Mirae Asset Global Investments Co. Ltd. raised its position in shares of CyberArk Software Ltd. (NASDAQ:CYBR - Free Report) by 155.4% in the 2nd quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The firm owned 4,770 shares of the technology company's stock after buying an additional 2,902 shares during the period. Mirae Asset Global Investments Co. Ltd.'s holdings in CyberArk Software were worth $1,941,000 at the end of the most recent reporting period.

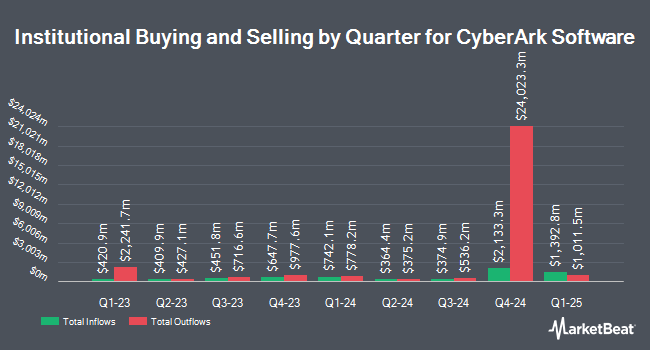

Several other institutional investors have also added to or reduced their stakes in the company. Bessemer Group Inc. boosted its holdings in shares of CyberArk Software by 421.1% during the first quarter. Bessemer Group Inc. now owns 99 shares of the technology company's stock worth $33,000 after purchasing an additional 80 shares during the period. Golden State Wealth Management LLC lifted its holdings in CyberArk Software by 100.0% in the 1st quarter. Golden State Wealth Management LLC now owns 78 shares of the technology company's stock worth $26,000 after buying an additional 39 shares during the period. Blue Trust Inc. lifted its holdings in CyberArk Software by 5.9% in the 1st quarter. Blue Trust Inc. now owns 1,099 shares of the technology company's stock worth $371,000 after buying an additional 61 shares during the period. Yousif Capital Management LLC lifted its holdings in CyberArk Software by 9.1% in the 1st quarter. Yousif Capital Management LLC now owns 2,235 shares of the technology company's stock worth $755,000 after buying an additional 187 shares during the period. Finally, Farther Finance Advisors LLC lifted its stake in CyberArk Software by 1,104.3% in the first quarter. Farther Finance Advisors LLC now owns 843 shares of the technology company's stock worth $294,000 after acquiring an additional 773 shares during the period. Hedge funds and other institutional investors own 91.84% of the company's stock.

CyberArk Software Price Performance

CYBR stock opened at $514.06 on Thursday. The firm has a 50 day moving average price of $454.76 and a 200-day moving average price of $398.24. CyberArk Software Ltd. has a 52-week low of $271.68 and a 52-week high of $514.28. The firm has a market capitalization of $25.95 billion, a price-to-earnings ratio of -152.54 and a beta of 1.01. The company has a debt-to-equity ratio of 0.53, a quick ratio of 2.31 and a current ratio of 2.31.

CyberArk Software (NASDAQ:CYBR - Get Free Report) last announced its quarterly earnings data on Wednesday, July 30th. The technology company reported $0.88 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.79 by $0.09. The business had revenue of $328.03 million during the quarter, compared to analysts' expectations of $315.43 million. CyberArk Software had a positive return on equity of 0.44% and a negative net margin of 13.78%.The firm's quarterly revenue was up 46.0% compared to the same quarter last year. During the same quarter in the previous year, the business earned $0.54 earnings per share. Equities research analysts forecast that CyberArk Software Ltd. will post -0.47 EPS for the current fiscal year.

Analysts Set New Price Targets

A number of analysts recently commented on CYBR shares. Stifel Nicolaus reaffirmed a "hold" rating and issued a $444.00 price target on shares of CyberArk Software in a research note on Thursday, July 31st. Baird R W cut shares of CyberArk Software from a "strong-buy" rating to a "hold" rating in a research report on Friday, August 1st. Royal Bank Of Canada reaffirmed a "sector perform" rating and issued a $448.00 target price (up from $420.00) on shares of CyberArk Software in a research report on Thursday, July 31st. Stephens lowered shares of CyberArk Software from a "strong-buy" rating to a "hold" rating in a report on Thursday, July 31st. Finally, Oppenheimer restated a "market perform" rating on shares of CyberArk Software in a report on Friday, August 1st. Twelve equities research analysts have rated the stock with a Buy rating and nineteen have given a Hold rating to the stock. According to MarketBeat.com, the company currently has a consensus rating of "Hold" and a consensus price target of $443.38.

Check Out Our Latest Analysis on CYBR

CyberArk Software Profile

(

Free Report)

CyberArk Software Ltd., together with its subsidiaries, develops, markets, and sells software-based identity security solutions and services in the United States, Europe, the Middle East, Africa, and internationally. Its solutions include Privileged Access Manager, which offers risk-based credential security and session; Vendor Privileged Access Manager combines Privileged Access Manager and Remote Access to provide secure access to third-party vendors; Dynamic Privileged Access, a SaaS solution that provides just-in-time access to Linux Virtual Machines; Endpoint Privilege Manager, a SaaS solution that secures privileges on the endpoint; and Secure Desktop, a solution that protects access to endpoints.

Read More

Want to see what other hedge funds are holding CYBR? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for CyberArk Software Ltd. (NASDAQ:CYBR - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider CyberArk Software, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CyberArk Software wasn't on the list.

While CyberArk Software currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.