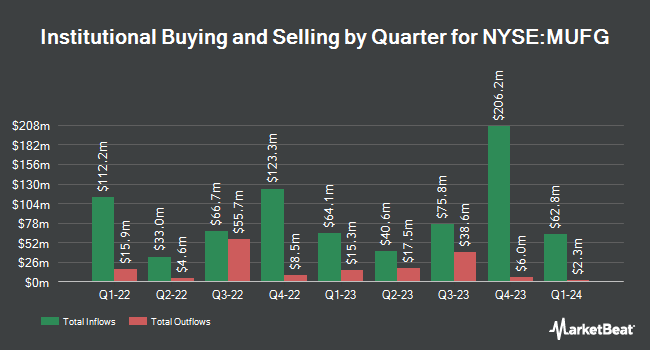

PNC Financial Services Group Inc. grew its holdings in shares of Mitsubishi UFJ Financial Group, Inc. (NYSE:MUFG - Free Report) by 12.5% during the first quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 343,602 shares of the company's stock after purchasing an additional 38,196 shares during the period. PNC Financial Services Group Inc.'s holdings in Mitsubishi UFJ Financial Group were worth $4,683,000 at the end of the most recent quarter.

Other hedge funds also recently made changes to their positions in the company. LPL Financial LLC increased its stake in Mitsubishi UFJ Financial Group by 52.9% during the 4th quarter. LPL Financial LLC now owns 333,403 shares of the company's stock worth $3,907,000 after acquiring an additional 115,315 shares during the period. JPMorgan Chase & Co. grew its stake in Mitsubishi UFJ Financial Group by 50.8% during the fourth quarter. JPMorgan Chase & Co. now owns 389,603 shares of the company's stock worth $4,566,000 after buying an additional 131,305 shares in the last quarter. Franklin Resources Inc. raised its position in shares of Mitsubishi UFJ Financial Group by 5.4% in the 4th quarter. Franklin Resources Inc. now owns 51,864 shares of the company's stock valued at $608,000 after buying an additional 2,656 shares in the last quarter. Wells Fargo & Company MN increased its stake in Mitsubishi UFJ Financial Group by 9.8% in the fourth quarter. Wells Fargo & Company MN now owns 2,556,797 shares of the company's stock valued at $29,966,000 after acquiring an additional 228,971 shares during the last quarter. Finally, Envestnet Asset Management Inc. raised its position in Mitsubishi UFJ Financial Group by 7.0% during the fourth quarter. Envestnet Asset Management Inc. now owns 4,806,932 shares of the company's stock valued at $56,337,000 after purchasing an additional 313,851 shares in the last quarter. 13.59% of the stock is owned by institutional investors.

Wall Street Analyst Weigh In

Separately, Wall Street Zen raised Mitsubishi UFJ Financial Group from a "sell" rating to a "hold" rating in a report on Saturday.

Read Our Latest Research Report on MUFG

Mitsubishi UFJ Financial Group Price Performance

Shares of NYSE MUFG traded up $0.17 during midday trading on Friday, reaching $14.55. 2,501,223 shares of the company were exchanged, compared to its average volume of 3,747,974. The stock's 50-day moving average price is $13.79 and its 200-day moving average price is $13.16. The stock has a market cap of $175.59 billion, a P/E ratio of 13.47, a PEG ratio of 1.43 and a beta of 0.42. Mitsubishi UFJ Financial Group, Inc. has a one year low of $9.54 and a one year high of $15.03. The company has a quick ratio of 1.01, a current ratio of 0.89 and a debt-to-equity ratio of 1.86.

Mitsubishi UFJ Financial Group (NYSE:MUFG - Get Free Report) last released its quarterly earnings results on Monday, August 4th. The company reported $0.32 EPS for the quarter, beating analysts' consensus estimates of $0.29 by $0.03. Mitsubishi UFJ Financial Group had a return on equity of 9.35% and a net margin of 13.95%. The firm had revenue of $22.10 billion for the quarter, compared to analyst estimates of $9.86 billion. On average, sell-side analysts anticipate that Mitsubishi UFJ Financial Group, Inc. will post 0.99 earnings per share for the current fiscal year.

Mitsubishi UFJ Financial Group Profile

(

Free Report)

Mitsubishi UFJ Financial Group, Inc operates as the bank holding company, that engages in a range of financial businesses in Japan, the United States, Europe, Asia/Oceania, and internationally. It operates through seven segments: Digital Service, Retail & Commercial Banking, Japanese Corporate & Investment Banking, Global Commercial Banking, Asset Management & Investor Services, Global Corporate & Investment Banking, and Global Markets.

Recommended Stories

Before you consider Mitsubishi UFJ Financial Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mitsubishi UFJ Financial Group wasn't on the list.

While Mitsubishi UFJ Financial Group currently has a Strong Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.