MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. increased its holdings in shares of FedEx Corporation (NYSE:FDX - Free Report) by 62.7% in the first quarter, according to its most recent disclosure with the SEC. The firm owned 37,831 shares of the shipping service provider's stock after purchasing an additional 14,574 shares during the period. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd.'s holdings in FedEx were worth $9,222,000 as of its most recent filing with the SEC.

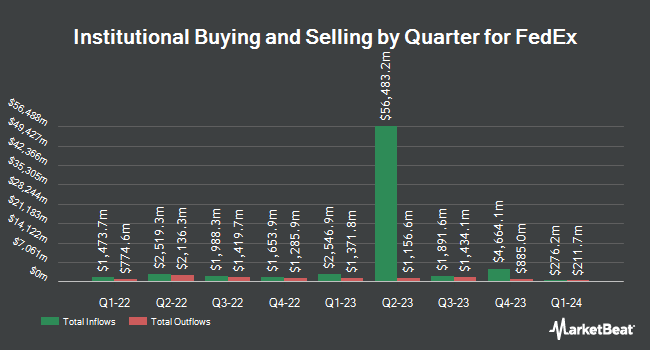

A number of other hedge funds and other institutional investors have also bought and sold shares of FDX. Nuveen LLC bought a new position in FedEx during the first quarter worth about $314,650,000. ACR Alpine Capital Research LLC boosted its holdings in shares of FedEx by 85.9% during the first quarter. ACR Alpine Capital Research LLC now owns 1,585,033 shares of the shipping service provider's stock worth $386,399,000 after acquiring an additional 732,266 shares during the period. GAMMA Investing LLC boosted its holdings in shares of FedEx by 18,202.1% during the first quarter. GAMMA Investing LLC now owns 545,586 shares of the shipping service provider's stock worth $133,003,000 after acquiring an additional 542,605 shares during the period. Worldquant Millennium Advisors LLC boosted its holdings in shares of FedEx by 276.1% during the fourth quarter. Worldquant Millennium Advisors LLC now owns 433,789 shares of the shipping service provider's stock worth $122,038,000 after acquiring an additional 318,448 shares during the period. Finally, Vanguard Group Inc. boosted its holdings in shares of FedEx by 1.4% during the first quarter. Vanguard Group Inc. now owns 20,489,161 shares of the shipping service provider's stock worth $4,994,848,000 after acquiring an additional 289,655 shares during the period. Institutional investors own 84.47% of the company's stock.

Analysts Set New Price Targets

A number of brokerages have recently issued reports on FDX. Barclays restated an "overweight" rating and set a $320.00 price objective (down previously from $330.00) on shares of FedEx in a report on Wednesday, June 25th. JPMorgan Chase & Co. reduced their price objective on FedEx from $290.00 to $285.00 and set an "overweight" rating for the company in a report on Friday, September 5th. Sanford C. Bernstein reduced their price objective on FedEx from $282.00 to $249.00 and set a "market perform" rating for the company in a report on Friday, June 13th. Raymond James Financial restated an "outperform" rating and set a $260.00 price objective (down previously from $275.00) on shares of FedEx in a report on Wednesday, June 25th. Finally, Stephens restated an "overweight" rating and set a $300.00 price objective on shares of FedEx in a report on Tuesday, May 20th. One investment analyst has rated the stock with a Strong Buy rating, seventeen have assigned a Buy rating, nine have issued a Hold rating and two have given a Sell rating to the company's stock. According to MarketBeat.com, FedEx currently has an average rating of "Moderate Buy" and an average target price of $282.54.

Get Our Latest Stock Report on FedEx

Insider Buying and Selling at FedEx

In other FedEx news, Director Marvin R. Ellison sold 3,610 shares of the business's stock in a transaction that occurred on Wednesday, July 9th. The shares were sold at an average price of $236.94, for a total transaction of $855,353.40. Following the completion of the transaction, the director directly owned 7,720 shares in the company, valued at $1,829,176.80. The trade was a 31.86% decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, Director Paul S. Walsh sold 3,610 shares of the business's stock in a transaction on Tuesday, July 8th. The stock was sold at an average price of $238.29, for a total transaction of $860,226.90. Following the sale, the director directly owned 15,513 shares in the company, valued at approximately $3,696,592.77. The trade was a 18.88% decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 9,343 shares of company stock worth $2,228,816 over the last three months. Corporate insiders own 0.53% of the company's stock.

FedEx Price Performance

FDX traded down $0.68 during trading on Monday, hitting $228.87. 342,753 shares of the stock traded hands, compared to its average volume of 1,943,890. FedEx Corporation has a twelve month low of $194.29 and a twelve month high of $308.53. The company has a market cap of $54.00 billion, a price-to-earnings ratio of 13.59, a PEG ratio of 1.29 and a beta of 1.20. The company has a debt-to-equity ratio of 0.68, a current ratio of 1.19 and a quick ratio of 1.15. The business has a 50 day moving average price of $229.77 and a 200 day moving average price of $227.21.

FedEx (NYSE:FDX - Get Free Report) last announced its quarterly earnings data on Tuesday, June 24th. The shipping service provider reported $6.07 EPS for the quarter, beating the consensus estimate of $5.98 by $0.09. FedEx had a net margin of 4.65% and a return on equity of 16.34%. The business had revenue of $22.20 billion during the quarter, compared to the consensus estimate of $21.86 billion. During the same period in the previous year, the business earned $5.41 earnings per share. FedEx has set its Q1 2026 guidance at 3.400-4.000 EPS. Equities research analysts forecast that FedEx Corporation will post 19.14 earnings per share for the current fiscal year.

FedEx Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Wednesday, October 1st. Shareholders of record on Monday, September 8th will be given a dividend of $1.45 per share. This represents a $5.80 annualized dividend and a yield of 2.5%. The ex-dividend date is Monday, September 8th. FedEx's payout ratio is currently 34.36%.

About FedEx

(

Free Report)

FedEx Corporation provides transportation, e-commerce, and business services in the United States and internationally. It operates through FedEx Express, FedEx Ground, FedEx Freight, and FedEx Services segments. The FedEx Express segment offers express transportation, small-package ground delivery, and freight transportation services; and time-critical transportation services.

See Also

Before you consider FedEx, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and FedEx wasn't on the list.

While FedEx currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report