Mitchell Capital Management Co. lowered its position in Broadcom Inc. (NASDAQ:AVGO - Free Report) by 7.9% during the 2nd quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm owned 83,008 shares of the semiconductor manufacturer's stock after selling 7,132 shares during the quarter. Broadcom comprises approximately 4.4% of Mitchell Capital Management Co.'s investment portfolio, making the stock its 4th biggest holding. Mitchell Capital Management Co.'s holdings in Broadcom were worth $23,519,000 at the end of the most recent quarter.

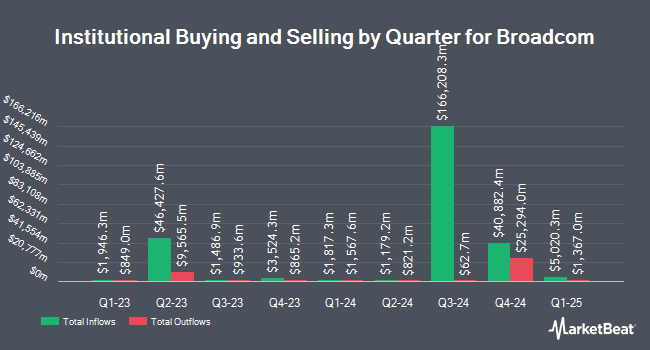

Several other large investors also recently made changes to their positions in AVGO. Nuveen LLC acquired a new stake in shares of Broadcom in the first quarter valued at approximately $6,649,117,000. Price T Rowe Associates Inc. MD boosted its holdings in shares of Broadcom by 37.8% in the first quarter. Price T Rowe Associates Inc. MD now owns 65,509,579 shares of the semiconductor manufacturer's stock valued at $10,968,270,000 after acquiring an additional 17,985,046 shares in the last quarter. Goldman Sachs Group Inc. boosted its holdings in shares of Broadcom by 16.7% in the first quarter. Goldman Sachs Group Inc. now owns 31,854,414 shares of the semiconductor manufacturer's stock valued at $5,333,384,000 after acquiring an additional 4,550,647 shares in the last quarter. Deutsche Bank AG boosted its holdings in shares of Broadcom by 36.9% in the first quarter. Deutsche Bank AG now owns 15,758,895 shares of the semiconductor manufacturer's stock valued at $2,638,512,000 after acquiring an additional 4,245,345 shares in the last quarter. Finally, Alliancebernstein L.P. boosted its holdings in shares of Broadcom by 16.0% in the first quarter. Alliancebernstein L.P. now owns 29,513,814 shares of the semiconductor manufacturer's stock valued at $4,941,498,000 after acquiring an additional 4,077,910 shares in the last quarter. Institutional investors and hedge funds own 76.43% of the company's stock.

Broadcom Trading Down 1.4%

Shares of NASDAQ:AVGO opened at $349.33 on Friday. The stock has a market capitalization of $1.65 trillion, a price-to-earnings ratio of 89.11, a PEG ratio of 1.97 and a beta of 1.20. Broadcom Inc. has a 1-year low of $138.10 and a 1-year high of $374.23. The company has a debt-to-equity ratio of 0.86, a quick ratio of 1.37 and a current ratio of 1.50. The company has a 50 day moving average price of $327.73 and a 200 day moving average price of $269.24.

Broadcom (NASDAQ:AVGO - Get Free Report) last issued its earnings results on Thursday, September 4th. The semiconductor manufacturer reported $1.69 earnings per share for the quarter, topping analysts' consensus estimates of $1.66 by $0.03. The firm had revenue of $15.95 billion during the quarter, compared to analysts' expectations of $15.82 billion. Broadcom had a net margin of 31.59% and a return on equity of 36.60%. The firm's revenue for the quarter was up 22.0% compared to the same quarter last year. During the same period last year, the firm posted $1.24 earnings per share. Broadcom has set its Q4 2025 guidance at EPS. On average, research analysts anticipate that Broadcom Inc. will post 5.38 EPS for the current fiscal year.

Broadcom Announces Dividend

The company also recently declared a quarterly dividend, which was paid on Tuesday, September 30th. Investors of record on Monday, September 22nd were given a $0.59 dividend. This represents a $2.36 annualized dividend and a dividend yield of 0.7%. The ex-dividend date was Monday, September 22nd. Broadcom's dividend payout ratio is 60.20%.

Wall Street Analysts Forecast Growth

Several research firms have recently issued reports on AVGO. Oppenheimer reiterated an "outperform" rating and issued a $360.00 price objective (up from $325.00) on shares of Broadcom in a report on Friday, September 5th. Benchmark increased their price objective on shares of Broadcom from $315.00 to $385.00 and gave the company a "buy" rating in a report on Friday, September 5th. Mizuho set a $430.00 price objective on shares of Broadcom in a report on Monday, October 13th. HSBC upgraded shares of Broadcom from a "hold" rating to a "buy" rating and set a $400.00 price objective for the company in a report on Tuesday, June 24th. Finally, Rosenblatt Securities increased their price objective on shares of Broadcom from $340.00 to $400.00 and gave the company a "buy" rating in a report on Friday, September 5th. Three research analysts have rated the stock with a Strong Buy rating, twenty-nine have issued a Buy rating and two have issued a Hold rating to the company's stock. According to data from MarketBeat.com, Broadcom currently has a consensus rating of "Buy" and a consensus price target of $372.33.

Read Our Latest Analysis on Broadcom

Insiders Place Their Bets

In related news, insider Mark David Brazeal sold 16,558 shares of the company's stock in a transaction that occurred on Wednesday, September 17th. The shares were sold at an average price of $347.61, for a total value of $5,755,726.38. Following the completion of the sale, the insider owned 329,302 shares in the company, valued at approximately $114,468,668.22. This represents a 4.79% decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, Director Henry Samueli sold 368,797 shares of the company's stock in a transaction that occurred on Wednesday, September 24th. The shares were sold at an average price of $337.91, for a total transaction of $124,620,194.27. Following the completion of the sale, the director owned 37,722,534 shares of the company's stock, valued at approximately $12,746,821,463.94. This trade represents a 0.97% decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders have bought 3,550 shares of company stock worth $1,227,869 and have sold 665,271 shares worth $225,464,248. Insiders own 2.00% of the company's stock.

Broadcom Profile

(

Free Report)

Broadcom Inc designs, develops, and supplies various semiconductor devices with a focus on complex digital and mixed signal complementary metal oxide semiconductor based devices and analog III-V based products worldwide. The company operates in two segments, Semiconductor Solutions and Infrastructure Software.

Recommended Stories

Want to see what other hedge funds are holding AVGO? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Broadcom Inc. (NASDAQ:AVGO - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Broadcom, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Broadcom wasn't on the list.

While Broadcom currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report