Mizuho Markets Americas LLC boosted its holdings in Snowflake Inc. (NYSE:SNOW - Free Report) by 9.2% during the first quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 438,391 shares of the company's stock after acquiring an additional 36,810 shares during the period. Snowflake comprises about 1.3% of Mizuho Markets Americas LLC's investment portfolio, making the stock its 19th biggest holding. Mizuho Markets Americas LLC owned about 0.13% of Snowflake worth $64,075,000 as of its most recent filing with the Securities & Exchange Commission.

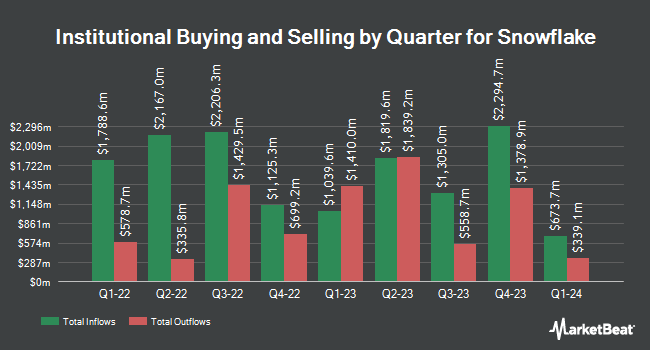

A number of other large investors have also recently bought and sold shares of the business. Opal Wealth Advisors LLC acquired a new position in shares of Snowflake during the first quarter valued at approximately $26,000. CVA Family Office LLC increased its stake in shares of Snowflake by 80.0% during the first quarter. CVA Family Office LLC now owns 198 shares of the company's stock valued at $29,000 after acquiring an additional 88 shares during the period. West Paces Advisors Inc. acquired a new position in shares of Snowflake during the fourth quarter valued at approximately $31,000. Spurstone Advisory Services LLC acquired a new position in shares of Snowflake during the fourth quarter valued at approximately $31,000. Finally, Capital A Wealth Management LLC acquired a new position in shares of Snowflake during the fourth quarter valued at approximately $31,000. Institutional investors own 65.10% of the company's stock.

Snowflake Stock Performance

Snowflake stock traded up $3.85 on Wednesday, reaching $196.91. 4,427,921 shares of the stock were exchanged, compared to its average volume of 5,083,586. The stock has a market cap of $65.74 billion, a PE ratio of -46.77 and a beta of 1.22. The company has a current ratio of 1.58, a quick ratio of 1.58 and a debt-to-equity ratio of 0.94. Snowflake Inc. has a twelve month low of $107.13 and a twelve month high of $229.27. The firm has a fifty day moving average price of $213.29 and a two-hundred day moving average price of $184.22.

Snowflake (NYSE:SNOW - Get Free Report) last announced its quarterly earnings data on Wednesday, May 21st. The company reported $0.24 EPS for the quarter, beating analysts' consensus estimates of $0.22 by $0.02. The business had revenue of $1.04 billion during the quarter, compared to analyst estimates of $1.01 billion. Snowflake had a negative net margin of 36.43% and a negative return on equity of 37.75%. The firm's revenue for the quarter was up 25.8% on a year-over-year basis. During the same quarter in the prior year, the business earned $0.14 earnings per share. Sell-side analysts anticipate that Snowflake Inc. will post -2.36 EPS for the current year.

Wall Street Analyst Weigh In

SNOW has been the topic of a number of research analyst reports. JPMorgan Chase & Co. raised their price objective on shares of Snowflake from $210.00 to $225.00 and gave the company an "overweight" rating in a research note on Thursday, May 22nd. Scotiabank restated an "outperform" rating on shares of Snowflake in a research report on Thursday, May 22nd. Piper Sandler restated an "overweight" rating and issued a $215.00 price target (up previously from $175.00) on shares of Snowflake in a research report on Wednesday, May 21st. Loop Capital lifted their price target on shares of Snowflake from $220.00 to $245.00 and gave the stock a "buy" rating in a research report on Wednesday, June 4th. Finally, Mizuho lifted their price target on shares of Snowflake from $215.00 to $235.00 and gave the stock an "outperform" rating in a research report on Wednesday, June 4th. Two equities research analysts have rated the stock with a sell rating, six have issued a hold rating, thirty-three have assigned a buy rating and three have issued a strong buy rating to the company. Based on data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and a consensus price target of $226.32.

Get Our Latest Report on Snowflake

Insider Buying and Selling at Snowflake

In related news, Director Teresa Briggs sold 1,146 shares of the company's stock in a transaction dated Thursday, July 3rd. The shares were sold at an average price of $217.74, for a total value of $249,530.04. Following the sale, the director owned 4,474 shares of the company's stock, valued at $974,168.76. The trade was a 20.39% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available through this hyperlink. Also, Director Frank Slootman sold 256,046 shares of the company's stock in a transaction dated Thursday, July 31st. The shares were sold at an average price of $227.15, for a total transaction of $58,160,848.90. Following the completion of the sale, the director directly owned 165,507 shares in the company, valued at approximately $37,594,915.05. The trade was a 60.74% decrease in their position. The disclosure for this sale can be found here. In the last three months, insiders sold 3,014,642 shares of company stock worth $657,325,186. Insiders own 6.80% of the company's stock.

Snowflake Profile

(

Free Report)

Snowflake Inc provides a cloud-based data platform for various organizations in the United States and internationally. Its platform offers Data Cloud, which enables customers to consolidate data into a single source of truth to drive meaningful business insights, build data-driven applications, and share data and data products, as well as applies artificial intelligence (AI) for solving business problems.

Further Reading

Before you consider Snowflake, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Snowflake wasn't on the list.

While Snowflake currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.