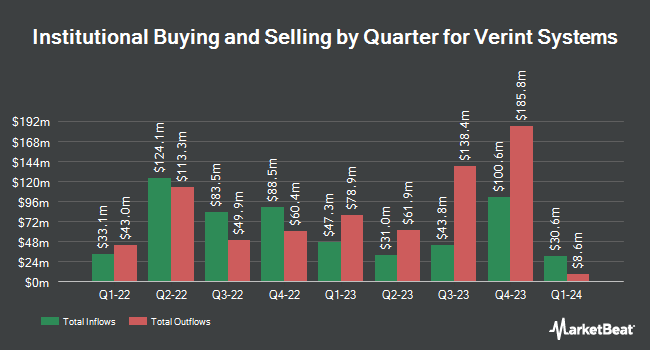

A number of other large investors also recently modified their holdings of VRNT. BI Asset Management Fondsmaeglerselskab A S acquired a new position in shares of Verint Systems during the first quarter worth approximately $40,000. Parallel Advisors LLC lifted its holdings in shares of Verint Systems by 14,079.2% during the first quarter. Parallel Advisors LLC now owns 3,403 shares of the technology company's stock worth $61,000 after buying an additional 3,379 shares during the last quarter. Wolverine Asset Management LLC acquired a new position in shares of Verint Systems during the first quarter worth approximately $94,000. GAMMA Investing LLC lifted its holdings in shares of Verint Systems by 916.9% during the first quarter. GAMMA Investing LLC now owns 5,837 shares of the technology company's stock worth $104,000 after buying an additional 5,263 shares during the last quarter. Finally, State of Wyoming lifted its holdings in shares of Verint Systems by 7.4% during the first quarter. State of Wyoming now owns 9,384 shares of the technology company's stock worth $168,000 after buying an additional 646 shares during the last quarter. 94.95% of the stock is currently owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

A number of research analysts have recently commented on VRNT shares. Rosenblatt Securities lowered Verint Systems from a "buy" rating to a "hold" rating and cut their price target for the stock from $40.00 to $20.50 in a report on Monday, August 25th. Needham & Company LLC lowered Verint Systems from a "buy" rating to a "hold" rating in a research note on Monday, August 25th. Royal Bank Of Canada restated a "sector perform" rating and issued a $20.50 target price (down from $29.00) on shares of Verint Systems in a research note on Tuesday, August 26th. Wedbush lowered Verint Systems from a "strong-buy" rating to a "hold" rating in a research note on Tuesday, August 26th. Finally, TD Cowen lowered Verint Systems from a "strong-buy" rating to a "hold" rating in a research note on Monday, August 25th. One research analyst has rated the stock with a Buy rating and seven have assigned a Hold rating to the company's stock. According to data from MarketBeat.com, the stock currently has an average rating of "Hold" and an average price target of $26.33.

Read Our Latest Analysis on Verint Systems

Verint Systems Stock Up 0.0%

NASDAQ:VRNT traded up $0.01 during trading hours on Tuesday, reaching $20.32. The company had a trading volume of 1,156,820 shares, compared to its average volume of 3,098,062. The stock has a 50-day moving average of $20.61 and a two-hundred day moving average of $19.21. Verint Systems Inc. has a one year low of $14.15 and a one year high of $34.80. The firm has a market capitalization of $1.23 billion, a PE ratio of 28.62, a PEG ratio of 0.89 and a beta of 1.47.

Verint Systems (NASDAQ:VRNT - Get Free Report) last announced its quarterly earnings results on Tuesday, September 2nd. The technology company reported $0.33 earnings per share for the quarter, beating analysts' consensus estimates of $0.26 by $0.07. Verint Systems had a return on equity of 11.06% and a net margin of 6.87%.The firm had revenue of $165.52 million for the quarter, compared to analysts' expectations of $200.43 million. During the same period in the prior year, the business posted $0.49 earnings per share. The business's revenue was down 1.0% compared to the same quarter last year. As a group, sell-side analysts expect that Verint Systems Inc. will post 1.92 earnings per share for the current year.

Verint Systems Company Profile

(

Free Report)

Verint Systems Inc provides customer engagement solutions worldwide. It offers forecasting and scheduling, channels and routing, knowledge management, fraud and security solutions, quality and compliance, analytics and insights, real-time assistance, self-services, financial compliance, and voice pf the consumer solutions.

Featured Stories

Before you consider Verint Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Verint Systems wasn't on the list.

While Verint Systems currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.